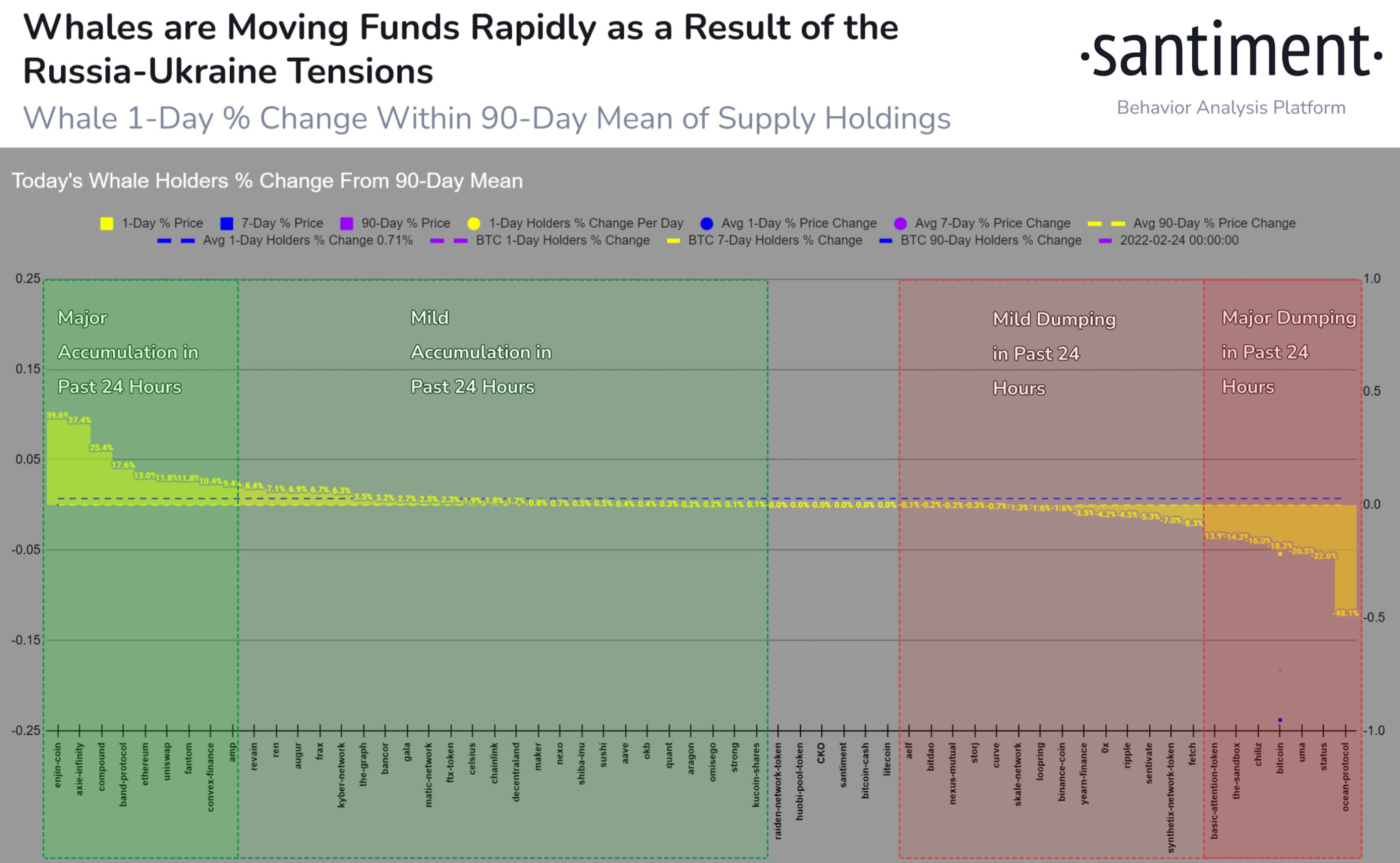

Crypto analytics firm Santiment evaluated the current situation in the crypto money markets after the global markets were affected after the conflicts between Russia and Ukraine. Publishing a new blog post, the firm shared data tracking the buying and selling movements of more than 50 digital assets.

According to Santiment, the most accumulated altcoins include gaming tokens Enjin Coin (ENJ) and Axie Infinity (AXS), while the leading smart contract platform Ethereum (ETH) It is also among the most purchased crypto assets.

Crypto whales also feature decentralized crypto lending and borrowing protocol Compound (COMP) and decentralized cross-chain oracle. Band Protocol (BAND) he bought.

“ENJ, AXS, COMP, BAND and ETH continue to accumulate massively as whales drop to lower prices. Frankly, prices have already rebounded pretty quickly, but that doesn’t necessarily mean things will continue.”

Markets across multiple asset classes have plummeted after the military clashes, but Santiment thinks prices will rise as investors recover from their initial shock.

“In the case of the Ukraine-Russia conflict, we clearly understand that there is a great deal of truth behind the war that has dragged down cryptocurrencies, stocks and other markets.

But as we’ve learned from the pandemic over the past two years, once the initial shock has passed, there’s often a huge price hike.”

Enjin Coin (ENJ) It is currently up 4.69% to $1.43. By market cap, crypto asset number 77 dropped as low as $1.21 on Thursday.

Axie Infinity (AXS) It also rebounded from the night’s low of $42.84 and was up 2.31% on the day to $50.46.

Ethereum dropped from $2,746 to $2,336 on Wednesday but almost completely retraced its previous level. The number two crypto asset is changing hands for $2,711.

Compound, on the other hand, took a hit midweek and fell as low as $96.26 at the time of writing before returning to $112.37.

Band Protocol is up 2.79% after dropping to $3.16 on Thursday and is trading at 3.64.

Santiment concludes by discussing the as-yet-unrealized hope among crypto advocates that digital assets will join precious metals as a “safe haven” asset in times of instability.

“For a long time, gold managed to be the ‘safe haven’ that investors flocked to in times of crisis. And with the advent of Bitcoin… there is a growing hope that the cryptocurrency can claim its own as a safe haven.

But that hasn’t happened in macro terms yet.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.