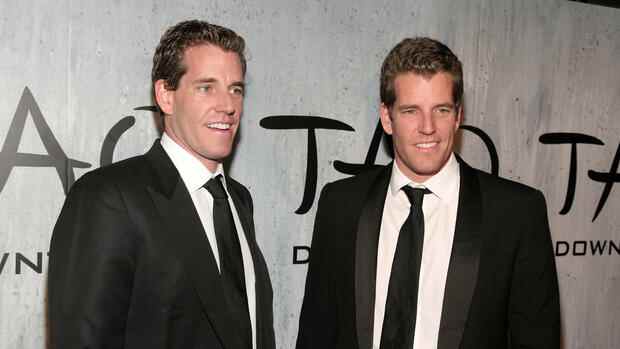

The twins feel the crisis of confidence in the crypto world.

(Photo: AP)

Denver Tyler and Cameron Winklevoss liked to portray themselves as the level-headed providers in the crypto world. Now, however, the founders of the crypto exchange Gemini are also feeling the consequences of the crisis triggered by the bankruptcy of FTX.

FTX was once the second largest trading venue for digital currencies in the world and was forced to file for bankruptcy last week after a huge fraud scandal. Since then, there have been domino effects in the industry, in which providers are closely interlinked.

The Winklevoss twins felt this acutely with their program “Gemini Earn”. The offering allowed users to lend the cryptocurrencies they hold in their Gemini accounts and earn interest on them. Since Wednesday, however, the exchange has frozen funds from this program. According to the Bloomberg news agency, around 700 million dollars are affected.

The reason: Gemini passed on the coins of its customers who participated in the program to the powerful crypto broker Genesis. This in turn lent the coins to hedge funds and other professional investors. Both Gemini and Genesis raked in fees for doing so. But in view of the price slumps in the wake of the FTX bankruptcy, Genesis itself no longer gets the crypto credits it was given back and had to stop withdrawals. With that could

Genesis also no longer pays back the coins to Gemini.

“We’re working with the Genesis team to ensure customers get their Earn program money back as quickly as possible,” the Winklevoss twins said. More information should be available “in the coming days”.

This in turn increased the nervousness of all Gemini customers. They withdrew $570 million in funds within 24 hours, according to data from analytics firm Nansen. The concern that investors could lose their money again is too great. The large rush temporarily led to failures in the Gemini app.

Top jobs of the day

Find the best jobs now and

be notified by email.

Industry experts are concerned about the problems at Genesis. The broker “sits right at the center of the crypto capital markets,” said Jason Yanowitz, founder of industry service Blockworks, in a lengthy statement on Twitter. Not only Gemini, but a number of crypto exchanges lent users’ coins via Genesis. The broker counts large hedge funds and family offices among its customers. The fact that he has now got into financial difficulties himself is “not good.”

Genesis had already lost money when hedge fund Three Arrows Capital went bankrupt in the summer. With the doldrums in the crypto markets this year, business has decreased significantly.

Ironically, Genesis is owned by crypto conglomerate Digital Currency Group, which is run by billionaire Barry Silbert. The group also includes the Coindesk news service, which raised doubts about the FTX business model with an article in early November.

Bitcoin, the largest and oldest cryptocurrency, was unchanged at $16,666 Thursday night. At the beginning of November, before the FTX crisis, it was still over $21,000. According to analysts at JP Morgan, the price could fall to around $13,000 as the confidence crisis unfolds.

More: The FTX founder is said to be looking for new investors even after his crypto empire went bankrupt – without success. Experts fear further bankruptcies in the crypto sector.