- Adding support to a number of Ethereum-based crypto assets, Coinbase has seen increases in altcoin prices by up to 107 percent.

A decentralized finance (DeFi) altcoin gained notable gains after being added to the digital asset list of top US cryptocurrency exchange Coinbase.

The DeFi altcoin has enjoyed an impressive rise to its list of 50 digital assets, which prominent US crypto exchange Coinbase plans to list in the second quarter of 2022.

As previously mentioned by KoinFinans, in a recent announcement, Coinbase is adding to the trading platform along with three other altcoins in the future. DeFi Yield Protocol (DYP) are planning to add explained and the altcoin had experienced a massive 400% increase.

In an announcement shared on its official Twitter account, Coinbase said that DeFi Yield Protocol (DYP) and five other Ethereum-based altcoins will begin trading on the platform, paired with Tether (USDT) once appropriate liquidity conditions are met.

Coinbase will add support for DeFi Yield Protocol (DYP), https://t.co/NHuJ3NUhfX (ALEPH), HOPR (HOPR), Math (MATH), PARSIQ (PRQ), and Elastos (ELA) on the Ethereum network ( ERC-20 token). Do not send this asset over other networks or your funds may be lost. pic.twitter.com/zpxiHeuoxh

— Coinbase Assets (@CoinbaseAssets) June 21, 2022

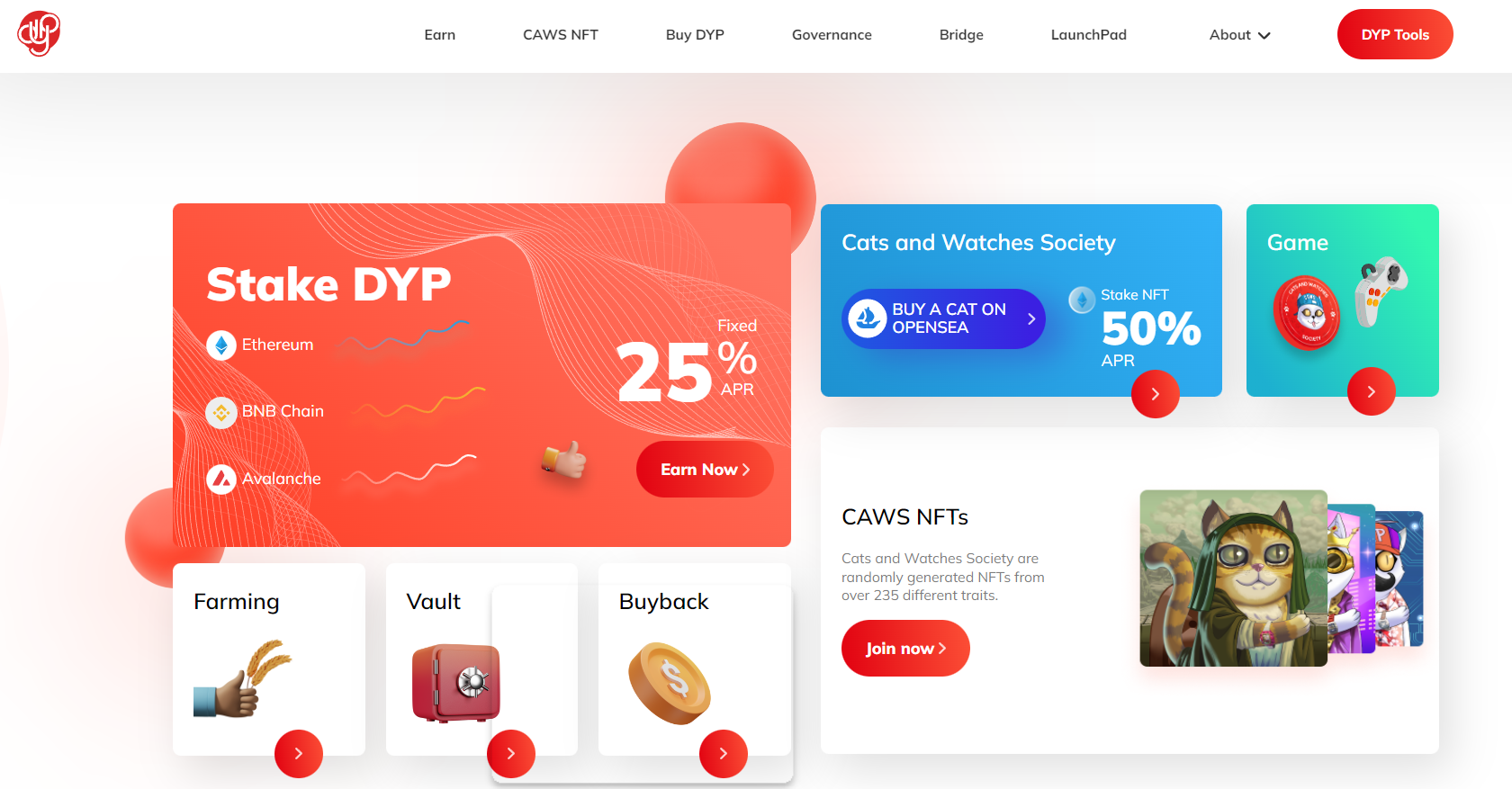

DeFi Yield Protocol to earn users a fixed 25% APR (Annual Percentage Rate) Ethereum (ETH), Binance Coin (BNB) and Avalanche (AVAX) is a platform that offers staking.

According to the project website DeFi Yield ProtocolDeFi is working on a wide range of decentralized ecosystem products that aim to “be accessible to beginners and advanced users alike” using a combination of non-fungible tokens (NFTs) and metaverse gaming.

DYP, which started to rise with the platform adding the altcoin to the list of altcoins that is expected to be supported, to be added to the stock market, and continues its positive trend with the realization of the listing, is trading at $ 0.43 at the time of writing, with a weekly increase of 107 percent.

HOPR

It is also a data privacy protocol that aims to solve what Web3 calls the Achilles tendon by securing metadata to maintain transport layer privacy among altcoins participating in Coinbase. HOPR exists.

HOPR, which has seen an increase of over 5 percent compared to the last 24 hours, is in the green and trading at $0.13 at the time of writing.

Math (MATH)

A modular blockchain that develops a crypto wallet that does more than just store tokens by serving these two altcoins to the needs of applications as well. Math (MATH) following.

MATH, which has experienced an impressive increase of about 40 percent compared to the previous day, is trading at $0.19 at the time of writing.

PARSIQ

Another altcoin joining Coinbase is the blockchain transaction monitoring protocol, which monitors blockchain events in real time and provides analytical options for various industries. PARSIQ (PRQ).

The platform’s native cryptocurrency, the Ethereum-based PRQ token, powers the project’s ecosystem. Holders can lend their tokens and earn passive income by staking in liquidity pools.

PARSIQ is one of the unluckiest cryptocurrencies in this altcoin package, trading at $0.15, down nearly 3%.

Elastos

A decentralized and community-based ecosystem to embrace the full potential of Web 3.0. Elastos (ELA)is next in the list of assets added to Coinbase. Offering tools for app developers, the platform has designed a crypto wallet called Essentials.

The Elastos is currently down about 7 percent and is priced at $1.55.

aleph.im

Last on the list of the newest assets added to the Coinbase platform is a decentralized cloud computing tool that aims to simplify the implementation process for DeFi and Web3 users. Aleph.im (ALEPH) is located.

Aleph.im is trading sideways and is at $0.25 at the time of writing.

You can check the price movements here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, KoinFinans and the author of this content cannot be held responsible for personal investment decisions.