Volatility in cryptocurrencies continues after the annual Jackson Hole meeting held by the Fed. With Powell’s hawk statements after the meeting cryptocurrenciesfaced a selling pressure.

However, if we look at the overall picture, cryptocurrencies have been in a general bearish market for about 9 months. Crypto on-chain analytics firm glassnodeshared the latest data and made some comments on the short-medium-term future of Bitcoin.

According to the on-chain metrics Glassnode has bitcoin Bear season continues. According to the data, the prospect of a general recovery or rally is still not on the horizon, as BTC price rebounds are short-term.

It measures the ratio between the selling and buying prices of the leading cryptocurrency. SOPR data cannot go above 1.0 level. SOPR data breaking above 1.0 can be a leading indicator for bullishness in some cases.

Glassnode officials interpret this data as follows:

This data shows that BTC investors tend to withdraw from the market by taking profits immediately on small rises in the bear market.”

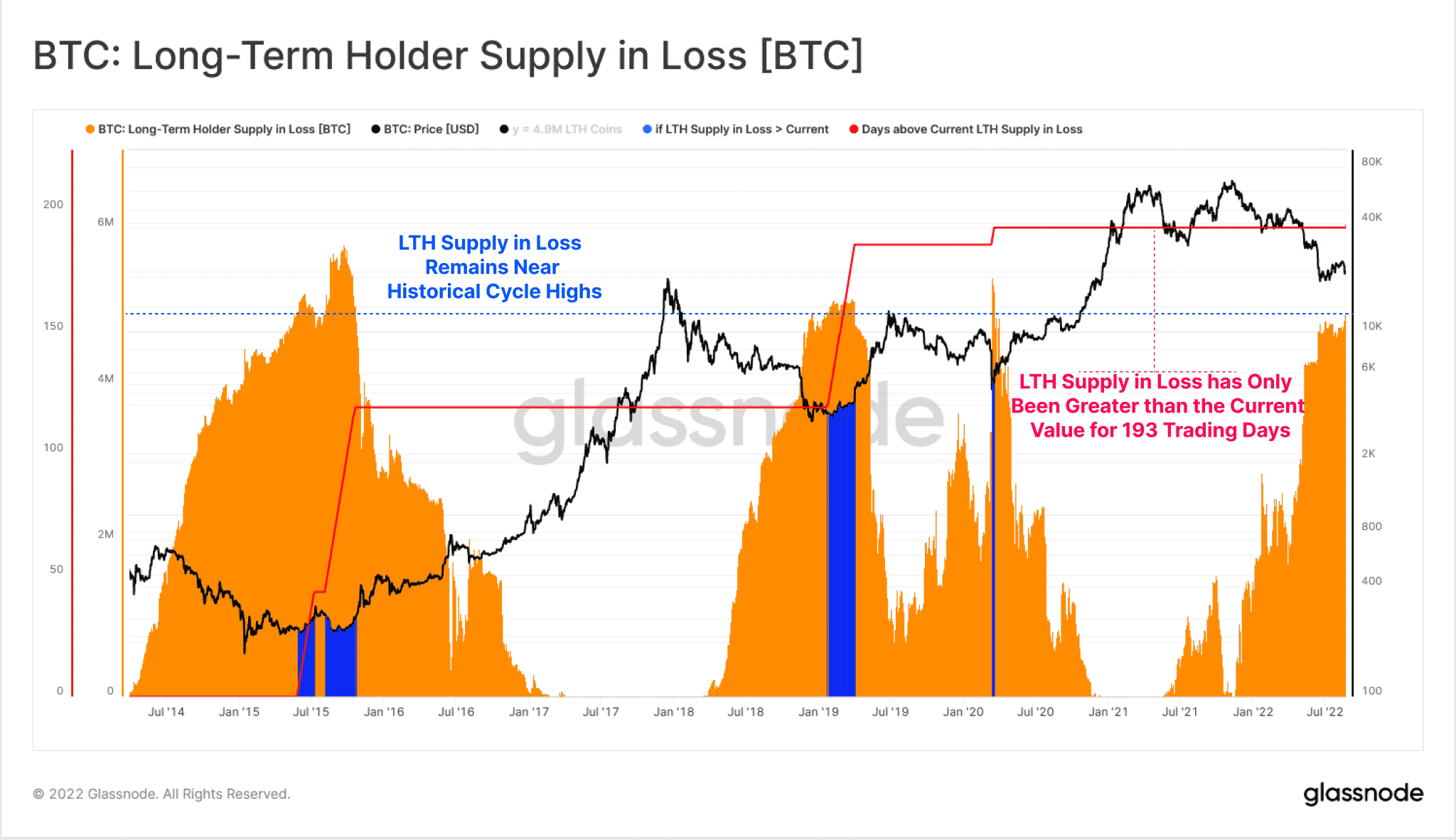

It measures the profit/loss ratio of long-term Bitcoin investors (traders who have held BTC for more than 155 days). LTH data remains in a state of loss. This data shows that the pressure of the bear market on investors continues.

Glassdnode analysts commented on the state of the crypto market in general as follows:

“The current market situation is still comparable to the bear season in 2018. But unless macroeconomic conditions around the world improve, we do not expect a long-term rally in cryptocurrencies.”

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!