Bitcoin (BTC) And cryptocurrency A new one has been added to the statements of the FED chairman, who is closely followed by the world.

Here are the highlights of FED Chairman Jerome Powell’s speech that started at 20:40 Turkey time:

- The message from last week’s FOMC meeting was that the disinflation process has begun, but there is still a long way to go.

- The process will have ups and downs, More rate hikes will be needed.

- The employment report was definitely stronger than anyone expected.

- The strong employment report shows why we think this will be a significant time-consuming process. We will probably need to raise interest rates further.

- The Fed anticipates that further rate hikes will be necessary, but it has not yet reached a sufficiently restrictive level.

- If data continues to come out stronger than expected, interest rates will almost certainly be pushed higher.

- 2 percent inflation is the global standard and the FED has no plans to change it.

- I expect 2023 to be a year in which there will be significant decreases in inflation. It will almost certainly take next year for inflation to drop to 2%.

- Because the economy is strong, the labor market is also strong.

- It is an encouraging development that disinflation started without harming the labor market. There is currently a labor shortage that appears to be structural rather than cyclical. The pandemic has created a long-term workforce gap in the United States, and this gap is felt to be structural.

- Even though the FED has the necessary tools to reach its 2% target over time, global events affect inflation.

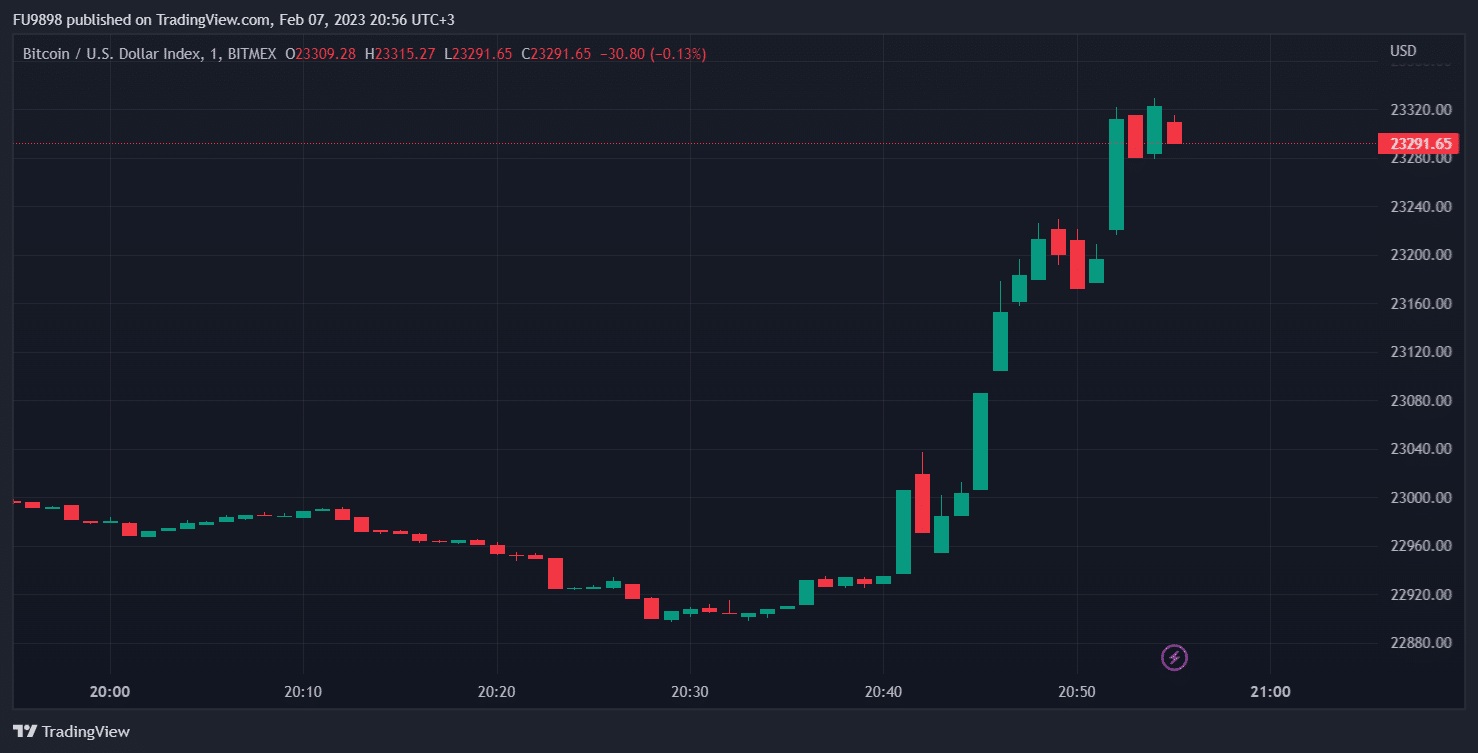

Movement was observed in Bitcoin price with Powell’s speech:

After Powell’s speech last week, a rally was observed in the BTC price.

After the FED President’s Speech Last Week, There Was a Rally in Bitcoin

Investors saw Federal Reserve Governor Powell’s speech as an opportunity to clarify where and for how long interest rates will go, and to elaborate on comments that were interpreted as dovish after a quarter-point increase in Fed funds last week.

Sam Stovall, chief investment strategist at CFRA Research, made the following statement before Powell spoke:

“Just as the Fed is dependent on data, investors are dependent on Powell’s comments. With his speech at the Economic Club of Washington today, I think people will pay attention to see if he’s saying anything new.”

Markets started a rally in equities, interpreting Powell’s press conference after the Fed’s decision last week as he believed the central bank was making solid progress in reducing inflation.

*Not investment advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android And iOS Start live price tracking right now by downloading our apps!