The US announced CPI data for March 2023 on Wednesday, April 12, and inflation figures remained at the expected level. The world’s largest cryptocurrency bitcoin (BTC) has shown little fluctuation against this macro development and continues to hover above $30,000.

Bitcoin (BTC) has gained more than 7% in value last week to surpass $30,000 and is poised for ‘explosive growth’ according to on-chain indicators. While everyone is focusing on the current macro developments, Ali Martinez is focusing on the “halving” event that will take place in 2024.

If past halving events are an indication, bitcoin price significantly increased before and after activity. In halvings, mining rewards are halved. The halving reduces the rate of new assets created in the market, and this reduction in supply drives prices up.

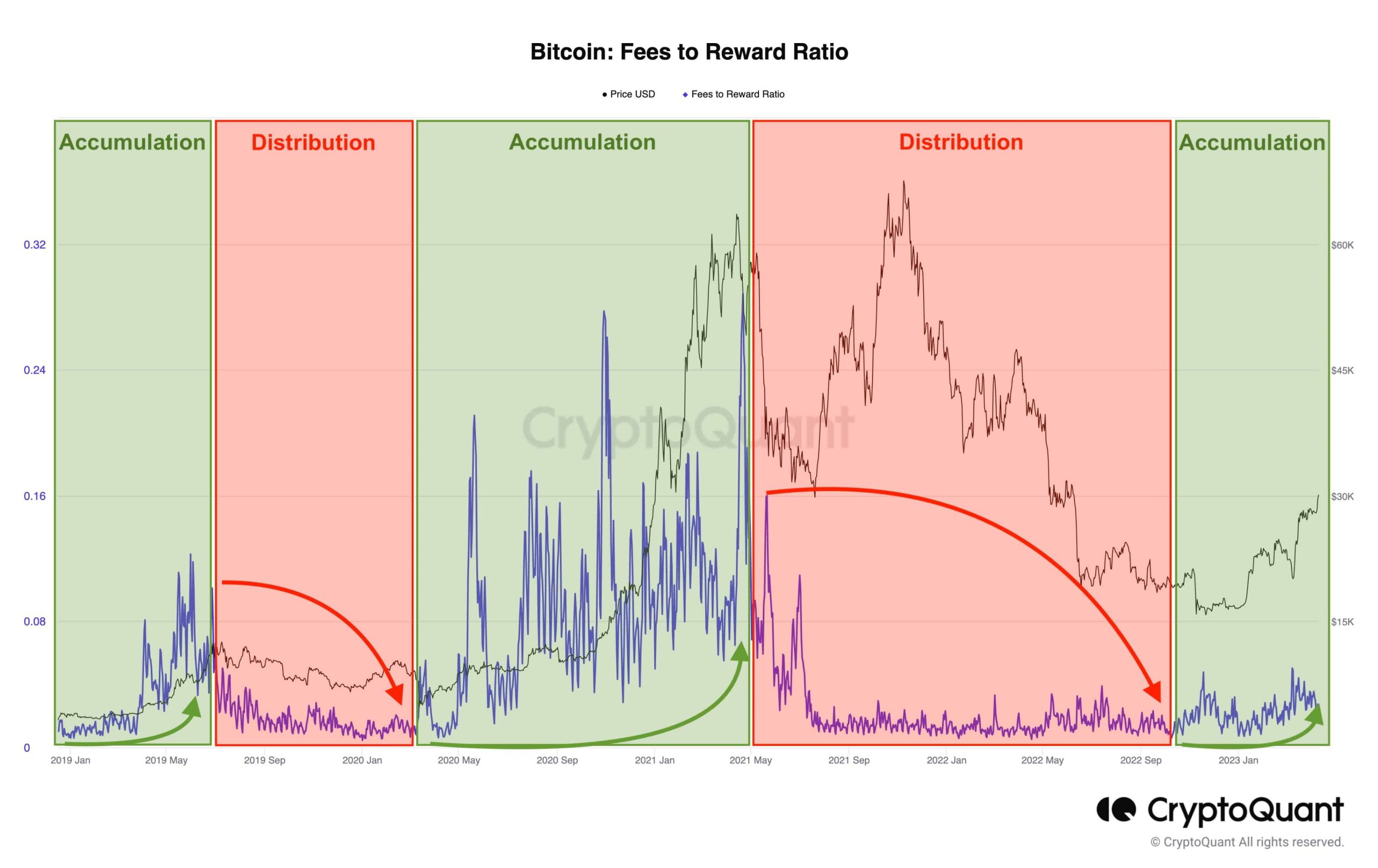

However, one metric that investors should watch carefully to gain insight into Bitcoin’s future performance is the fees-rewards ratio.

Bitcoin Fee – Reward Ratio

Cryptocurrency Analyst Ali Martinez believes that the ratio of Bitcoin fees to rewards is a very important indicator of the financial sustainability of the network. With the block rewards decreasing after the halving event, the fee-reward ratio has become an extremely critical source of income for miners. is coming.

A higher rate indicates a healthy and sustainable network, increases investor confidence and demand, and pushes the $BTC price higher. Conversely, a lower rate could negatively impact the #BTC price, raising concerns about long-term sustainability.

NEWS CONTINUES BELOW

As you can see from the chart, the market has entered a strong accumulation cycle similar to what we saw in 2019 and 2020. This indicates a potential Bitcoin price rally heading towards the 2024 halving. However, this does not always mean a definite result.

You can follow the current price action here.