The computer games retailer wants to concentrate on the digital business in the future.

(Photo: Bloomberg)

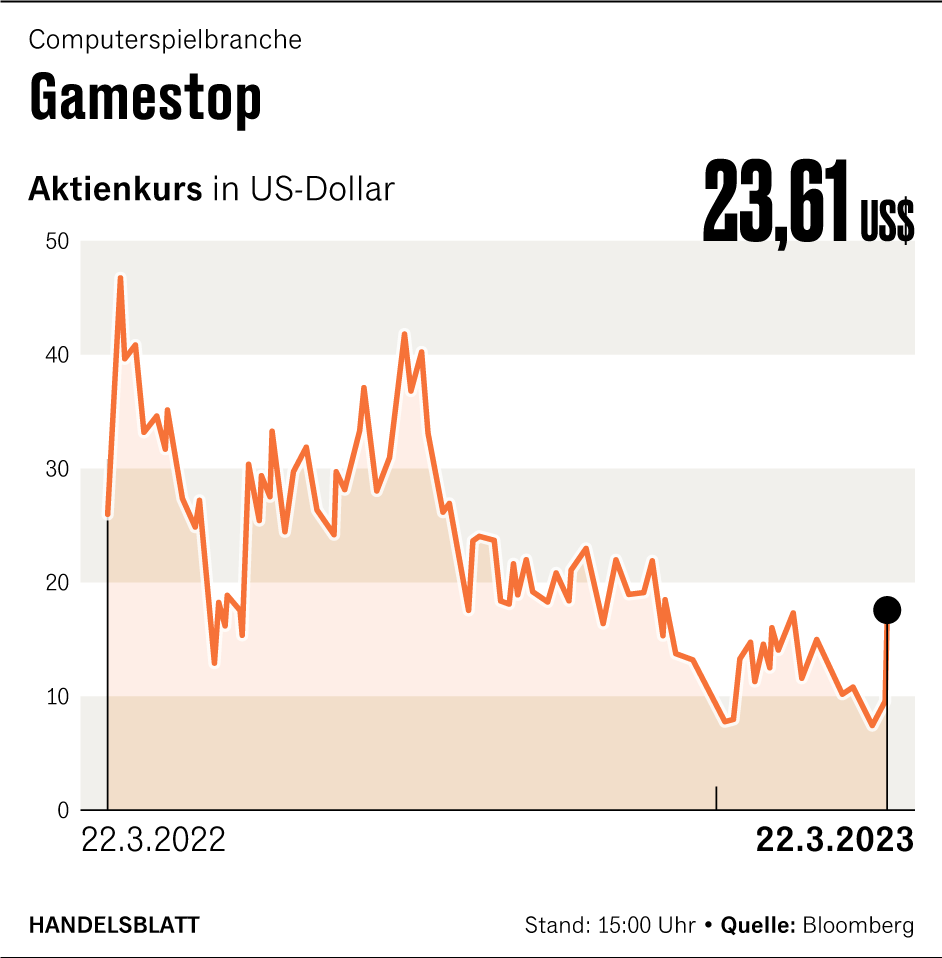

Dusseldorf The fact that the US video game retailer Gamestop has returned to profitability is being celebrated on the stock exchange. Gamestop shares started trading on Wall Street on Wednesday with a jump. The titles increase by around 40 percent to just under 25 dollars.

Gamestop was also in demand on the futures market: According to the “Options Clearing Corporation”, more than 15 times as many options on Gamestop shares were traded at the start of trading on Wednesday, more than Apple, Amazon or Alphabet. The majority of these were call options, which investors can use to benefit from rising prices.

Gamestop made a profit of $48.2 million for the quarter ended January. The company announced this on Tuesday evening after the market closed. In the previous year it had suffered a loss of 147.50 million dollars. This clearly exceeded the expectations of the analysts: They had expected a loss of 13 cents per share – but Gamestop actually achieved a profit of 16 cents per share.

This is particularly popular with younger private investors. In the “Wallstreetbets” forum on the online platform Reddit, which is popular with this group of investors, Gamestop shares were by far the most frequently discussed securities.

Gamestop stock is up 40 percent — but there’s a catch

However, despite the first quarterly profit, there has been a downer since the beginning of 2021: The profit is mainly due to cost cutting and a reduction in personnel costs. Analyst Michael Pachter from Wedbush Securities sees this as a warning sign: “It is unlikely that they can grow by spending less. I expect them to return to losses next quarter and I think this is a one-time result.”

It is true that sales of $2.23 billion were above analysts’ average estimates of $2.18 billion. Year-on-year, however, it fell by 1.2 percent.

Gamestop has been in a transformation process for around two years: the company wants to continue to reduce its original core business, stationary retail. This is because competition from larger retailers is increasing.

Instead, Gamestop wants to strengthen its digital presence. The company even entered into a partnership with the failed crypto platform FTX.

The transformation process could necessitate further tough decisions, said CEO Matt Furlong in a conference call after the publication of the quarterly figures. He indicated that further layoffs are possible in order to increase profits and the share price.

In fiscal 2023, we will take a number of actions to improve our efficiency and support these overarching goals. This also means that we continue to reduce excess costs. Matt Furlong, Gamestop CEO

“We are aggressively focused on improving year-over-year profitability while pursuing pragmatic, long-term growth,” Furlong said. “We will take a number of actions in fiscal 2023 to improve our efficiency and support these overarching goals. This also means that we continue to reduce excess costs.”

Gamestop stock all-time high far away

Gamestop became known to a broader public in Germany at the beginning of 2021. After hedge funds bet excessively that the company would go bankrupt, the entry of investor Ryan Cohen caused a change in sentiment on the stock market.

Above all, via online forums such as Wall Street Bets, private investors arranged to buy Gamestop shares and encouraged each other to make further investments. In the course of this, the share rose by several hundred percent. As a result, the hedge funds at times made billions in losses with their bets on falling prices.

Since then, the Gamestop hype has flared up again and again for shorter phases. So far, however, there has not been a similarly strong development as in 2021. Even after the recent jump in price towards $25, the stock is well below its high of just under $121 at the time.

With material from the Reuters news agency.

More: What is left of the Reddit traders