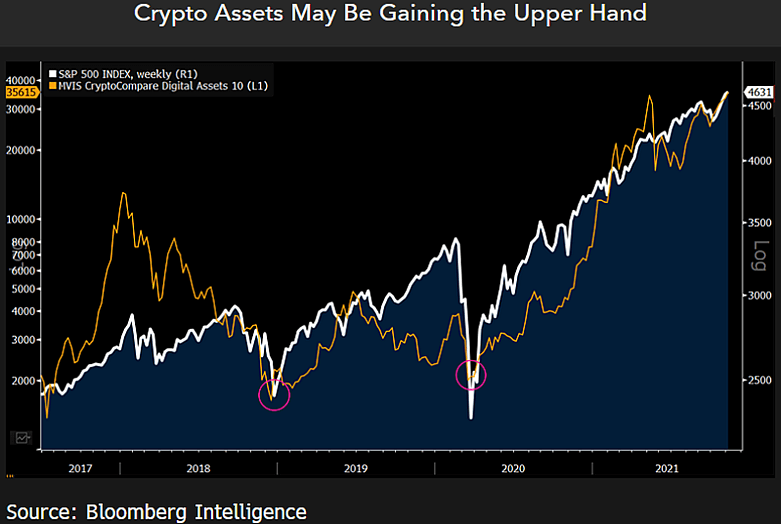

Bloomberg Intelligencesenior commodity strategist Mike McGlonenoted that crypto can have a huge advantage over the stock market.

Strategist, S&P 500which tracks the performance of the 10 largest and most liquid digital assets. MVIS CryptoCompare Digital Assets compared to the index. According to McGlone, the ability of digital assets to survive spikes and rebounds from excess leverage in the system appears to be a major advantage of crypto over the stock market.

“If past patterns that should have solidified the foundations for Bitcoin continue, the next time the stock market ‘shakes’ Federal ReserveIt’s “almost guaranteed.” The ability of crypto-assets to clean up speculative excesses within an hour could be an advantage it has over the S&P 500.

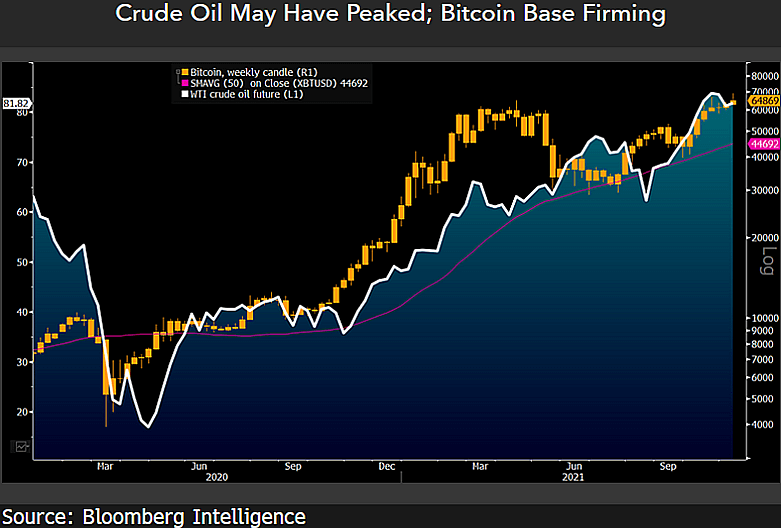

bitcoinMcGlone, who also examined .

“Crude oil and commodities are the best indication that high inflation is at hand. We believe crude oil has basically been a “bear market” against the upper end of the price range since the 2014 drop. Bitcoin is becoming a digital collateral and part of the digital revolution.”

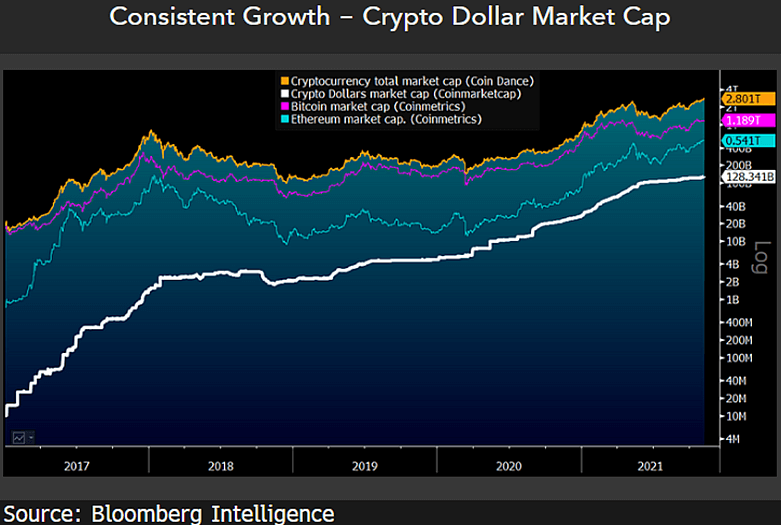

McGlone is also among Bitcoin (BTC), Ethereum (ETH) and stablecoin He focused on the three main components behind the growth of crypto markets, which include large amounts of stablecoins (which he calls crypto dollars).

“I see three “crypto guns” achieving a market cap of $3 trillion, finding a better way to trade, and a strengthening ecosystem as the top two factors, where “crypto dollars” representing a permanent asset class are the most important advancing part of the digital currency revolution. and I can call it the third pillar of crypto.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.