Aareal Bank in Wiesbaden.

(Photo: PR)

Frankfurt The private equity houses Advent and Centerbridge intend to submit another offer for the Wiesbaden-based real estate financier Aareal Bank in the near future. The financial investors have already secured around 37 percent of the voting rights. The bidding company announced this early Tuesday morning.

The major shareholders Petrus Advisers, Talomon, Teleios and Vesa have therefore pledged their support with a view to the new offer. The new offer is 33 euros per share and values the financial institution at two billion euros. The major shareholders reinvest part of the proceeds from the share sales and acquire a package of 20 percent of non-voting shares in the bidder company.

In a statement, Petrus welcomed the fact that the offer was increased again “despite a more uncertain macroeconomic environment and in particular the Ukraine crisis”. The new offer is “fair”. Petrus holds around 18 percent of the shares directly and via derivatives.

Advent manager Ranjan Sen explained that the bidding consortium plans to “further develop Aareal Bank in accordance with the strategy decided by the Management Board”.

Top jobs of the day

Find the best jobs now and

be notified by email.

The last takeover attempt in February had failed. At that time, the investors had collected only 42.55 percent of the shares and were thus well below the self-imposed threshold of 60 percent. At that time, according to financial circles, the bidders said that a new attempt was not planned. The price at that time was 31 euros per share certificate.

The software subsidiary as a topic of dispute

Petrus Advisers and another fund – Teleios with a good seven percent of Aareal shares – had also considered the recently failed offer to be far too low. Petrus manager Till Hufnagel had stated in mid-January that the value of the Aareal software subsidiary in particular was not being adequately reflected, and had given drastically higher price expectations.

The future of the software subsidiary is the most important point of contention between the Wiesbaden real estate financier and Petrus Advisers and Teleios. The activist hedge funds had been calling for a spin-off from Aareon for some time because they considered this to be more attractive from a shareholder perspective. Teleios declined to comment on the matter.

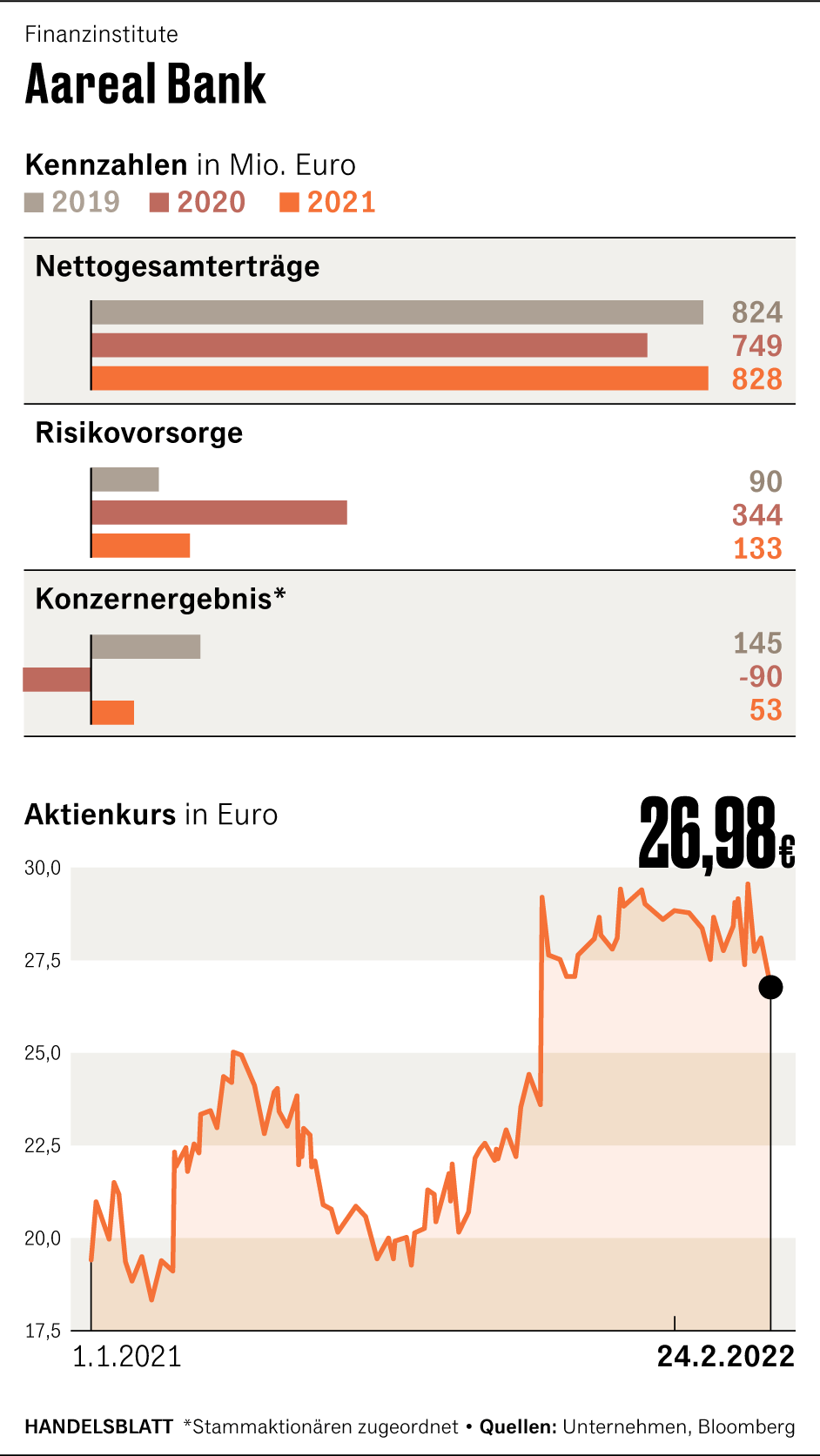

Aareal Bank itself had recently shown itself to be more open to parting with its software subsidiary Aareon. “With regard to our target year of 2025, the transfer of Aareon to new owners, whether through a sale or an IPO, is not taboo for us,” said CEO Jochen Klösges when presenting the preliminary annual results.

For 2022 and the coming years, Klösges, who has been in office since mid-September, plans to significantly increase profits. The operating result is expected to grow to between EUR 210 million and EUR 250 million in the current year.

That would be roughly the same as before the pandemic. For 2024, the management is aiming for a further increase to up to 350 million euros. The IT subsidiary Aareon should then also make a significant contribution to this.

More: Hedge fund attacks – More than 60 companies are ‘extremely vulnerable’