Changing times, as recently announced by the chancellor, can only be diagnosed with certainty in historical retrospect. The Ukraine war certainly has what it takes to become one.

But there is also a second turning point that is in the offing and is only indirectly related to the terrible war: almost 20 years with extremely low capital market interest rates, low inflation rates and a global economy that oscillated from crisis to crisis – again and again nurtured by gigantic rescue packages , be it through the fully comprehensive insurance state, which always tries to compensate for losses in prosperity through compensation payments.

Or be it hyperactive central banks that, with their zero interest rate policy, have created an illusion of prosperity that has no basis in the real economy. Financial crisis, euro crisis, pandemic – and now the war: The means of choice in fighting the crisis was always the same: more money for free.

The real miracle is the fact that this balancing act on the abyss seemed to go well for a surprisingly long time. There have always been those who suspected and warned that this supposedly “perfect” world of limitless money creation would be temporary with hardly measurable price increases.

Top jobs of the day

Find the best jobs now and

be notified by email.

And indeed, the strong rise in inflation figures everywhere is an unmistakable sign of the end of this era. In the US, they could soon be in the double digits. In Europe and Germany, too, there is a high probability that the more than eight percent in May was not yet the peak.

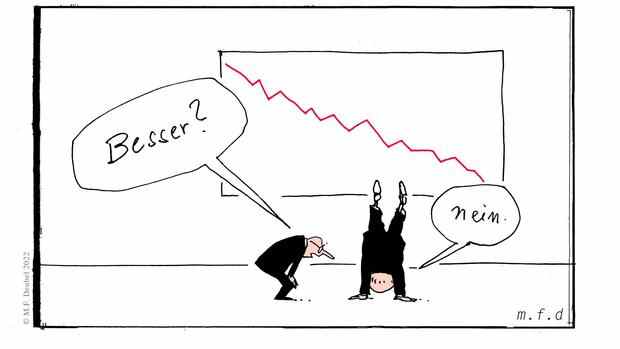

Financial markets: from ecstasy to sadness

Because even classic Keynesians like US economist Larry Summers are now expressing unease, US Treasury Secretary Janet Yellen openly admits to having underestimated the risk of inflation – and central bankers and the financial markets are increasingly going into panic mode. The Fed raised its key interest rate by 0.75 percent. In many asset classes – bonds, shares, real estate and above all the cryptocurrencies, sadness prevails in unison after the low interest phase had put them in a state of ecstasy for many years.

The situation in Europe is special – once again. After a long phase of appeasement, the European Central Bank is taking on the fight against inflation – but not really. The first rate hike will come next month – later than at other central banks, and it can only be a mini step. Yes, the government bond purchase programs are to be ended. Of course, the expiring bonds in the ECB’s portfolio will be bought later – and primarily by heavily indebted or over-indebted countries such as Italy.

>> Read here: What can the ECB do against crises? The six most important answers to fears about the euro zone

What’s more: ECB boss Christine Lagarde, who actually wanted to send a clear signal by ending the bond purchases, is bringing a new instrument into play. Unlike the OMT program, for example, which was never activated, the ECB could allow it to buy any amount of bonds from individual countries without imposing any conditions. The new “boundless battle is against fragmentation”. In other words, the risk premiums on southern European bonds must not exceed a certain limit.

The ECB therefore presumes to know which spread is adequate and when speculation begins. Yields on ten-year Italian bonds briefly exceeded the four percent mark – and were thus 2.4 percentage points above the Bund. The Italian national debt is now 150 percent of economic output, that of Germany at a good 70 percent.

The head of the ECB is bringing a new monetary policy instrument into play.

(Photo: dpa)

The assertion that the risk premium is fundamentally unjustified is at least daring. The fact that the ECB is now looking for a more efficient means of adjusting these spreads shows one thing above all: the ECB’s assertion that it is not there to help finance ministers with their budgets is ultimately self-deception. Because it is undoubtedly an implicit financing of state budgets by artificially reducing interest rates.

ECB suspends disciplining market mechanism

In the short term, this policy may alleviate the euro crisis. In the long term, the central bank will override precisely those disciplining market mechanisms that create incentives for necessary reforms to strengthen growth – and ultimately are also a prerequisite for public finances to recover.

If one more proof was needed that the ECB is ultimately in danger of having to choose between an efficient fight against inflation and a rescue of the euro, then Lagarde has supplied it with the implementation of another instrument for buying government bonds .

The former ECB president saw it as the task of the ECB to hold the currency community together.

(Photo: Reuters)

Even when Lagarde’s predecessor Draghi gave his legendary “Whatever it takes” speech in 2012, he left no doubt that it was the task of the central bank to keep the common currency together. Who would deny that the euro is the ECB’s raison d’être?

But there are two key differences to today’s situation: while inflation rates tended towards zero in the Italian’s era, they are now in the vicinity of double-digit rates. And unlike her predecessor, who now governs Italy, Lagarde rarely says a word about the need for reform and fiscal discipline.

The return of inflation means a turning point, possibly even the end of the debt illusion. In any case, the pressure on finance ministers and money creators to return to the established order is growing. The economic theory that healthy public finances are a prerequisite for the long-term success of national economies is gaining weight again. And the times when central banks ruled with emergency programs, drove stock and real estate prices up and kept business models alive that weren’t – may be coming to an end.

More: Inflation in the euro area climbs to a record level of 8.1 percent