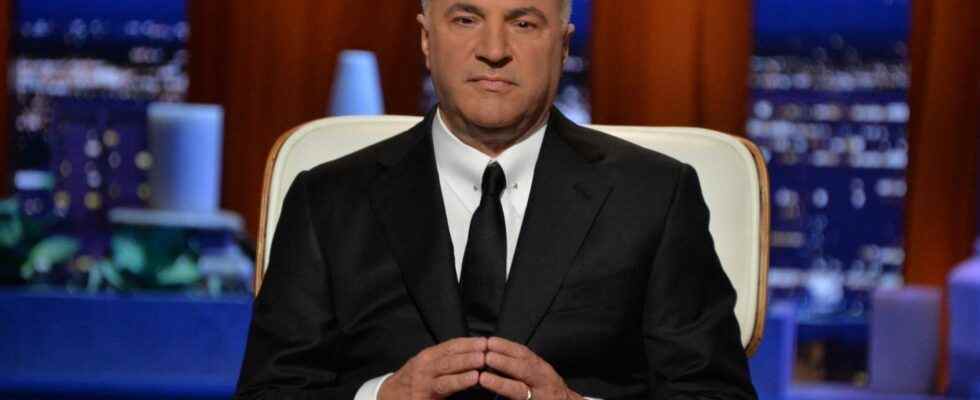

Shark Tank investor Kevin O’Leary says that a group of investors can transform the Bitcoin (BTC) and crypto markets once they decide to allocate capital to the space. The famous investor says in a new interview with Bitcoin bull Anthony Pompliano at The Best Business Show, there will be a huge opportunity for crypto when funds in the Middle East invest in digital assets. He also states that these funds are only focused on Bitcoin, not Ethereum, layer 1-2 coins.

“The real opportunity is in sovereign funds in the Middle East”

Kevin O’Leary said, “The real opportunity is not with family offices or hedge funds operating outside the Middle East. Real money is in de facto sovereign funds in both Saudi Arabia and the United Arab Emirates. Billions, billions and billions of dollars,” he said. However, these funds have not yet allocated funds to crypto. According to O’Leary, once the investment is made, “you will see it reflected in the Bitcoin price”. Given the size and number of funds, O’Leary says even a 1 percent allocation will have an impact on the markets.

They generally adhere to discipline and risk diversification principles, so for example, no stock should represent more than 5 percent of the fund or no industry more than 20 percent. These are diversification agents used all over the world and they do it there too. However, when dealing with billions of dollars, a 1 percent allocation is a tremendous amount of money.

O’Leary: Ethereum, no layer 1-2 coins! Bitcoin only

cryptocoin.com As we have also reported, Kevin O’Leary, who drew attention to coins such as Ethereum and Solana in his previous statements, says that the only cryptocurrency on the radar of sovereign funds is Bitcoin. He estimates that they could easily decide to allocate 1-3 percent to BTC alone. O’Leary makes the following statements on the subject:

I talk to those guys almost every day. They would just invest 1 percent to 3 percent right away in Bitcoin. Just Bitcoin, let alone Ethereum, or any layer-1 or layer-2 coin in its network. They didn’t even think about it. They only think of Bitcoin and owning BTC as an asset. Once the regulator approves Bitcoin as an asset, currency or security (or whatever way they are going to regulate it), the amount of capital going into this market will be incredible.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.