According to an analyst closely followed in the crypto world bitcoin It may have finally caught a bottom from the bear market that has been going on for about eight months. Here are the metric that the analyst follows closely and the analyst’s remarkable predictions.

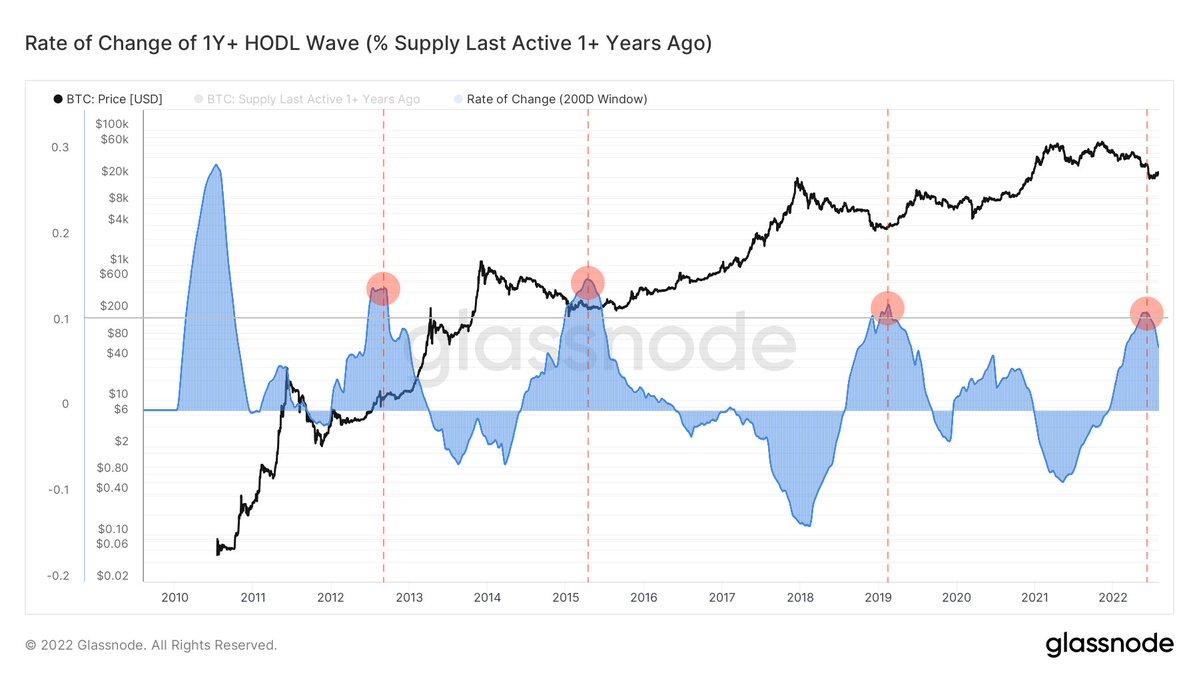

In a post on his Twitter account, the analyst, known by the alias TechDev, noted the importance of “1-year HODL” waves, a metric that tracks Bitcoin holdings that have been dormant for more than a year. In the previous three instances, where static BTCs peaked in 2012, 2015, and 2019, a rally was soon observed.

“1 year+ HODL wave 200-day exchange rate peaks above 0.1. 4 signals in 11 years.”

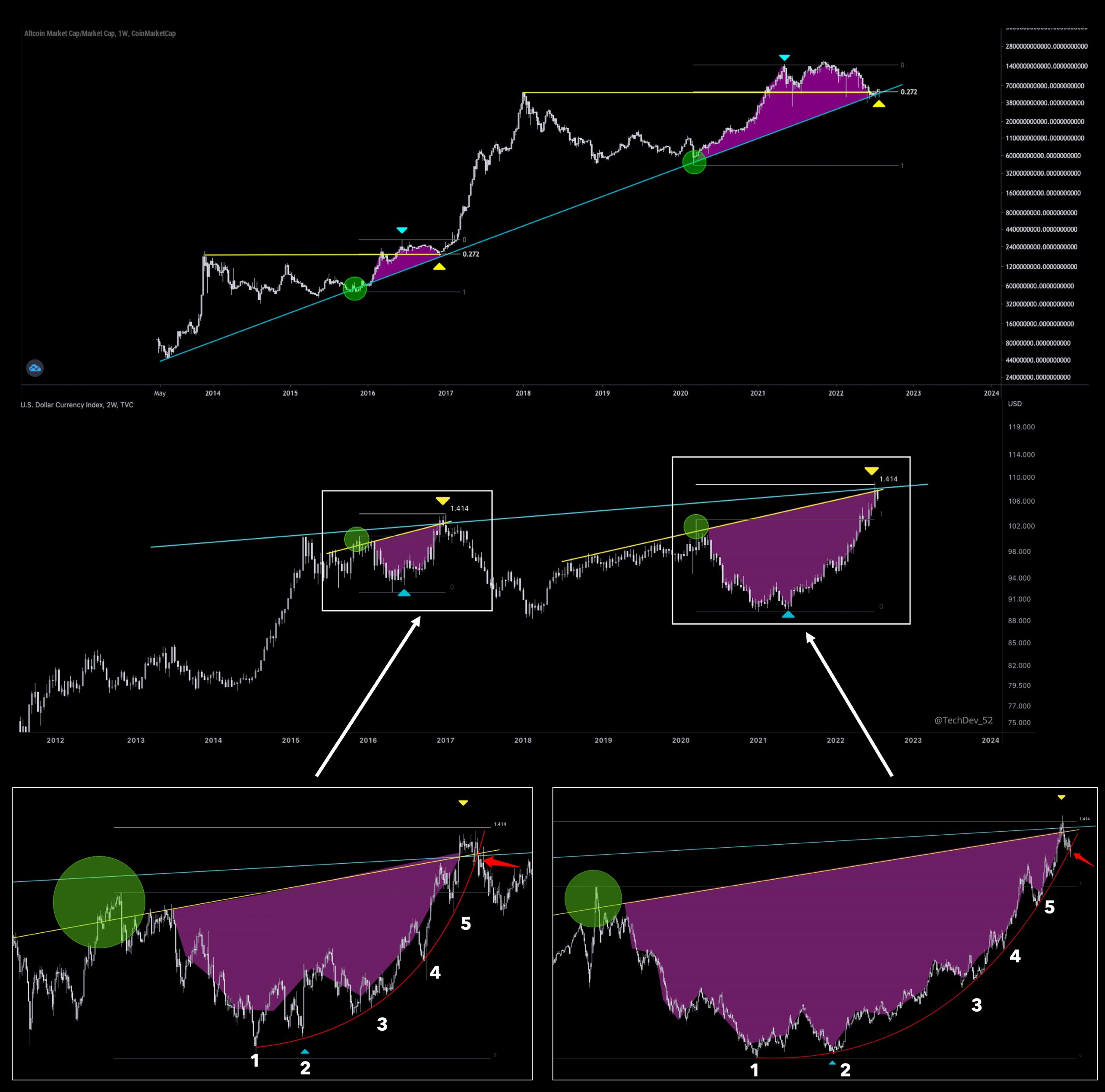

TechDev He then comments on a metric that tracks how altcoins have performed against the US dollar index (DXY) for nearly a decade, and draws Fibonacci extensions that suggest altcoins may be prepared to push higher if DXY loses strength.

The analyst rounds off the relative strength of Bitcoin by comparing it to the top 50 Dow Jones stocks dating back to 2012. The relative strength index (RSI) is an important indicator used by traders to gauge the momentum of an asset’s trend, where a falling RSI is interpreted as a strong bearish one.

TechDev provides a chart showing similar up and down price momentum while highlighting key moments in 2012, 2016, 2020 and this year.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.