bitcoin (BTC) managed to climb above $30,000 last week but soon began to struggle with some selling pressure. While BTC is trading around $29,600 at the time of writing, it is waiting for an opportunity to move towards the $30,000 levels.

bitcoin priceAnalyst Ali Martinez commented on the on-chain data known as “Bitcoin Reserve Risk”, which points to the rise for BTC.

This Bitcoin data points to great potential! When BTC Reserve Risk rises above 0, it indicates parabolic price movements. It resulted in gains of 2,830, 566%, 6,400, 99% and 487% in 2012, 2013, 2015, 2019 and 2020, respectively. Reserve Risk has crossed 0 again!

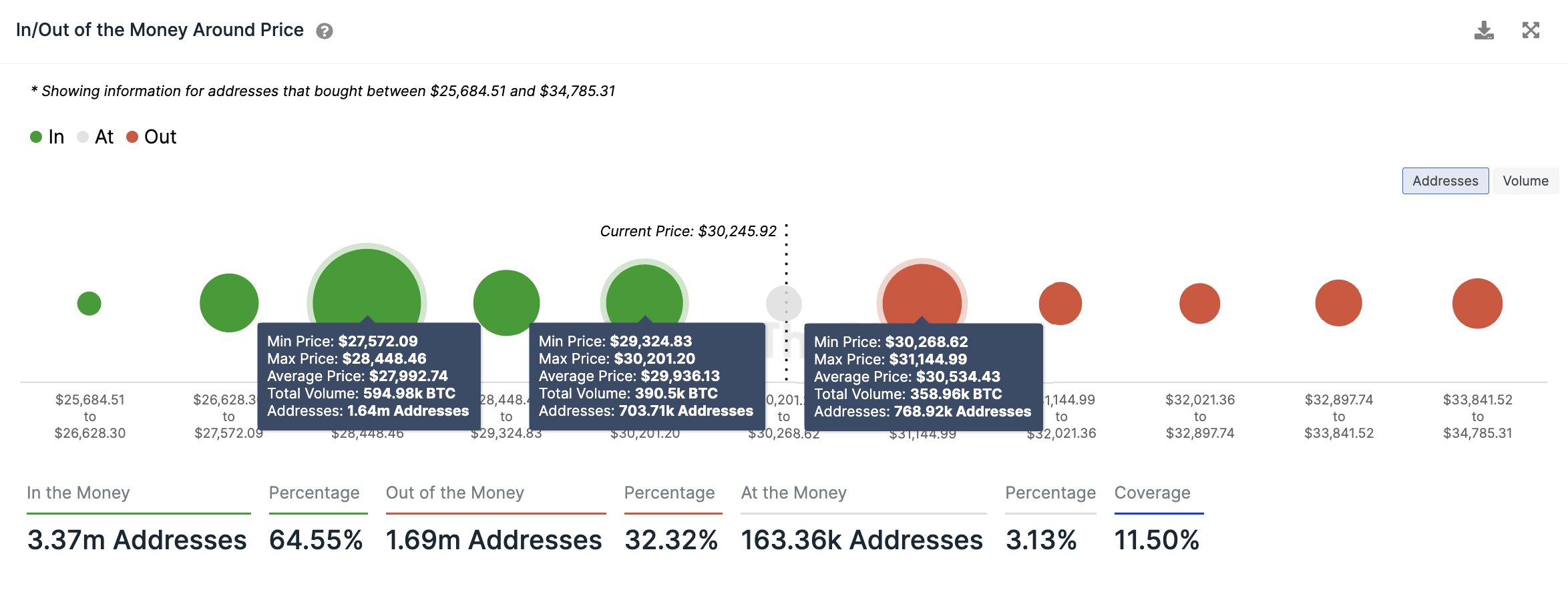

Ali Martinez commented on strong support and resistance levels for Bitcoin, based on purchases of Ethereum addresses.

For Bitcoin, where 770 thousand addresses bought 360 thousand $ BTC, the $ 30,270-32,150 resistance remains a formidable hurdle. Meanwhile, support at $29,330-30,200 remained strong, with 700k addresses buying $390kBTC. Be careful if this level is broken, the next key support is located at $27,600-28,450.

NEWS CONTINUES BELOW

Is the Bitcoin Bear Market Over?

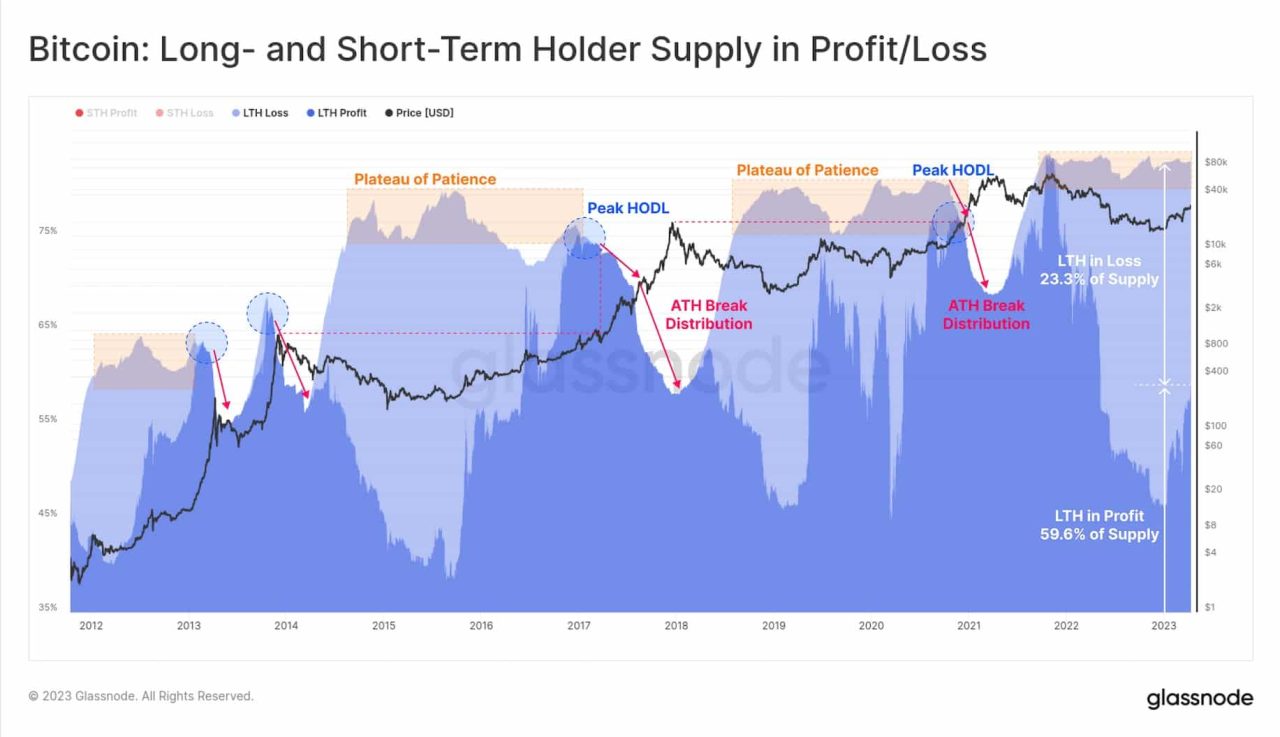

In order to make this kind of assessment, it is necessary to understand the “supply dynamics” of long-term holders (LTHs) and short-term holders (STHs).

According to on-chain data provider Glassnode, “more than 23.3% of the non-exchange supply is owned by LTHs whose positions are under water”, which is similar to early 2016 and early 2019.

Glassnode stated that as the 2023 Bitcoin price rally continues, a total of 6.2 million BTC has profited (32.3% of the supply). So, with so many coins currently in unrealized profits, the incentive to spend and sell BTC will increase with every price increase.

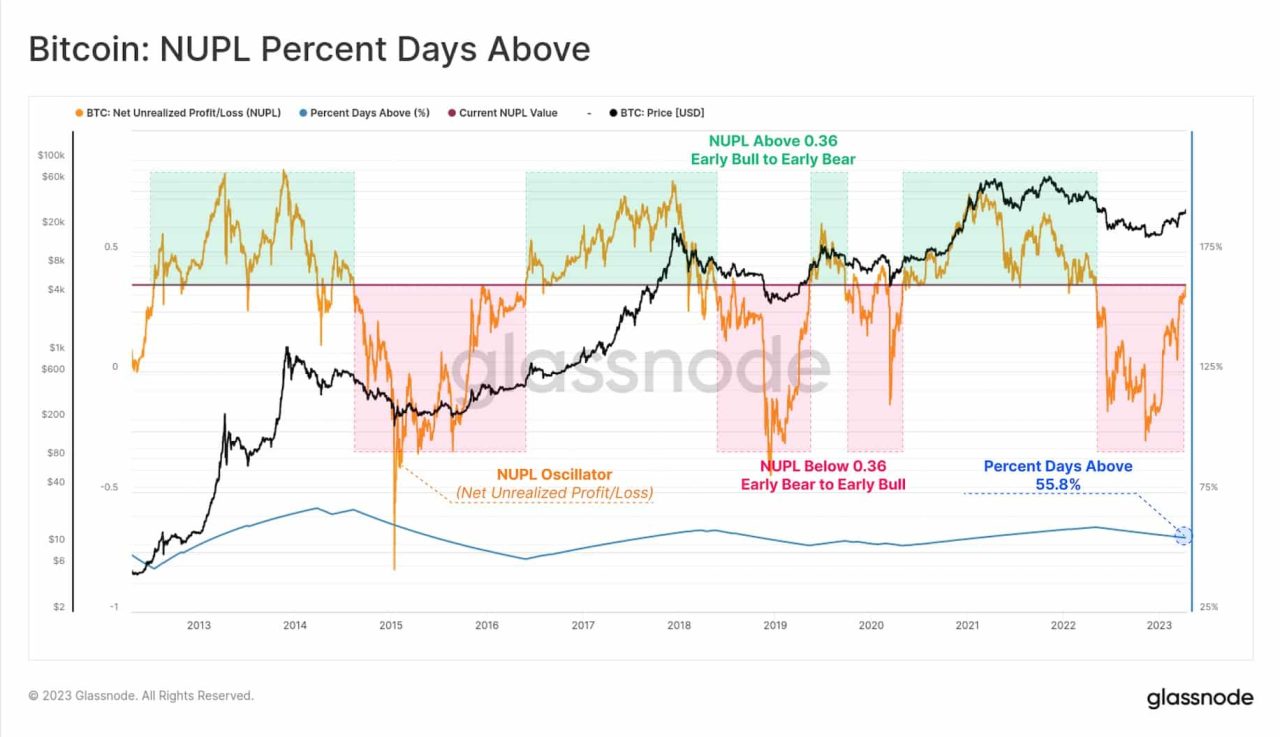

Koinfinans.com As we reported, Glassnode also pointed out another interesting metric called NUPL, which measures how Bitcoin market cap is currently positioned against unrealized profit.

The market is fairly neutral compared to the current value of 0.36, with a higher value 55.8% and a lower value 44.2% of the days. This also indicates that the market is neither overpriced (as at $16,000) nor overvalued (as at $60,000 peak).

You can follow the current price action here.