Bitcoin (BTC) support at $60,000 strengthens the hands of long-term investors and calls for HH levels. When will it be the most important here? Analyst William Suberg listed 5 factors for the answer.

What happened in Bitcoin price?

BTC price is having a week to test the $60,000 support, despite pushing the ATH level to $67,000. After a classic Market plunge, the bulls took control and managed to keep BTC price from bottoming out. While Bitcoin’s ATH level has seemed distant since April, now investors can’t wait to see where the price might go.

While some forecasts predict prices to reach $300,000 by 2022, we take a look at five factors that could shape BTC price movements in the coming weeks…

Bitcoin (BTC)’s “brutal spot bid”

Inflation continues to bite markets, and even the US Federal Reserve admits it could go on for much longer. Discussions in the crypto community also continue over the taxation of unrealized gains. However, beyond rising commodities, the picture is cooler when it comes to Bitcoin price triggers, as a divergence from macro movements has already characterized BTC/USD.

Prior to the launch of the third Bitcoin futures exchange-traded fund (ETF) on Monday, more attention is being paid to gold and traditional ETFs and the threat Bitcoin poses to them. Charles Edwards, CEO of investment firm Capriole, said in a statement last week:

If CME open interest has jumped to #1 globally in a matter of days this week, if not a barometer for massive corporate interest, I don’t know what is.

Edwards has previously said that futures-based ETFs would provide a “brutal spot offering” on Bitcoin, countering concerns about the overall potential of the tool.

Looking at futures volumes, Ki Young Ju, CEO of on-chain analytics firm CryptoQuant, adds that each $60,000 challenge is accompanied by large turnouts. The consequences that can be drawn from Bitcoin’s bull cycles point to more…

Tracking the 2017 bull run

Classically, on a weak Sunday, Bitcoin was bullish on Monday this week as it rallied above $62,000. Last week saw a 10% drop from the ATH level of $67,100 and the April high of $64,900 provided almost no support. However, when bearish calls began to emerge, Bitcoin (BTC) was not in the mood to leave the new trading zone. Even though the analysis claims that even $50,000 will still constitute solid price action.

The weekly close failed to challenge a massive buy wall just under $60,000 and provided further relief. cryptocoin.com Michaël van de Poppe, who we share the analysis with, summed up in his latest update on Monday morning, “So far so good” and said that $90,000 of Bitcoin is the way.

The schedule for such a goal has been extended this month. For Van de Poppe, this will come only later, in the first quarter of next year, as opposed to six-figure forecasts with a much lower timeframe. October is estimated to end at around $63,000, meanwhile, uncharted territory remains for the last two months of 2021, the analyst said.

For popular analyst TechDev, Bitcoin is still repeating its 2017 price action with almost uncanny accuracy. This would suggest much higher price levels before the end of the year, in line with December 2017 highs.

VanEck ETF gearing up for Monday launch

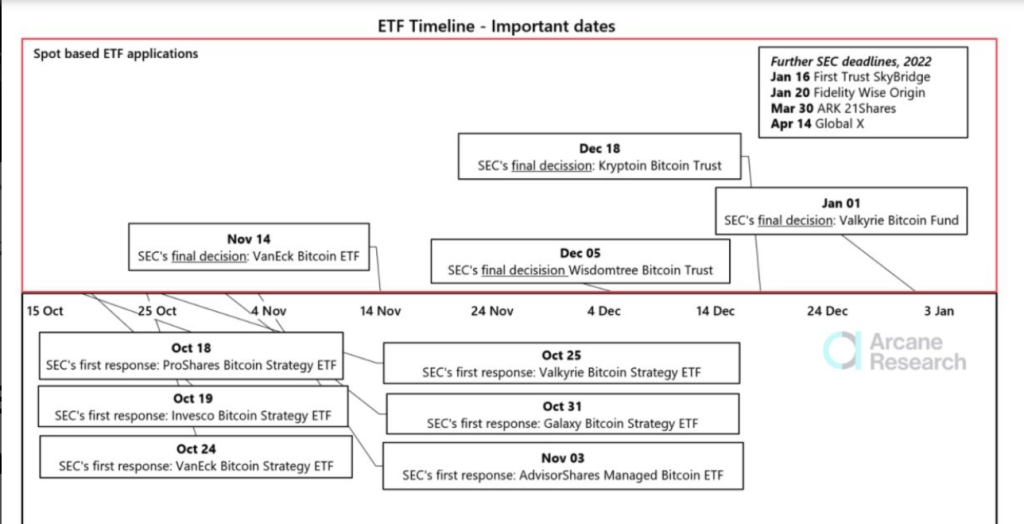

Another week, another reason to be bullish in institutional investing as Bitcoin sees another exchange-traded fund (ETF) go live. This Monday, it’s VanEck’s turn, which has become almost a household name in cryptocurrency circles thanks to years of trying to launch a Bitcoin ETF product. Like last week’s offerings, VanEck’s Bitcoin Strategy ETF (XBTF) will feature Bitcoin futures, increasing competition ahead of the first regulatory decision on physical ETFs next month.

XBTF will have a 0.65% management fee and will begin trading as the third Bitcoin futures ETF in the US market. VanEck also plans to launch a physical ETF with the Securities and Exchange Commission as its fate decides on Nov. Despite mixed views on the overall usefulness of futures-based ETFs, ProShares’ pioneering U.S. debut saw an almost unprecedented rise last week. The second one from Valkyrie was calmer. “We see that Bitcoin is on its way to trading like gold,” Bloomberg senior commodity strategist Mike McGlone said on Bitcoin’s launch day.

He also referred to the rags-to-riches transformation that accompanied gold when it first attracted its own US ETFs in the early 2000s. At the time, SPDR Gold Trust (GLD), the first gold ETF, like ProShares, had raised over $1 billion in the first three days of its trading in November 2004.

No major stock market sales

Exchanges are a key focus in the current market conditions, as the macro trend of reduction in bitcoin supply slows. During bull runs, bulk BTC inflows into exchanges tend to mark the price point at which the masses are planning to sell, and thus the highest possible price. More broadly, however, the amount of Bitcoin held on exchanges is falling, and this has accelerated since the May price drop.

According to the latest data, it now appears that Binance has split from other major platforms this month and has seen BTC entries in its order book, with most of the rest continuing to drop in reserves. Running to new all-time highs for BTC/USD resulted in a slight increase in BTC levels overall, but this is negligible given the overall bearish trend.

Hodlers are known to have little interest in selling previous all-time highs in such a short period of time, and it is assumed that institutional buyers do not plan for quick sell-offs immediately after taking the risk.

Derivatives exchanges saw particularly active buying last week.

Sensitivity is changing!

The crypto market sentiment is once again shifting, but unlike earlier in the month, investors are being cautious. According to the Fear and Greed Index, the unsustainable optimism in “Uptober” is no longer the mood when it comes to Bitcoin or altcoins. Having hit “extreme greed” last week, the Index faded at 72/100 on Monday – in line with BTC price action that simply meant “greed.”

This level has clustered at various times over the past three months, reinforcing the feeling that a “reset” has occurred for the feeling that Bitcoin is still at $60,000. Given that the classic cycle peak corresponds to a Fear and Greed score of 95/100 or more, this means that further rise in price – if slow enough – could continue for much longer.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.