Closely followed crypto analyst Justin Bennett thinks that both stock and digital asset markets, especially Bitcoin, are on the verge of another selling event.

Bennett has 101,000 Twitter followers, total market value of all crypto assets (TOTAL) diagonal [çapraz] that he is ready to break his support told.

“Everything seems to be either breaking support or ready to break.

TOTAL (total crypto market cap) stands at over $940 billion with a false spike. We are now focusing on channel support.

I doubt that this support will be maintained a little longer.”

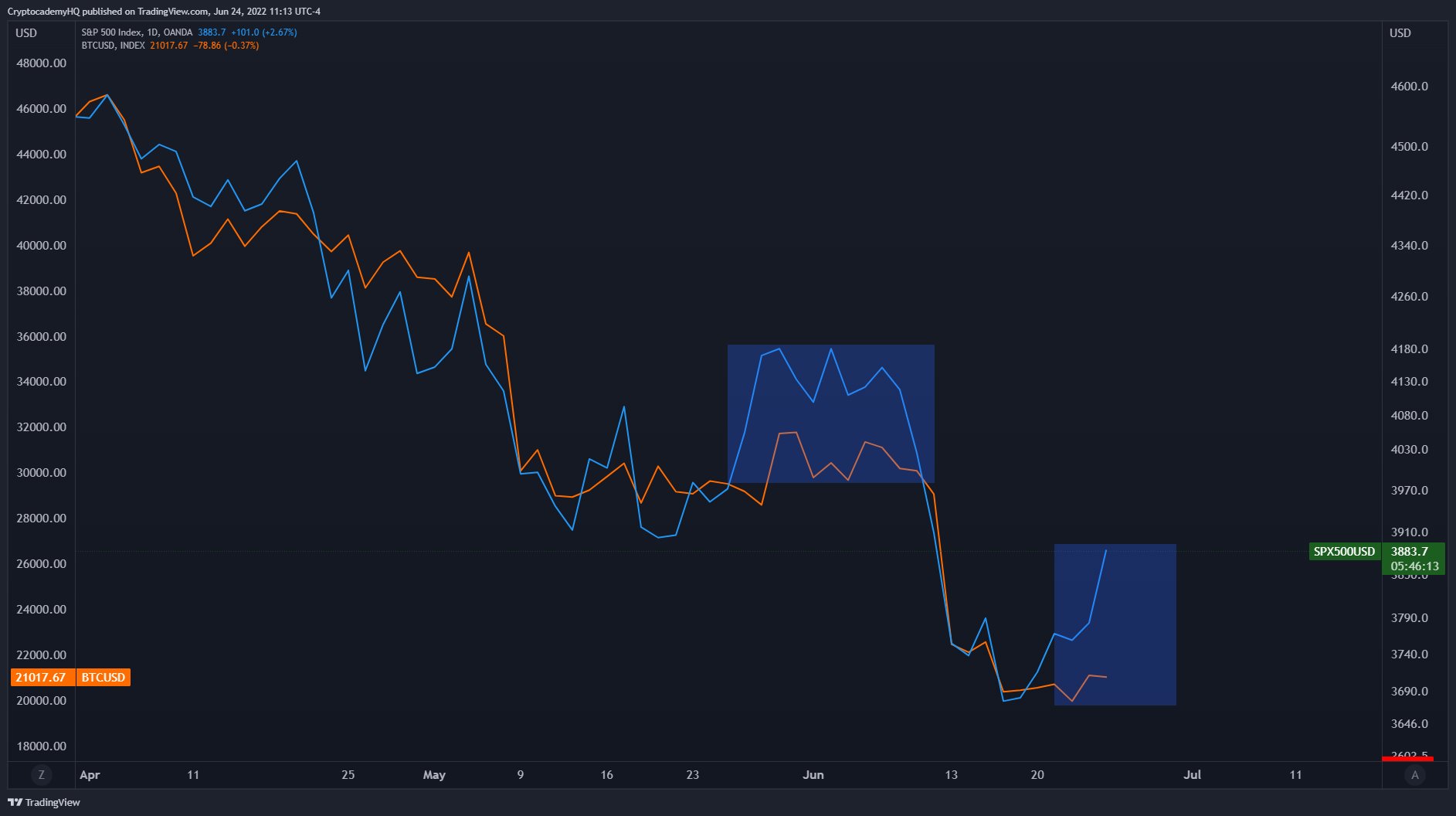

Koinfinans.com As we mentioned, the analyst also warned that a resumption of the downtrend is on the horizon, as the S&P 500 closed strong on Friday. The analyst went back a bit and shed light on similar price movements of the stock market and Bitcoin. Looking at the chart, it can be clearly seen how both the stock market and Bitcoin bounced from late May to early June, then quickly lost their gains in a matter of days.

“Good move from the S&P 500 today, but crypto fits. The last time this happened, things got ugly.

Be careful here.

S&P 500 is blue, BTC is orange.”

While Bennett expects the crypto market in general to be one step closer to new lows, there are those in the industry who believe that the bottom is very close for Bitcoin.

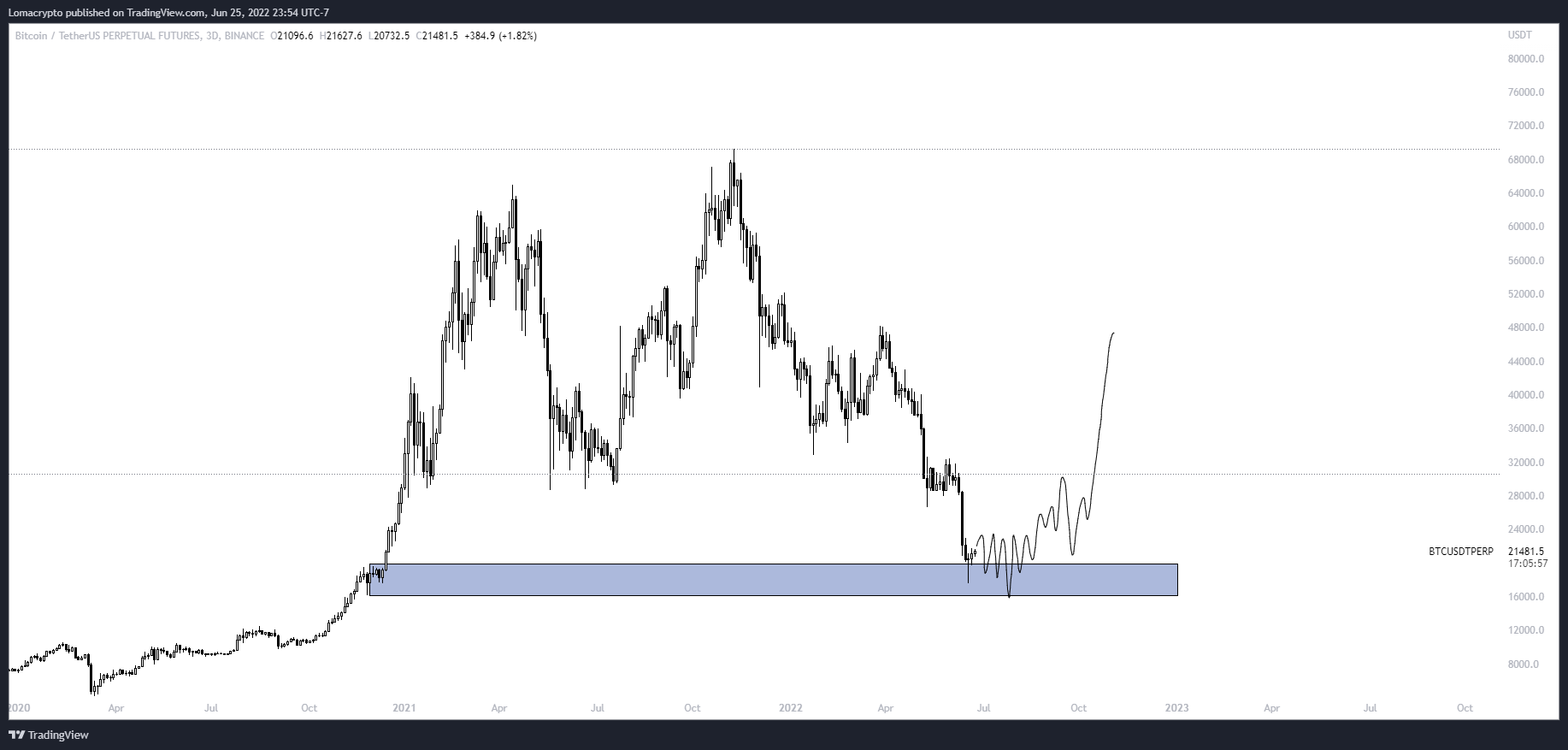

A popular trader known by the pseudonym Loma expects Bitcoin to enter an accumulation phase before moving upwards faster than most expected. told.

“Assuming price has bottomed out (local bottom but I don’t know about macro):

We experience a period of accumulation that will probably be a little faster than usual

· I focused on catching swing positions more or less in an early trend and praying to Satoshi that I don’t sell out too soon.”

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.