The Montenegrin Court of Appeals ruled that a lower court would collapse in May 2022. terra It annulled its decision regarding the extradition of Do Kwon, the controversial founder of .

In an earlier decision dated November 17, the Supreme Court in Podgorica approved the extradition of Do Kwon to the Republic of South Korea and the United States on multiple charges related to the collapse of Terra.

However, upon appeal, the country’s Court of Appeals ordered a retrial. In its statement on December 19, the Court of Appeals found a significant violation of criminal procedure in the lower court’s decision.

The Court of Appeals alleged that the investigating judge did not inform Do Kwon about the reasons and evidence for his extradition, especially regarding the request from the United States.

This situation was found to be contrary to the Law on International Legal Assistance in Criminal Matters.

In a related decision, the Court of Appeals had previously annulled a decision by the Supreme Court that had postponed Do Kwon’s extradition until he completed his prison sentence for a separate crime.

The Court of Appeal ruled that this decision was outside the court’s authority and emphasized that the authority to decide on the postponement of extradition belongs to the Minister of Justice, not the court.

How LUNC Reacted

Koinfinans.com As we reported, LUNA Classic (LUNC) recorded a 13% intraday rally following the Court of Appeals decision. According to CoinMarketCap data, the altcoin reached its highest price point last week, trading at $0.00017.

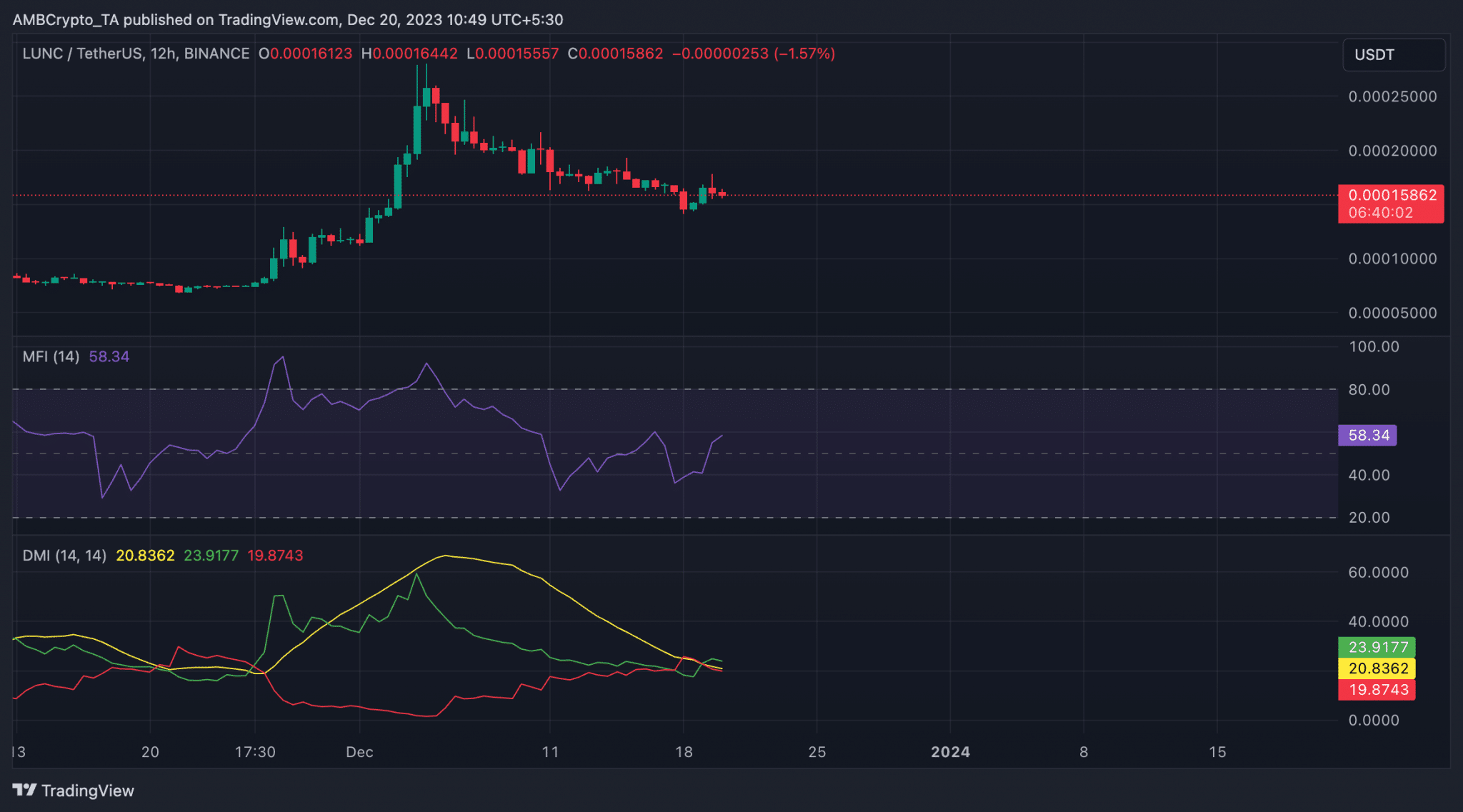

After the market learned of the court’s decision, the bulls took the market back from the bears. The directional movement index (DMI) of the coin evaluated on a 12-hour chart showed this.

The indicator’s positive index (green) quickly rose above the negative index (red), indicating that LUNC bulls are regaining control.

Moreover, altcoin‘s Money Flow Index (MFI) was determined at 58 levels. 37. An asset’s MFI value of 58 indicates that there is a significant amount of buying pressure in the market.