With the approach of the Merge update, the position volumes in the market’s second largest cryptocurrency Ether (ETH) derivatives are increasing.

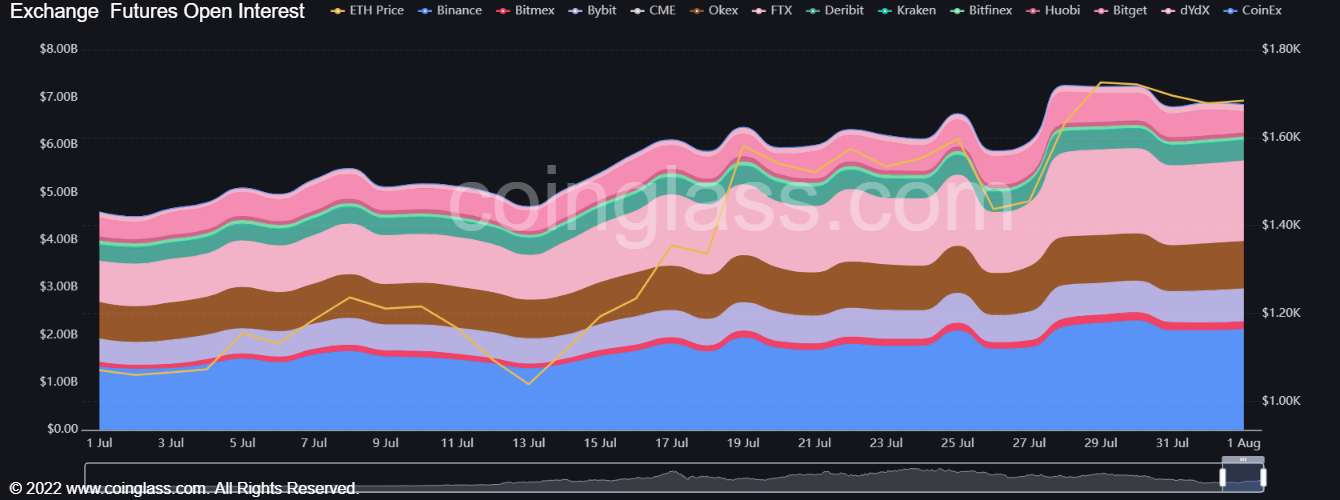

According to the news of The Block on July 31, the second largest coin in the cryptocurrency market Ethereum major structural update Merge’s date as you get closer Ether (ETH) derivatives increasing interest. Options written on ether total open interest (total volume of open positions) in 1 month 2.92 between July 1 and August 31, with an increase of $ 1 billion. 2.87 billion dollars 5.85 It is said to be worth billions of dollars. On the forward side, the total open interest in 1 month 2.27 between July 1 and August 31, with an increase of $ 1 billion. 4.58 billion dollars 6.85 reported to be worth a billion dollars. 27-30 July It is said that the dates are quite interesting for Ether derivatives, because between these dates both option as well as term total open interest on the side 7 billion dollars surpassing 2022 April appears to be approaching the level of

Total Open Interest of Ether Options (1 July-31 August)

Total Open Interest of Ether Futures

Joshua Lim, Head of Derivatives at Genesis Global Trading In his interview, he said that the increase in transactions in derivative products Merge position before the update from macro hedge funds announced its origin. Lim said low premiums on Ether options are attractive to hedge funds. rising volumes Expected in ether 3000 dollars a price level call butterfly (a cost reduction strategy by simultaneously buying and selling options with different strike prices) He said it could be a combination.

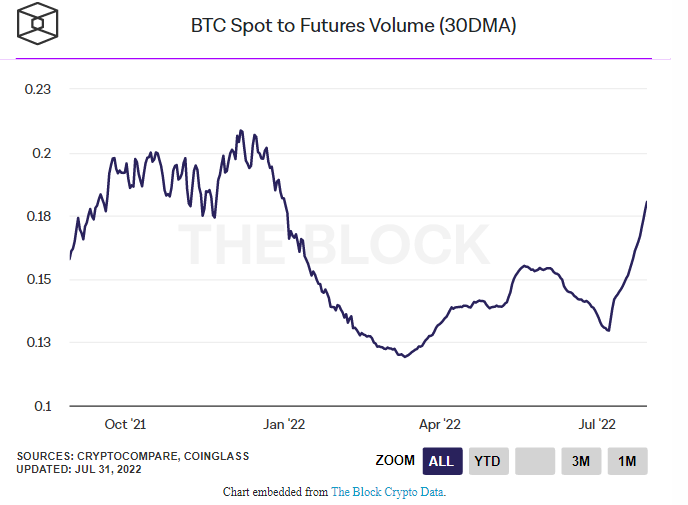

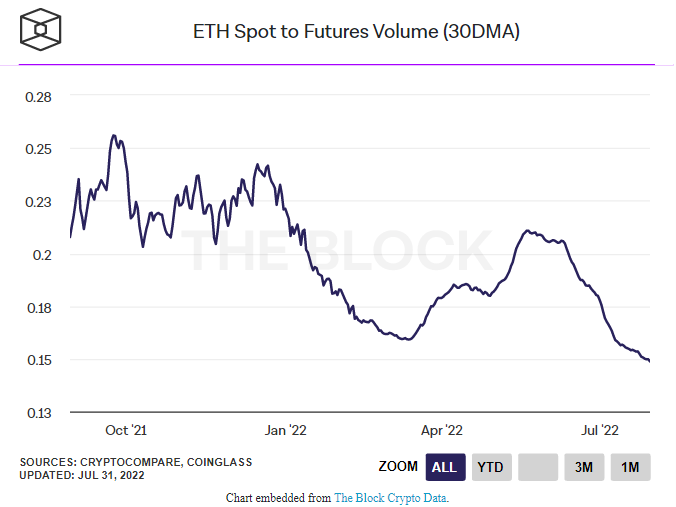

According to the data in the news, of bitcoin spot to futures volumes with Ether’s between spot-to-futures volumes positive correlation collapsed is seen. According to experts, the collapse of the correlation between these two assets, which have been positively correlated for a long time. harbinger of a break It may be, but the more remarkable point is: in bitcoin spot to futures the more ether also decreasing this is in bitcoin growing shorts could be an indicator.

Bitcoin spot-to-futures volume (30-day moving average)

Ether spot-to-futures volume (30-day moving average)