On Friday, we saw Bitcoin fall as low as $53500 with the effect of global markets. While the withdrawal in Bitcoin wiped out gains in many altcoins, we are observing that Metaverse-focused projects are recovering quickly.

However, Bitcoin’s difficulty in rising lowers the risk appetite of investors. We observe that the volumes are declining due to the decrease in risk appetite and the intervening weekend.

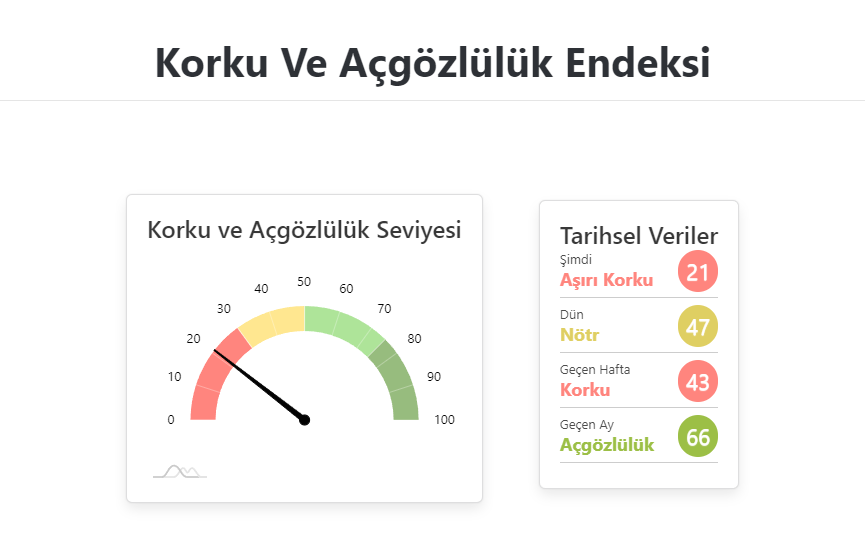

The “fear and greed index” calculated by the popular analysis company, which tries to measure the emotional reflexes of crypto money investors, based on the trends of market volatility, market volume acceleration, social media interest, Bitcoin dominance graph and the types of research on cryptocurrencies on the internet, is 21 points out of 100 today. was calculated as.

While there is a state of extreme fear in the crypto money markets with the recent declines, experts say that these levels can be a good place to buy historically. At this point, pullbacks up to $50,000 can be considered as a stop for a new entry.

Will investors who act on the principle of “buy fear, sell greed” be right again? Time will show that.

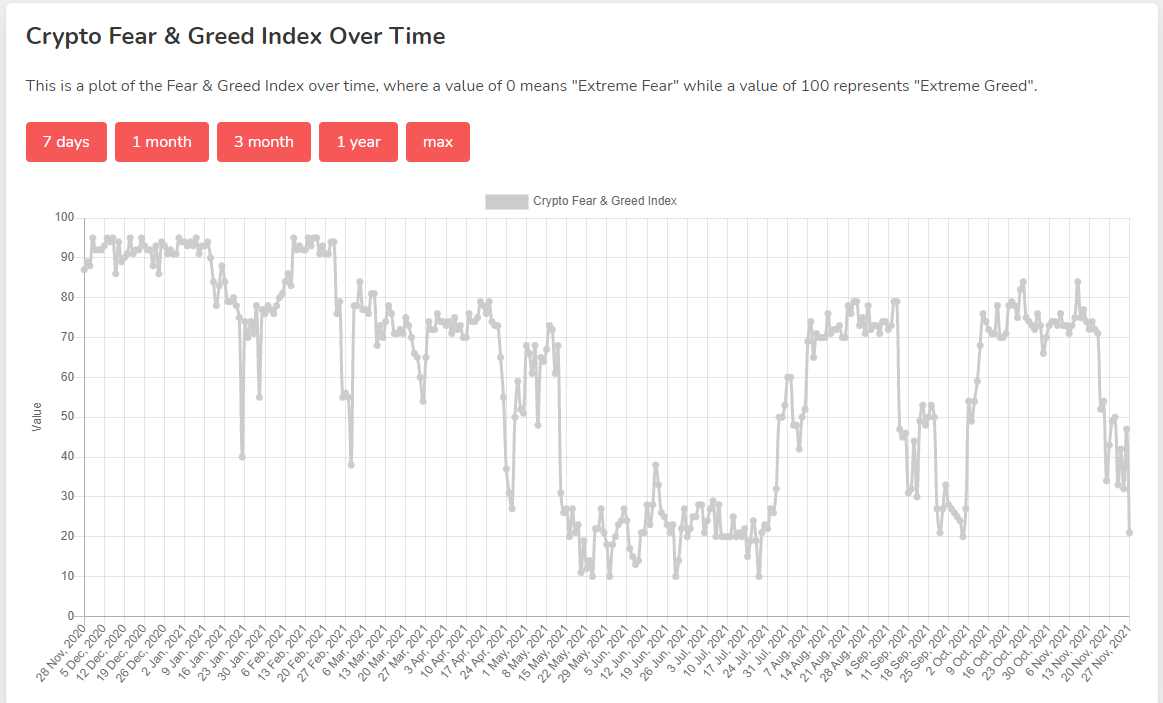

When we look at the historical data, we observe that after the Bitcoin collapse in April, the fear decreased to 10 points and the market started to rise at a point where everyone abstained.

*Not Investment Advice.