The US Federal Reserve made another 75 basis points increase, in line with expectations. However, Fed Chairman Jerome Powell noted that they will not compromise their stance. After that, the gold price went down. Analysts interpret the market and share their forecasts.

“It is clear that we are not in an environment that is very supportive of gold”

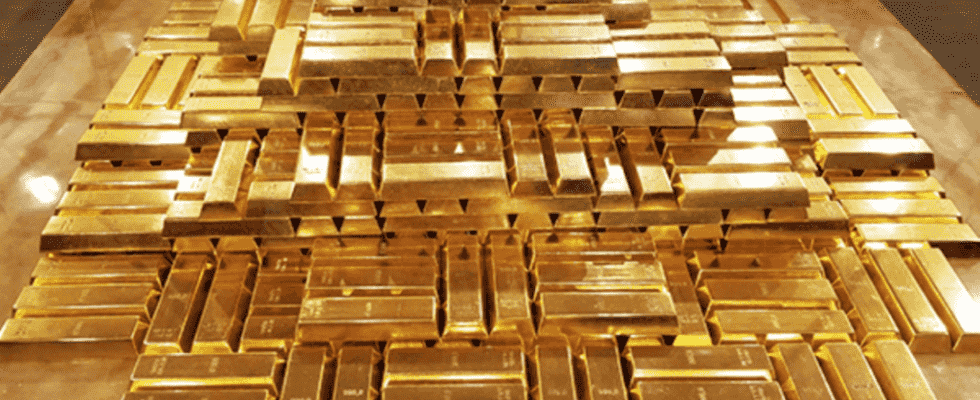

Spot gold is trading at $1,672, down 0.08% at the time of writing. U.S. gold futures rose 0.18% to $1,678. Bullion has lost nearly 9% of its value so far in the year. DailyFX currency strategist Ilya Spivak comments:

The phasing from the FOMC shows that there is a little more room for real rates to continue rising. Also, it is clear that this is not a very supportive environment for gold.

“The rate of increase in interest will definitely put pressure on the gold price”

cryptocoin.comAs you follow, the Fed increased interest rates by 75 basis points for the third time in a row on Wednesday. President Jerome Powell said curbing inflation was “a broad focus”. The Fed also predicts that the policy rate will rise faster and higher than expected. It also predicts that the economy will slow down and unemployment will rise. Sugandha Sachdeva, vice president of commodity and currency research at Religare Broking, comments:

The rate of increase in interest rates will definitely put pressure on the gold price. Eventually, however, concerns about growth and recession will come to the fore. Thus, it will lead to renewed buying interest in gold at lower levels. We predict prices to drop below $1,580. The area between $1,620 and $1,580 is likely to provide ground for the yellow metal.

“Fawn Fed comment will not keep gold in long-term downtrend”

Also, the Federal Reserve signaled more rate hikes. According to David Meger, metals trading director at High Ridge Futures, the gold market quickly realized that the expected path of rate hikes and, more importantly, rate hikes is well influenced by market prices.

Standard Chartered analyst Suki Cooper shared:

The drop in yields supported gold’s rise after the FOMC meeting. It is possible that we may see a short-term closing activity during a relief rally. However, the hawk interpretation is poised to keep gold prices in a long-term downtrend.

“Gold price may form a short-term bottom at $1,655”

The Fed’s new forecasts show that the policy rate will rise to 4.4% by the end of this year and to 4.6% in 2023. Tai Wong, a senior trader at Heraeus Precious Metals in New York, predicts:

Price action suggests that gold could form a short-term bottom at $1,655. However, the upside will remain a challenge unless there is a clear message from the Fed that rate hikes are definitely not going to happen.

“Financial markets have already priced in the 75 bps increase”

Saxo Markets UK senior sales trader William Masters says Vladimir Putin’s partial mobilization announcement shook markets ahead of the Fed’s policy decision on Wednesday. That’s why he rally in flight to gold and dollar heavens, he notes. However, gold’s gains remained relatively modest for the session. A stronger dollar weighed on commodity prices.

“There are no surprises here, except for those who fear a full percentage point increase,” says George Milling-Stanley, chief gold strategist at State Street Global Advisors. Milling-Stanley notes that the 75 basis point increase was priced mainly in the financial markets. Therefore, he does not expect a significant price movement as a result of this meeting.

US dollar DXY gained strength right after the policy decision. Thus, it put pressure on the price of gold. Raffi Boyadjian, XM’s leading investment analyst, says the decisions of the Bank of Japan, the Bank of England and the Swiss National Bank will be followed on Thursday, following the Fed policy decision.

Pablo Piovano: More consolidation ahead

Open interest in the gold futures markets reversed two consecutive days’ gains, according to preliminary data from CME Group. Thus, nearly 3.1 thousand contracts shrank on Wednesday. On the other hand, volume increased sharply for the second day in a row, this time around 87.5k contracts.

Wednesday’s recovery in gold came amid continued erratic performance and with a marked increase in contracting open interest and volume. However, the continuation of the current range-bound theme is in the cards for now, with good support in the $1,650 region.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.