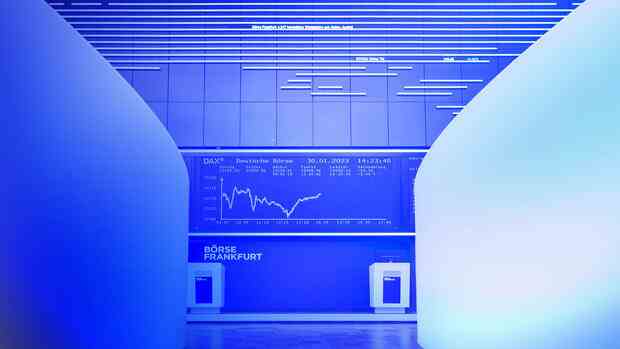

The Dax is currently benefiting from an intact upward trend.

(Photo: Bloomberg via Getty Images)

Dusseldorf With a good 15,500 points, the Dax is back where it was a year ago, i.e. two weeks before the start of the Russian war of aggression in Ukraine. Since its low of 11,975 points at the end of September, it has risen by 31 percent in just four and a half months. Although the cause of the interim crash, the outbreak of war in Europe, has not changed.

But is the Dax threatened with a correction after its brilliant rally? In view of the further rise in interest rates, future investments and loans will become more expensive. Or does the leading German index have even more upside potential due to lower energy prices, catch-up effects in China following the opening of the markets and good profit development among companies?

A look at the global economy, corporate profits, stock valuations, charting, geopolitics and central bank policy provides orientation. Two risks and four opportunities for price development that investors should know.

Risk 1: Interest

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Further

Read on now

Get access to this and every other article in the

Web and in our app free of charge for 4 weeks.

Further