Changpeng Zhao, who played an active role in the FTX bankruptcy, and his exchange Binance, along with other exchanges, were called to testify before the UK Parliament’s Treasury Committee. Experts predict that the bearish trend on FTX Token (FTT) will continue in the short term.

Did Binance trigger a market crash that destroyed billions?

Daniel Trinder, Binance’s Vice President of European Government Affairs, confirmed that the exchange will provide the information requested by the authorities. This information includes internal communications as well as records of Binance’s sudden sale of FTT funds. As part of the investigation, the Treasury Committee will examine evidence of Bitcoin’s acquisition of FTX in bankruptcy.

It is very important to understand whether there was malicious intent behind Binance’s decision to sell its FTTs. The announcement of the sale led to the collapse of the crypto market. Therefore, the burden of proving that he did not cause the crash is entirely on Binance. Days later, FTX filed for bankruptcy as only $900 million of liquid assets remained against $9 billion in debt.

On November 14, Binance CEO CZ announced a “Recovery Fund”. This fund was basically ready to save strong projects in a liquidity crisis. Binance also initially planned to save FTX by purchasing it. Less than 24 hours after the announcement, he gave up on this move. Referring to the general situation of the market after Binance’s decision, the chairman of the committee, Harriett Baldwin, said:

You have to admit that you’re an actor in that storyline.

OKX also announced a $100 million support fund

Wu provided new information from OKX in an update on Blockchain via Twitter:

OKX announced $100 million to support projects with liquidity issues and switch from Solana. Binance had previously announced similar plans. Huobi and Justin Sun said they will join Binance’s recovery plan.

What do experts say for the future of FTX Token (FTT)?

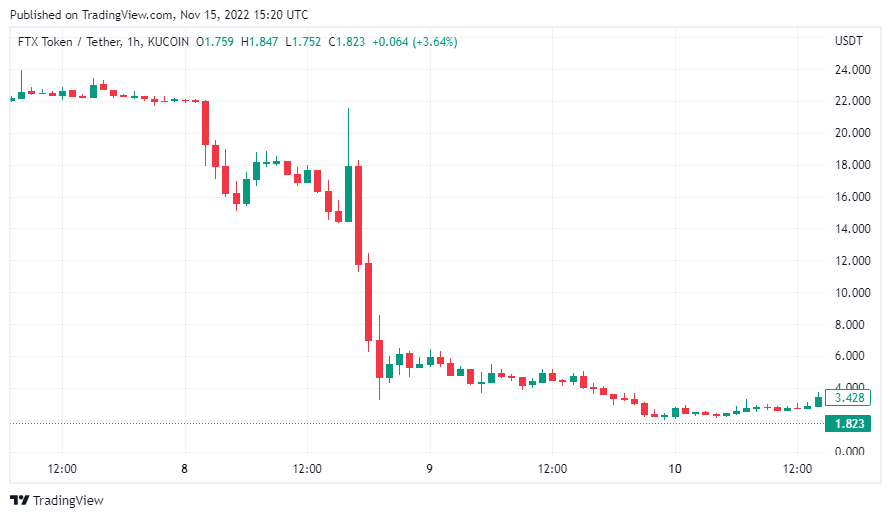

One of the reasons behind FTT’s depreciation of over 50% was Binance’s abandonment of the purchase. Hayden Hughes, CEO of Alpha Impact, says that FTX has made large transactions with client funds. He also states that FTX has promised to re-enable all withdrawals, but this is said for the moment.

Bitrue analyst Whitney Setiawan said FTT investors do not want to be caught in the middle of the conflict between CZ and SBF. Many investors wanted to save their funds, fearing the announcements from Twitter. According to Setiawan:

Based on this statement, we’re likely to see FTT drop further in the next few days. Depending on how events are handled by Sam Bankman-Fried and interested parties, price fluctuations are likely over the next few weeks.

Setiawan’s reference to the conflict between CEOs is based on a blog post by SBF suggesting limitations on DeFi. Bankman-Fried had come up with a draft regulatory framework for cryptocurrencies – a set of standards – while awaiting full federal regulatory regimes.

Zhao later said he would not support people lobbying behind their backs against other industry players. He confirmed that Binance has sold all the FTT tokens it holds in its reserves. Zhao’s announcement had a knock-on effect on FTT that caused a drop of nearly 35% on Tuesday.

Aarti Dhapte says a rally is unlikely in the near future

The senior analyst at Market Research Future said that the bulls will stay away from the scene for a while due to the market uncertainty brought by the midterm elections in the USA. Meanwhile, the FTX price has been in a significant negative trend for the past three weeks. Additionally, Dhapte says it fell below the 50-day and 25-day moving averages.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.