Mike McGlone, senior macro strategist at Bloomberg Intelligence bitcoin He says it could be bearish for (BTC) and the rest of the crypto markets.

McGlone says risk assets such as stocks and crypto could become cheaper in the coming months as he believes an economic recession is on the horizon.

According to the macro strategist, the Federal Reserve is still on track to raise interest rates. Bitcoin and other crypto- states that its assets may adversely affect its performance.

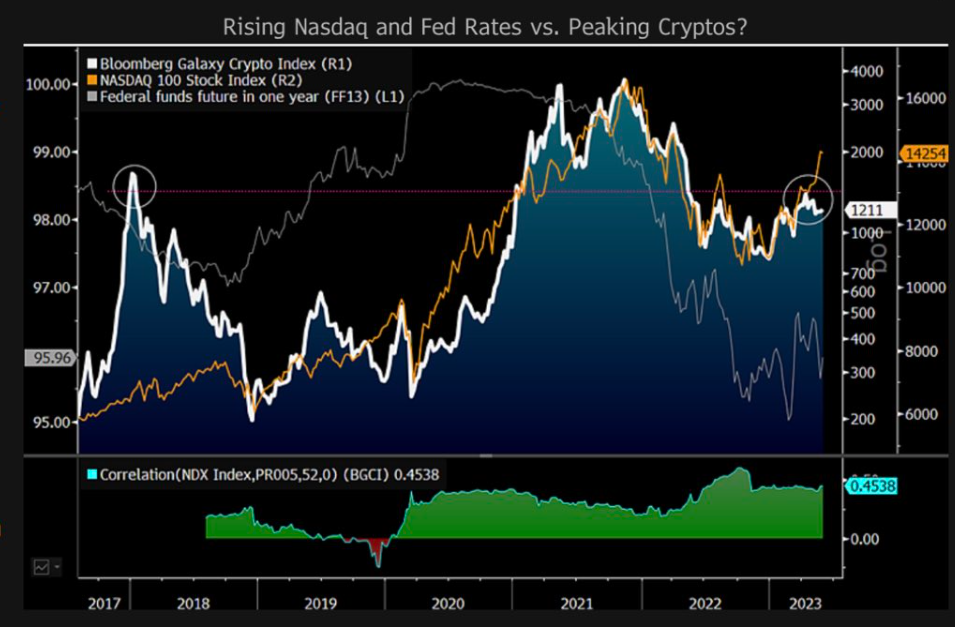

“Risk assets can become cheaper during recessions. The cat-and-mouse game between the rising stock market and cautious central banks could be a stumbling block for risky assets. Cryptos are among the riskiest. There may be a good reason why the Bloomberg Galaxy Crypto Index (BGCI) failed to stay above its 2018 high in 2023: the Fed is still tightening it.”

NEWS CONTINUES BELOW

BGCI tracks the performance of the largest crypto assets traded in USD.

McGlone also says that the Bloomberg Economics team is predicting an “ugly” second half for cryptos and stocks.

“Our chart shows a rare divergence with the Nasdaq 100 Equities Index rising and BGCI falling (Q2).

One-year Federal funds futures (FF13) are a gauge of liquidity, and adding increased expectations of rate hikes to a climbing stock market could put a ceiling on crypto prices.

In 2023, BGCI rose approximately 50% and the Nasdaq 30% through June 1; This could shift the trend towards what is typical in recessions, making risk assets cheaper.”

You can find the current market movements here.