Chainlink looks ready to start a new bull rally. Chainlink may be approaching a new uptrend, but it needs to stay above $20. Popular altcoin Solana, on the other hand, appears to be on a hiatus after posting significant gains in September, but it may be approaching a breakout. On the other hand, Terra’s LUNA looks set to rise to higher heights as the network prepares for the launch of Inter Blockchain Communication. Details cryptocoin.com‘in.

Three altcoins with a bull run expected

According to analyst Ali Matinez, the first of the altcoin projects that are expected to run bulls is Chanilink. Chainlink is currently trading at the lower boundary of a parallel channel. The increase in buying pressure around current price levels could push LINK into a new bull run. However, a breach of the $20 support could result in significant losses. Popular altcoin project Chainlink appears to be trading at a crucial support level, which previously marked the start of a bull run. A similar price action could push LINK up to $200. According to the analyst, Chainlink looks set to work towards new all-time highs.

LINK has undergone a sharp correction since it rallied to $36.40 on September 6. Every time LINK has since climbed to the upper boundary of this technical formation, the uptrend has been exhausted and prices have retreated to the lower edge of the formation. From this point on, LINK tends to rebound, which is consistent with the characteristics of a parallel channel. Now that the coin has found support around the lower trendline of the channel, it looks like the uptrend continues. According to the analyst, Chainlink may soon be bullish.

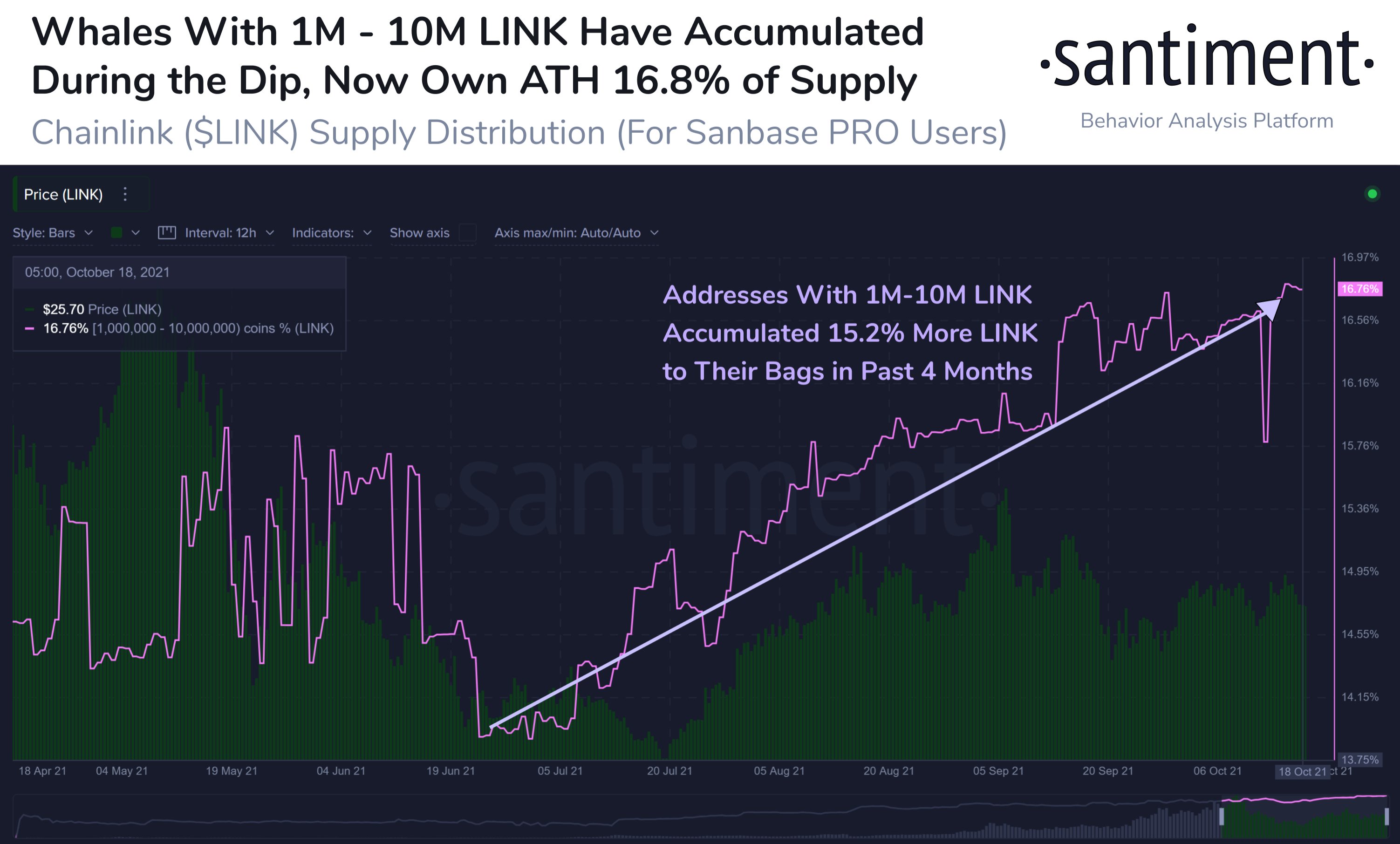

The behavior of whales buying LINK supports the bullish outlook. The resulting data shows that the buying pressure behind Chainlink has increased dramatically over the past few months, with addresses between 1 million and 10 million LINK currently holding 167.7 million tokens.

Although the odds seem to be in favor of the bulls, the lower boundary of the parallel channel could create a bearish scenario. This key support area has included every wave of bearish pressure since May 2018. Breaking such a strong foothold could trigger panic selling among investors and result in significant losses. The bottom line for the channel was $20 at the time of writing. According to the analyst, any signs of weakness at this price point could result in a correction towards $13 or even $8.

Solana is approaching

Solana appears to be on a hiatus after posting significant gains in September, but may be approaching a breakout. Solana is approaching the top of a symmetrical triangle on its daily chart. Breaking outside of this pattern could result in a significant price action. SOL could target an all-time high of $243 if buying pressure accelerates. Solana went through a long period of consolidation after recording an all-time high of $216 in early September. While SOL remains stagnant, the cryptocurrency could be preparing for a significant spike in volatility. The smart contract blockchain token SOL has been consolidating for several weeks.

SOL makes a series of lows and highs without offering a clear view of where it’s headed. This price action seems to have developed a symmetrical triangle on the daily chart of SOL. Measuring the height of the y-axis of the triangle attached to the breakout point shows that the ongoing recession could result in a 43% price move. Still, Solana should first print a daily candlestick above resistance or below support to determine the direction of its trend.

The Fibonacci retracement indicator, measured from September 9’s all-time high at $216 to September 21 low at $116, shows that Solana’s most important resistance barrier is sitting at $166. Both the upper trendline of the triangle and the 50% Fibonacci retracement level are located around this price point. Considering the importance of rejecting any bullish impulses over the past few days, a definitive close above $166 could result in a breakout from $243 to the all-time high. Under such unique circumstances, Solana may dive to retest the September 21 low at $116.

Terra third altcoin

According to the analyst, Terra’s “Interoperability Updates” could help LUNA rise. Terra’s LUNA looks set to rise to higher heights as the network prepares for the launch of Inter Blockchain Communication. The new protocol will allow sovereign chains to communicate with each other. Terra is about to see an increase in network adoption as it enables interoperability with other blockchains.

South Korean company Terraform Labs, which developed the stablecoin-focused blockchain Terra, is taking important steps to increase the utility of blockchain. With the imminent launch of Inter-Blockchain Communication (IBC), the firm aims to open the network to numerous dApps in the Cosmos ecosystem. The expansion of Wormhole to Terra is another major milestone before the release of IBC. The cross-chain bridge will enable the transfer of Terra-specific assets such as UST and LUNA to Solana, Ethereum and Binance Smart Chain via a single interface.

Meanwhile, Terra’s native token, LUNA, has recently bounced off a crucial support level. LUNA corrected 30% after hitting an all-time high of $49.60 on October 4. The immediate downtrend appears to be capped by the 50-day moving average as prices are able to recover from this key support level. The formation of a buy signal according to the Tom DeMark (TD) Sequential indicator has also contributed to the upward price action LUNA has experienced over the past few days.

As long as the 50-day moving average at $37 remains as support, the bullish outlook will hold. However, failing to stay above this strong support could result in significant losses as the next key demand zone is around $31.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. Therefore, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.