After the increase in cigarette and alcohol products, those who consumed these products were very bored, and most of the people who did not consume thought, “I wasn’t using it anyway, it doesn’t affect me.” However, the truth of the matter is unfortunately not so.

As many of you know, the SCT, which covers the products in the alcohol and cigarette group, 47 percent announced to be increased. It is known what the effect of this increase will be on people who regularly consume cigarettes and alcohol; well this hike, these products those who do not consume What effect will it have on you?

although “I don’t consume cigarettes or alcohol either,” Even if you think so, unfortunately yes; This hike will also hit those who do not consume cigarettes and alcohol. Why If you are asking, let’s look at these reasons together.

You may not be consuming; However them consuming

Now look at it this way: You may not be smoking or drinking alcohol; however, the owners of the markets you frequently shop at, the shops you enter and the cafes you sit in consume. What will happen when the expenses of these people increase after the hike? You got it right; Naturally, the owners of these businesses also depend on the products they sell and the services they provide. interest will make.

Of course, there are also recent hikes in other areas. Here specifically fuel and electricity We need to mention the price hikes. The increase in the price of fuel used by drivers who supply the products we buy or other products made from those products, and transport them from one city to another when necessary (we are talking about food products such as vegetables and fruits in particular); that driver of your expense means increase. So yes, he will get a raise too.

The electricity hike is also the same; Electricity is used without interruption to maintain the temperature of the products, especially in businesses selling food products. So what will happen when electricity is hiked? Because the money out of the pocket of the owner of the business has increased our pocket will also burn. In short, whether you consume cigarettes and alcohol or not; this way somehow you too will find.

A ‘balance’ point must be found

Price hikes applied to addictive consumer products with low elasticity of demand; directly affects all inflation. At this point first ‘inelastic demand’We need to talk about. For example, if the price of a product increases or decreases by 10 percent and this causes a 3 percent decrease or increase in the demand of the consumer for that product, it is called inelastic demand. When a 10 percent increase in goods causes a 30 percent decrease in demand, it is called elastic demand.

Cigarette and alcohol-like products are in the inelastic class. This means that even if the government raises more than 20 percent, the demand for these products 3-4 percentIt does not decrease more than .

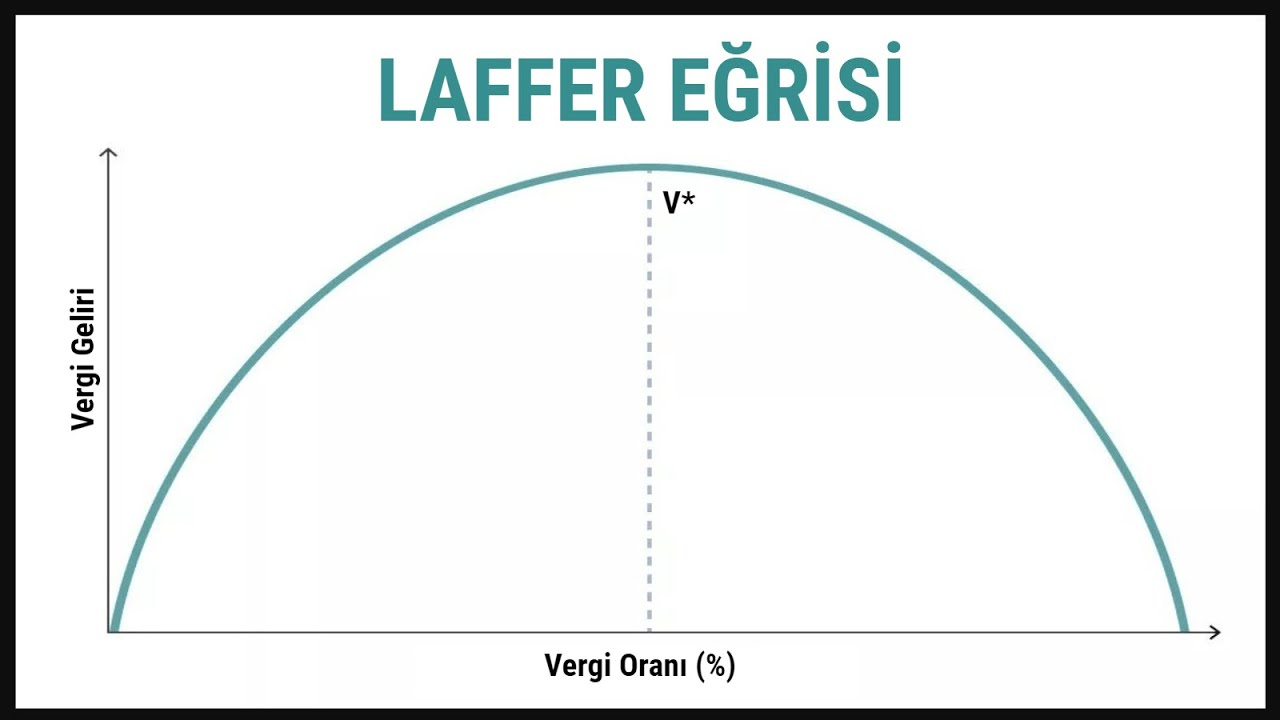

Another thing we should mention is Laffer curve. The Laffer curve shows that income will not increase as a result of the government increasing taxes; It is based on the principle that when the opposite is applied, that is, when taxes are reduced, total income will increase. Accordingly, the higher the tax on the product, the higher the number of products sold. to decrease and this leads to a decrease in the tax revenue of the state.

RELATED NEWS

Historical Increase in Intercity Buses: “A raise of at least 50 percent is required”

The prices of alcohol sold in our country have been on the opposite side of the Laffer curve for a very long time already. However, with the latest hike, the decrease in tax revenue will make itself felt much more harshly. The most logical thing to do is to rectify this situation. ‘balance’ determination of the point. Unless a balanced amount is found that will both satisfy the government, not lower consumer morale and relieve complaints, this situation we are in is very, very difficult to improve.

Source :

https://seyler.eksisozluk.com/alkol-ve-sigara-zammi-neden-onlari-İlkkazan-insanlari-da-etkiyor