Cryptocurrency market has been frequently criticized for being associated with ‘criminals’ since day one. As a matter of fact, it would be wrong to claim that even though there are such people as in traditional markets, they are all like that.

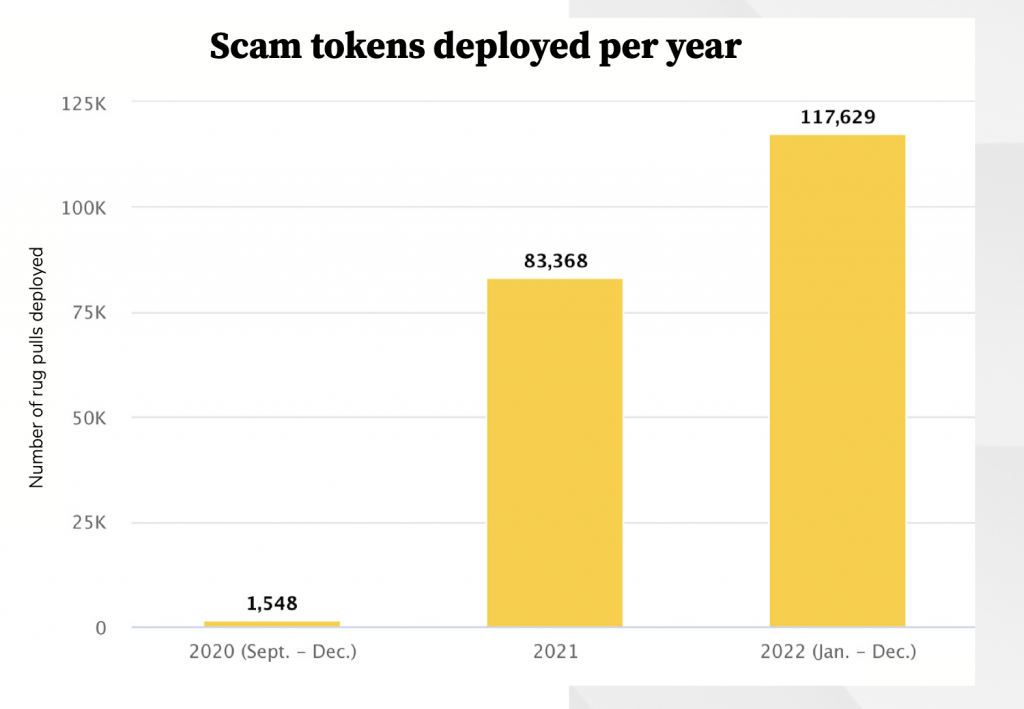

According to Solidus’ latest 2022 Rug Pull Report, 117,629 fraudulent tokens have been detected so far in 2022. The data highlighted a 41% increase from about 83,000 in 2021. According to the report, more than 350 scam tokens were created every day in 2022. Also, the current number is astronomically higher than 1548 in 2020.

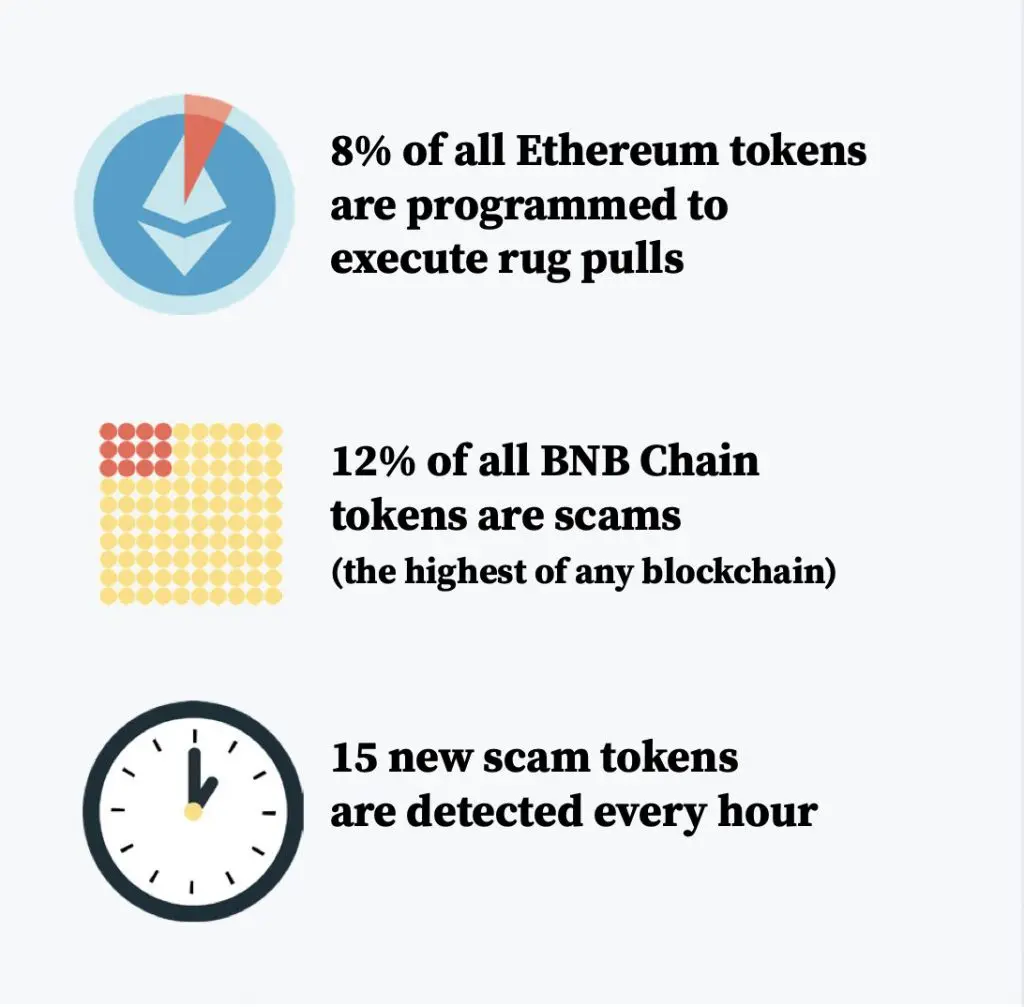

According to the report, the majority of fake tokens reside on BNB Chain. Moreover, 12% of all BEP-20 tokens are fake projects. The Ethereum network accounts for 8% of fake ERC-20 coins.

The report also highlights that 15 new fraudulent tokens are discovered every hour.

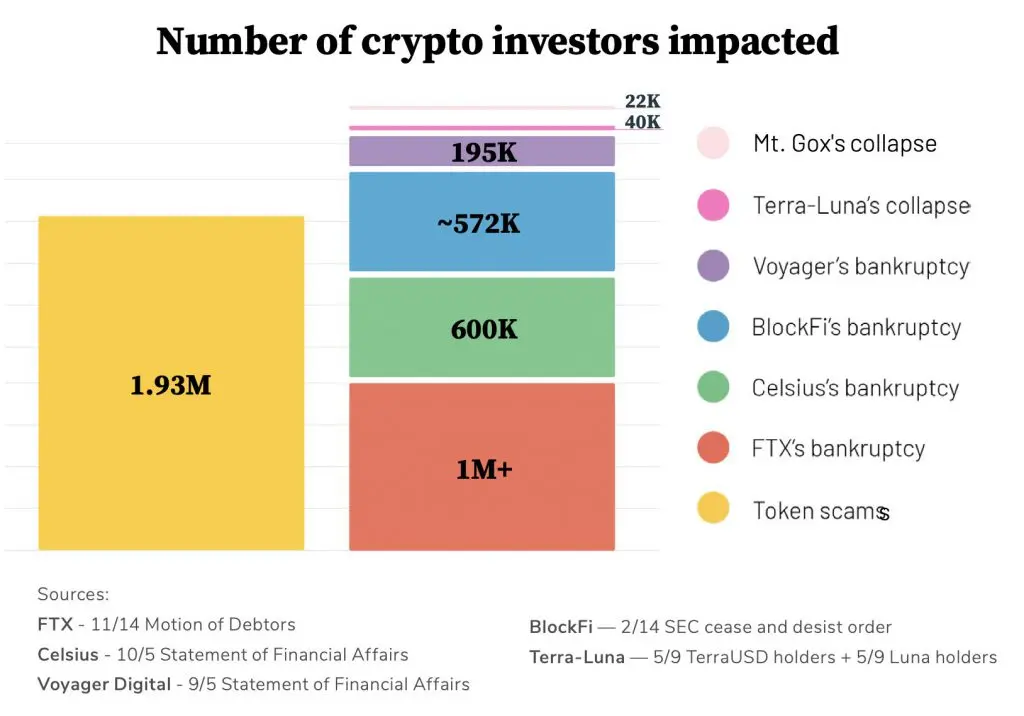

In the report, nearly 2 million people rug pull due to the loss of funds. This figure equates to the number of investors who suffered unsecured losses in the biggest crypto market crashes.

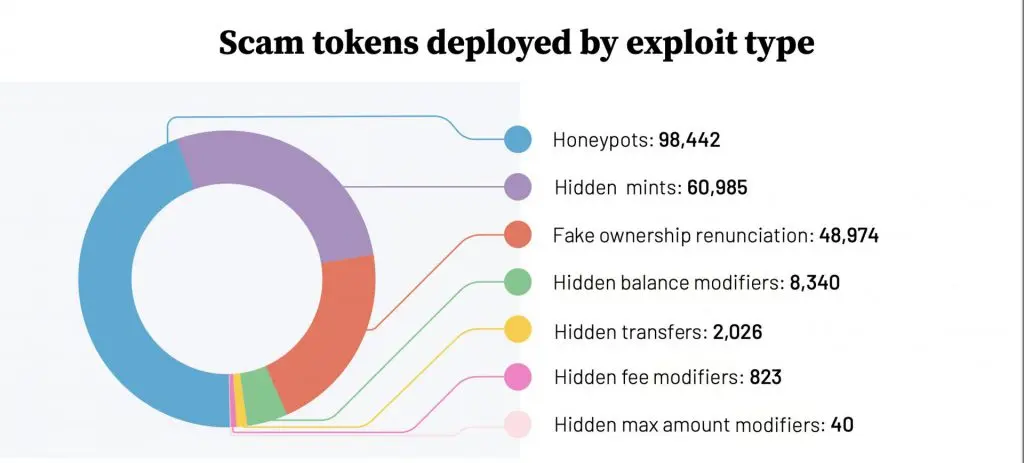

The report also found “Honeypots” to be the most common type of fraudulent token. “Honeypot” is a smart contract that prohibits buyers from reselling. According to Solidus, the $3.3 million Squid Game (SQUID) token scam, which surged 45,000% in just a few days, was the most extensive “honeypot” ever in 2022. Investors bought but failed to sell the hype, and the developers soon got away with client funds.

Rug pulls also damage centralized exchanges (CEXs). The people behind these fake tokens prefer centralized exchanges to finance their dubious projects and pay for their ill-gotten gains.

Since September 2020, 153 CEX allegedly processed $11 billion in stolen Etherum assets via fraudulent tokens, with many of these exchanges being managed by American authorities.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.