Michael Burry’s portfolio, which has been critical of popular meme coins Shiba Inu (SHIB) and Dogecoin (DOGE) in recent years, has come to light. Burry, who foresaw the 2008 crisis and took action to add to his wealth, has invested in many stocks. Here are the details…

Michael Burry benefits from banking crisis

The regional banking crisis in the US revealed a contrast in stability between the large Wall Street banks and the smaller banks. The collapse of Silicon Valley Bank and Signature Bank had a widespread impact on US banking stocks. Clients withdrew their funds for fear of further negative impact. Fear and uncertainty dominated the market. However, some investors saw this as a good opportunity to buy. Meanwhile, the cryptocurrency market has seen a decline as regional banks appear less vulnerable. Cryptos are in decline as the US Federal Reserve’s decision to raise interest rates is still pending in the coming months.

Meanwhile, it was revealed that popular investor Michael Burry bought shares of distressed banks such as First Republic Bank, PacWest Bancorp, Western Alliance Bank and New York Community Bancorp. During that time, these stocks were trading at their lowest levels. A substantial recovery could have resulted in substantial profits. Market sentiment remained favorable for buying at lower prices amid concerns about new bank bankruptcies.

What’s in Burry’s portfolio?

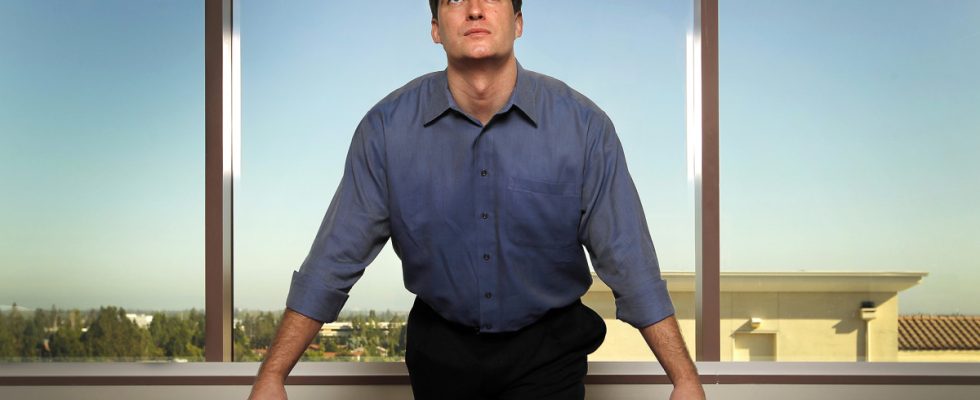

Michael Burry is an American investor and hedge fund manager best known for his successful bet against the US housing market bubble in the mid-2000s. He was one of the first investors to realize the risk and potential of collapse of the housing market. He made substantial profits by betting against subprime mortgage bonds. It inspired the movie The Big Short, starring Christian Bale. Now, some assets in his portfolio draw attention.

As disclosed in the annual shareholder report shared by Compounding Quality, Burry’s portfolio includes investments in New York Community Bancorp, Capital One, Wells Fargo, Western Alliance Bancorp, Huntington Bancshares, PacWest and First Republic Bank. Other key assets include JD.com and Alibaba Group, which make up the largest percentage of its portfolio, as well as energy shares Coterra Energy and Devon Energy. It also reportedly bought shares of the health and insurance company Cigna Group. After the recent US banking crisis, Burry acted similarly to the short selling he did in 2007. Because he predicted a potential market bottom in March 2023.

SHIB, DOGE criticized: What did he say?

cryptocoin.com As we reported, Michael Burry has previously expressed his opposition to Shiba Inu (SHIB), a cryptocurrency inspired by Dogecoin. He pointed out that its large circulating supply causes significant limitations on the potential price increase brought about. For this reason, he stated that he does not see SHIB as an important investment. He described Dogecoin as pointless.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.