A closely followed crypto analyst has offered a potential scenario for Bitcoin (BTC) to trap the bears and break above $30,000.

Nicknamed analyst Cred said in a recent strategy session that he sees a setup where BTC could ignite a “meaningful” rally even though Bitcoin still appears bearish.

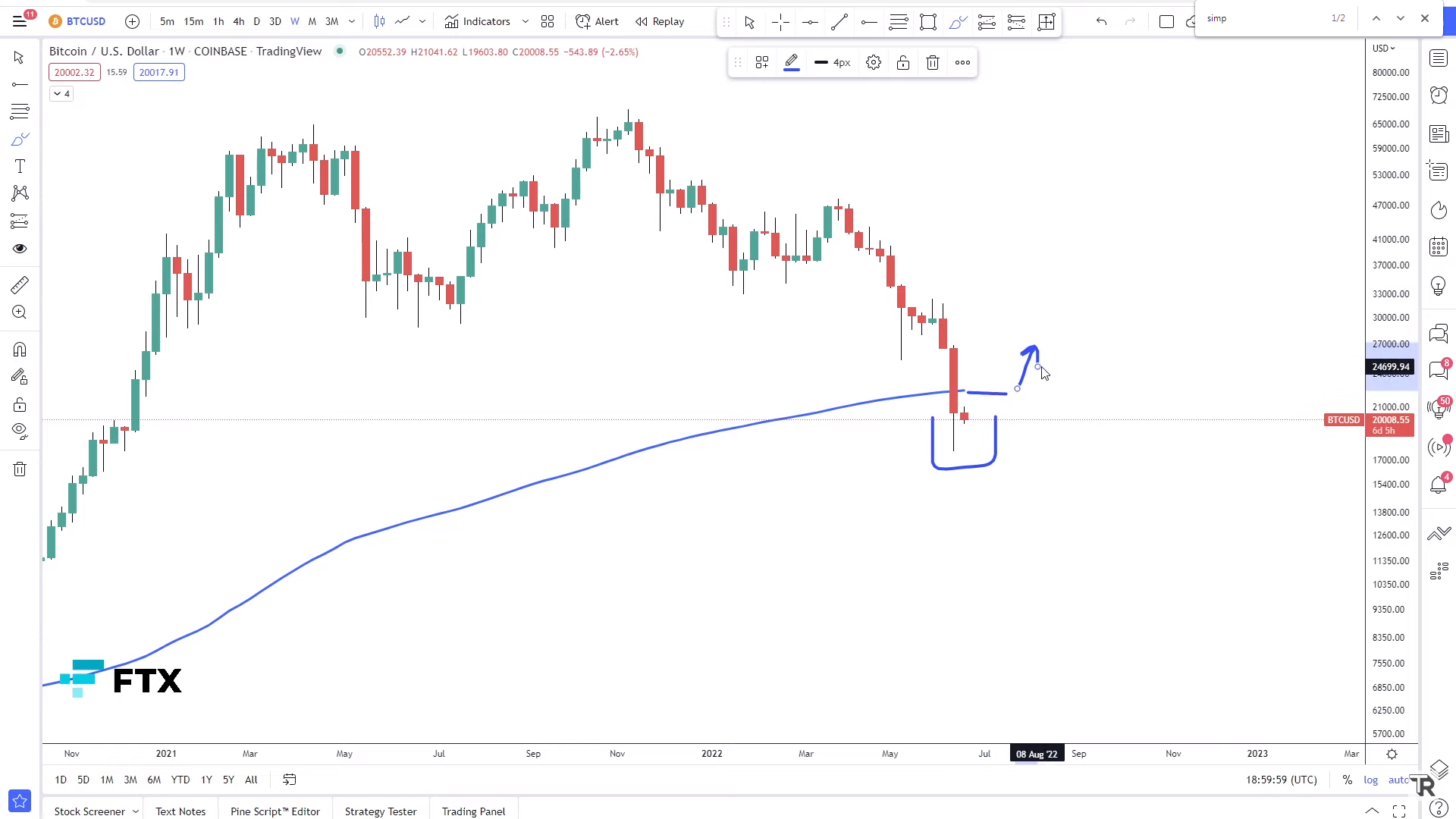

“At its simplest, this could look like a weekly close above the 200-week moving average, which is at or around $22,000. In such a case, [22 bin doların altındaki] all these activities – all sales, new positions, existing positions, whatever you call it – will be offside.

I think this will setup setup for a visible, meaningful fallback towards higher. By visible and meaningful, even green candles that are just a few weeks old are included. There has been absolutely zero relief rally in this entire downtrend.”

Koinfinans.com As we quoted above, according to Cred, Bitcoin has dropped from $48,000 to $17,000 with an incredible downward momentum in the past few weeks. However, he says that a rebound of the 200-week moving average at $22,000 could suddenly turn the momentum in favor of BTC bulls.

“As you can tell from the trade around $20,000, the weekly time frame is in the support area. The weekly close is below the bearish support in the nominal value. [200 haftalık hareketli ortalama] was not very constructive. If it’s going to be bullish, we need a weekly close above this level ($22,000) to consider this price action a failed breakout and then we can target a reversal higher…

What would the goal be at this point? To some extent, I think most of the sales that got us here – much of this one-sided inefficient price action – should be reversed. On the weekly timeframe, at least 32,000 support, which was the bottom in the previous range, has been broken and turned into resistance.”

At the time of writing, Bitcoin is trading at $20,318, slightly below the 200-week moving average.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.