Market analyst Yohay Elam states that the Fed’s fears open the door to a negative interest rate hike for gold and that gold is likely to decline gradually to $1,752. Yohay Elam’s technical analysis and forecasts in his own words cryptocoin.com We have prepared for our readers.

“Upside move for yellow metal may be coming to an end”

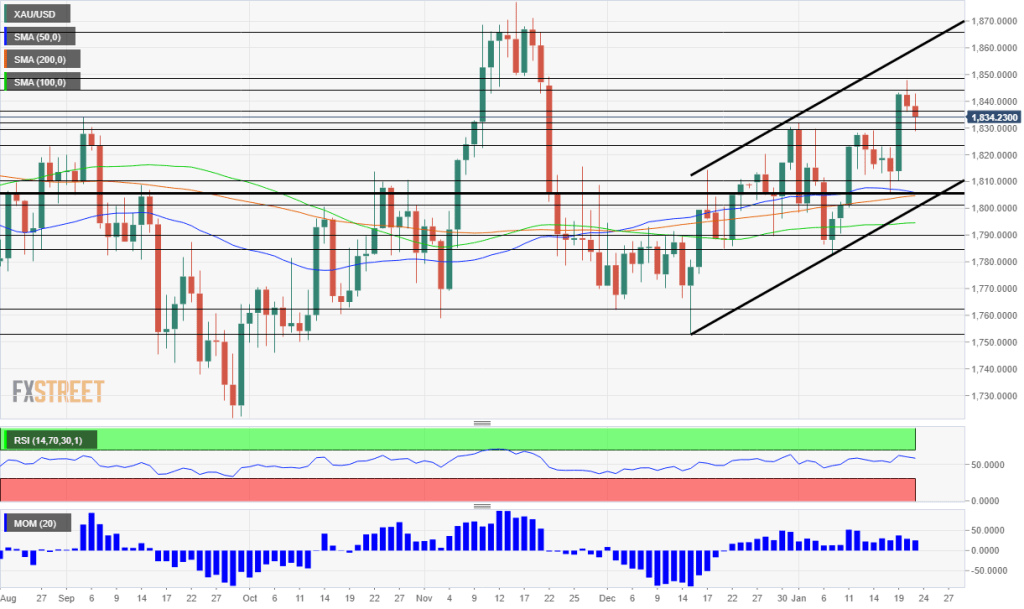

When the Golden Cross pattern emerged for gold in early December, it marked the beginning of a bullish trend. Gold has been trading in an upside channel since the middle of last month, poised for a move in the other direction. When the 50-day Simple Moving Average (SMA) breaks above the 200-day SMA, it is called a ‘Golden Cross’, which is a bullish pattern. It last happened on December 2 when gold was trading below $1,780. Since then, the precious metal has been in an uptrend, reaching almost $1,850 on Thursday. The yellow metal has been trading in an uptrend since Dec. 15, when it was temporarily posted to $1,752 by decision of the Federal Reserve.

This $100 move may be about to end despite the upside momentum and bullish channel. This is because of the ‘Death Cross’ pattern, which is the exact opposite of the Golden Cross pattern.

The Death Cross is formed when the 50-day SMA crosses the 200-day SMA to the downside. As the chart shows, the 50-day SMA (blue line) is tilting down and the 200-day SMA is rising. They’re about to ‘kiss’ and then they’ll go for about $1,805 (thick black line).

The move looks inevitable and will likely follow a bearish. To where? up to $1,752. While falling, there are several support lines including $1,829, $1,823, $1,810, $1,805, $1,800, $1,790, $1,785, and $1,762.

The bulls are emboldened if gold retraces $1,844 and more importantly $1,850. This will open the door for $1,865 and $1,900.

Gold fundamental analysis

Basically, the precious metal is at the mercy of US 10-year yields. The yield on Uncle Sam’s debt fell from 1..90% to 1.75%, rising to 1.80%. Because gold has no returns, it competes with the security of holding American debt. Larger movements in interest tend to have more of an impact on the precious metal than slow-moving changes. The next major event to watch is the Federal Reserve’s decision on January 26.

If the Fed signals an imminent rate hike in March, and if money is pulled from the markets by potentially selling bonds later this year, rates could jump and gold could suffer. Conversely, if Fed Chairman Jerome Powell and his colleagues send a soothing message about continued support for the economy, the gold may avoid the kiss of the Cross of Death.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Disclaimer: The articles and articles on Kriptokoin.com do not constitute investment advice. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, asset or service in this article.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.