such as USDT, USDC stablecoinThe ‘s increased its adoption throughout 2022 as the bear market greatly restrained the rally. However, as 2023 kicks off with a huge price action, demand for such “fixed” assets has dwindled. The dominance of such assets is falling by a large margin and is currently testing one of the key support levels.

As a matter of fact, the strength of the last recorded rally weakened considerably. Therefore, the fall can be quite drastic. Moreover, the Trend Break Indicator (TBO) confirms that the rally has weakened as it indicates the start of a deep downtrend.

Koinfinans.com As we reported, the combined market cap of the two largest stablecoins (USDT, USDC) has dropped from around 15% and is hovering just over 10%. If levels fail to continue above these critical levels, a continued downtrend could drop the combined market cap below 10% to reach 9.69%.

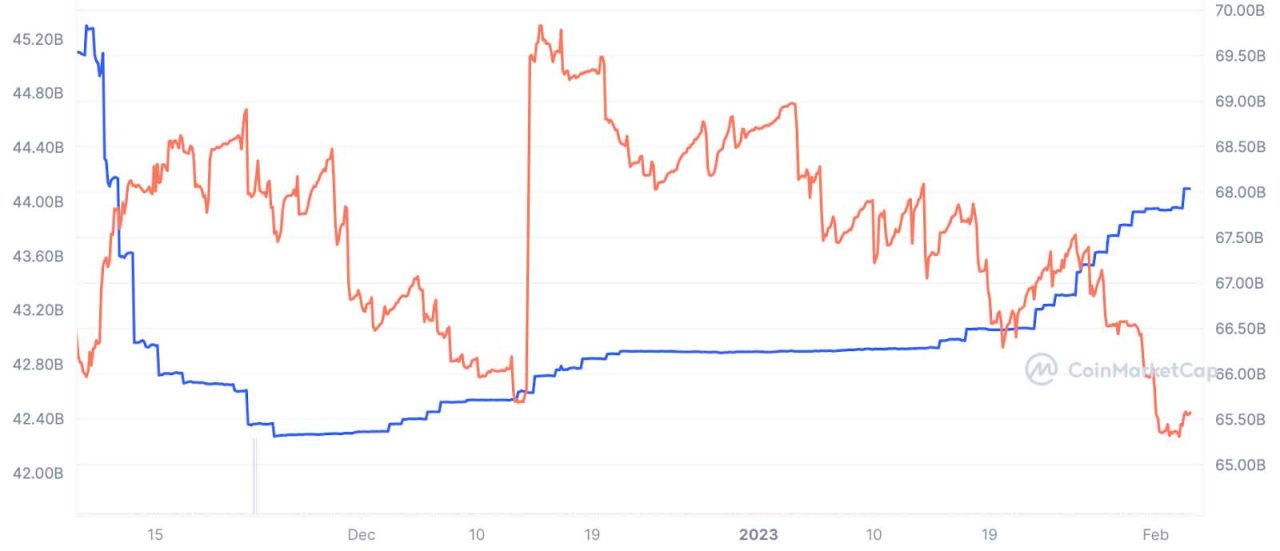

However, given the individual market cap of both USDT and USDC, the USDC market cap is falling sharply and was rejected from $70 billion to just under $65 billion. Meanwhile, USDT’s market cap has witnessed significant growth last week, rising from $66.29 billion to just over $68 billion last week.

Therefore, it can be predicted that market participants have shifted back to USDT as the market value of USDC has decreased relatively. Therefore, while it is believed that USDT will maintain its dominance against USDC, bullish market sentiments may prevail for cryptos in the long run.