A US-based crypto investment company transferred a large amount of altcoins purchased in 2021 to its Binance wallet. It is unclear whether the company, which lost more than 80% on its altcoin investment, will sell.

Dragonfly Capital moves its altcoin position, which it lost $44 million, to Binance

Blockchain researcher Lookonchain found that 4.69 million PERP was transferred to Binance from the address marked Dragonfly Capital. On-chain records show that company-owned wallets started purchasing PERP on July 20, 2021. With purchases made during this period, the company purchased a total of 4,264,921 PERP at an average price of $10.92. Calculated from the current price of $0.463, Dragonfly Capital has a variable loss of $44 million on this transaction.

Dragonfly Capital began buying and staking PERP on July 20, 2021, according to a report by Lookonchain on Twitter on Dec. The company bought a total of 4,264,921 PERP ($46.55 million at the time) during the bull market. The average purchase price was $10.92.

Perpetual Protocol (PERP) is currently trading at $0.4666. Dragonfly Capital has lost $44 million from this investment last year.

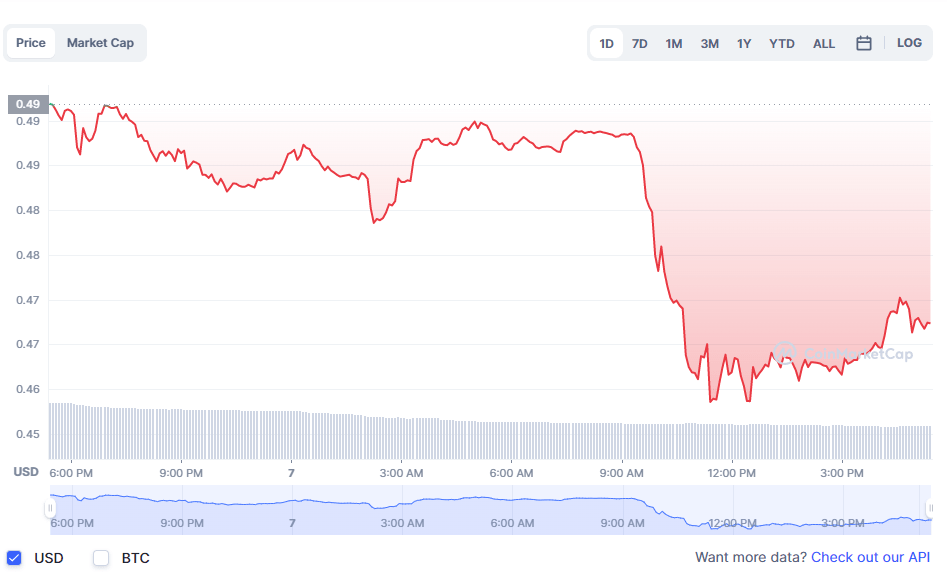

PERP price drops after news

Meanwhile, on Binance, the PERP token 24-hour trading volume was just $3 million. After Dragonfly Capital transferred PERP, the price initially dropped around 2.5%. Then the last 24-hour depreciation reached over 5%. Dragonfly Capital may not have sold all 4.69 million PERP yet, as the downward move has yet to gain significant momentum.

Perpetual Protocol (PERP) is software project that creates financial tools to enable users to trade various assets. The protocol provides a DEX platform that derives its value from another asset called a perpetual contract. Just like PERP, Avalanche has raised investments from Dragonfly in NEAR, Compound, MakerDAO, 1inch and Dune Analytics. The cryptocurrency company spent a total of $700 million on these projects.

About Dragonfly Capital

cryptocoin.comAs you follow, Dragonfly led the funding round of ApeX Protocol, which was completed in March. Other strategic investors such as Jump Trading, Tiger Global, Mirana and M77 also participated in the funding round. In April, the company raised $650 million for its third crypto fund. This increased its assets under management to approximately $3 billion. Thanks to large investments, Sequoia Capital and Bain Capital managed to stay in the league of giants. Founded in 2018, Dragonfly Capital’s investment portfolio includes Avalanche and Near Protocol.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.