Crypto analyst Aaryamann Shrivastava says investors stumbled as MATIC dropped 30% in one month. Also, the analyst expects a 25% drop in Ethereum price. According to analyst Akash Girimath, if the BNB bulls’ recovery plan fails, the altcoin price is likely to drop by 25%. Finally, analyst Lockridge Okoth says that ATOM is trading in a bear trend.

This altcoin price has paused to form lower lows

MATIC price witnessed March lows over the past month. The altcoin is currently on track to test potentially year-to-date lows. Fear of this happening has made investors paranoid. Thus, it caused them to withdraw from the network. This maneuver will work out in their favor as the altcoin is showing signs of recovery. MATIC price witnessed a drop of around 30% in 30 days. The altcoin marked $1.18 as its April high. However, later on, MATIC started drawing red candlesticks and dropped to $0.84.

This decline has frightened investors to the point where they have withdrawn from trading on the network. Active addresses, which averaged around 3,000 in mid-April, dropped to 1,500 when MATIC price dropped 30%. Investors’ assets were last this low in March 2021. This also affected the active address rate, which is currently at an all-time low.

A resurgence of the asset can be expected once MATIC price manages to flip the $1 mark as support ground. This is true not only because it is an important psychological level, but also because once most of the decline in trader activity begins, the altcoin falls below this point.

Leading altcoin price at risk of falling to this level

cryptocoin.comAs you can follow, Ethereum price action has worried investors across the market. But popular trader Cryptonary says that big investors know what they’re doing. Some of these investors started selling this week. Wallets holding 10,000 ETH and 100,000 ETH in their hands sold approximately 800,000 ETH worth $1.45 billion, increasing their balance to 28.38 million ETH.

The network has faced some accuracy issues over the past two days, which naturally affect on-chain transactions and investor engagement. Earlier this week, certainty had to be stopped for about half an hour. This has also affected the rotation of the altcoin. It also justified the stability of networks as a key feature.

There are chances of a possible drop to $1,400 in ETH. The drop is likely to occur unless $1,850 turns into a support base. In this case, there could be a bullish path for Ethereum price. However, not all aspects of the altcoin are bearish. While whales are selling, holders of large wallets holding 100,000 ETH to 1 million ETH buy the supply drained by individual investors.

The altcoin is showing further bullishness as more than 20 million ETH have been staked to date and another 3.5 million ETH has been burned from the supply. This is a positive development. Because it triggers deflationary debates, making Ethereum the most sought-after altcoin.

If more bullish signs are observed in the next few weeks, it is possible for Ethereum to start a recovery. Otherwise, a drop to $1,400 seems inevitable. This means a 23.43% collapse.

BNB price at a crossroads

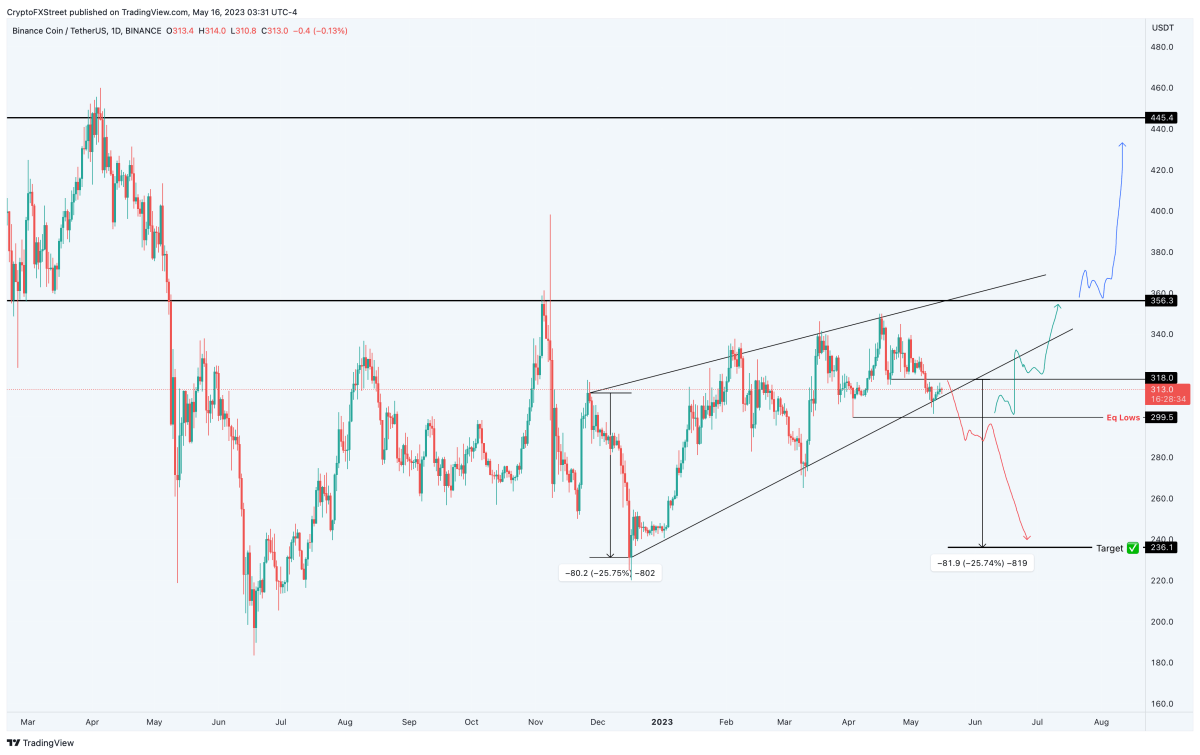

Binance Coin price has been consolidating in an ascending wedge pattern since November 2022. This technical pattern includes four high highs and three low lows formed between November 2022 and May 2023. Combining these swing points using trend lines reveals an ascending wedge pattern.

Meanwhile, BNB is trading at $312 at the time of writing. BNB has yet to make a definitive break in the rising wedge. However, a daily candlestick close below $300 will likely trigger a sharp correction. Adding the distance between the initial swing and the low swing to this breakout point would reveal the target at $236. This means a 25% decrease from current price levels. There are chances for BNB price to sweep $300 and trigger a rebound bounce, especially if Bitcoin price rebounds. In such a case, it is possible for the altcoin to try to break through the $356 barrier.

On the other hand, if BNB price bounces off the $300 psychological level and turns the $356 hurdle into a support level, the bearish thesis will be invalidated. Such a move would attract buyers to the edge and potentially trigger a rally to $445.

This altcoin price faces 5% loss

Cosmos price has recorded a series of lower highs and lower lows since mid-April. Thus, the critical support level of $10.69 remained stable. This price action led to the formation of a descending triangle chart pattern that would cause ATOM holders to incur more losses. Sellers currently controlling altcoin price action are taking a temporary break to consolidate their latest gains before extending the downtrend downwards. Breaking the support line below $10.69 will activate the pattern and give traders two options for entry:

- Diving into the market right after the breakout candle closes.

- Possible pullback in Cosmos price.

Meanwhile, the governing chart pattern is bearish. Therefore, it is possible that an increase in selling momentum could lead Cosmos price to drop towards the bottom of the descending triangle at $10.69. Such a decrease would mean a 5% retracement from the current price. This too is likely to open the sewers for another descent into the $10.33 swing low.

Conversely, if the buyer momentum builds, the altcoin’s management pattern is likely to break above the bearish trend line. A decisive candlestick close above this technical pattern at $11.15 will invalidate the bearish thesis. Further north, ATOM price could extend to label supply congestion zones due to the 50- and 100-day Exponential Moving Averages (EMAs) at $11.32 and $11.58, respectively, and the 200-day EMA at $12.00 if highly bullish.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.