The investment experts use stocks of corporations that they consider to be crisis-proof.

Frankfurt The contrast could hardly be greater: the stock exchanges are rushing from record to record, many companies are valued extremely highly – and at the same time there is increasing uncertainty as to whether the monetary policy turnaround by the central banks this year will be smooth.

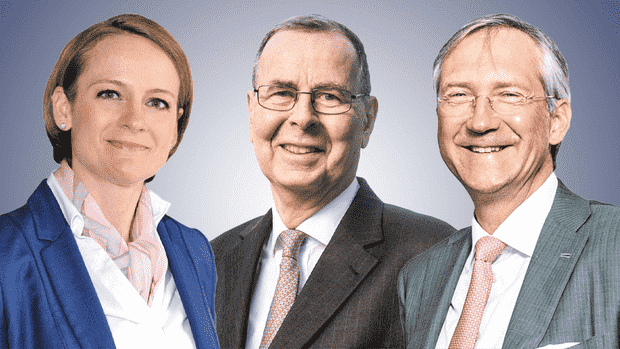

Handelsblatt spoke to three well-known fund managers about how they navigate these difficult times. The bottom line: You are buying shares in corporations that you consider to be crisis-proof. They no longer believe bonds have any potential for returns. And the tried and tested gold helps against larger losses in the portfolio. Cryptocurrencies fluctuate too much in value for the professionals.

“I am amazed at how well the stock markets went despite the rampant Omikron mutant in 2021,” says Klaus Kaldemorgen, one of the most experienced fund managers on the German market. “There are a lot of good expectations in the share prices,” warns the 68-year-old stock and bond professional of the Deutsche Bank fund subsidiary DWS.

Read on now

Get access to this and every other article in the

Web and in our app for 4 weeks free of charge.

Continue

Read on now

Get access to this and every other article in the

Web and in our app for 4 weeks free of charge.

Continue