According to crypto analyst Rakesh Upadhyay, it is possible for the S&P 500 to rise in the short term. This is also likely to trigger a rebound in Bitcoin and certain altcoins including DOGE. The analyst examines the charts of the 8 most bent cryptocurrencies.

An overview of the cryptocurrency market

cryptocoin.comAs you follow, crypto markets are trading at record low volatility as investors stay away. This may be because investors are unsure about cryptocurrencies that could lead to the next bull run. Cumberland senior research analyst Steven Goulden said in his ‘Review of the Year’ report that he expects four ’emerging narratives’ to lead the crypto space over the next six to 24 months. Goulden expects growth in NFTs, Web3 applications and games. He also expects export-oriented nations to add Bitcoin and Ethereum as reserve assets. If that happens, it’s possible to have a huge positive impact.

However, Jared Gross, head of corporate portfolio strategy at JPMorgan Asset Management, takes a different view. Speaking to Bloomberg, Gross said that the bear market broke the idea that Bitcoin could act as a form of digital gold or an inflation hedge. He also noted that large institutional investors stay away from the crypto industry. Finally, he added that this approach is unlikely to change anytime soon. Now it’s time for analysis…

BTC, ETH, BNB and XRP analysis

Bitcoin (BTC)

Bitcoin has been trading in a small range for the past few days. This shows that traders are not clear on the next directional move, so they are sitting on the sidelines.

This narrow gap trade may not last for long as traders are successful in a volatile market. Buyers will try to establish their edge by pushing the price above the moving averages and resistance at $17,100. If successful, BTC is likely to rally to $7,854 and then the hard resistance at $18,388. This level is likely to act as a major obstacle. Therefore, the bulls may have a hard time overcoming it. If the price declines sharply from the current level and dips below $16,550, the bears will attempt to extend the decline to the $15,500 and $16,000 support zone.

Ethereum (ETH)

The bears tried to pull Ether to the $1,150 support on Dec. 25. However, the long tail on the candlestick indicates that the bulls are buying on small dips. Buyers are currently trying to push the price above the moving averages.

If they do, it is possible for ETH to accelerate towards $1,352. This level is likely to act as a major obstacle. Because the bears will try to defend him as best they can. If the price drops from $1,352, it will indicate that ETH is likely to be stuck in a wider range for a while. If the price declines sharply from the current level, it will increase the likelihood of a break below $1,150. It is possible for ETH to drop to $1,075 later on where buying will emerge. The horizontal 20-day EMA ($1,227) and the RSI near 47 indicate possible range-bound action in the near term.

Binance Coin (BNB)

The bears are aggressively defending the $250 breakout level. One small positive, however, is that the bulls haven’t left much ground. This suggests that the bulls will again attempt to push BNB above the overhead resistance zone between $250 and $255.

If they do, it is possible for BNB to quickly rally to the $290-$300 resistance zone. It is also possible that this will act as a major obstacle. The downward sloping moving averages and the RSI in the negative zone point to the advantage for the bears. If the price drops and dips below $236, it will show that the bears have managed to turn $250 into resistance. BNB is likely to drop to $220 later. If this level is broken, a drop to the psychological $200 level is possible for BNB.

Ripple (XRP)

XRP is trading within a symmetrical triangle pattern. The price bounced off the support line on December 19 and reached the 20-day EMA ($0.36) on December 26.

If the price drops from the 20-day EMA, the bears will again try to push XRP below the support line. If successful, XRP is likely to drop to the main support at $0.30. Contrary to this assumption, if the bulls push the price above the 20-day EMA, XRP is likely to rise to the resistance line. The bears will fiercely maintain this level. However, if the bulls break through the resistance, XRP is likely to start a strong recovery. In this case, it is possible for XRP to rally to its pattern target of $0.42 and then $0.47.

DOGE, ADA, MATIC and DOT analysis

Dogecoin (DOGE)

DOGE recovery from strong support at $0.07 failed at $0.08. This indicates that the bears continue to sell in minor relief rallies.

DOGE can trade between $0.07 and $0.08 for a while. The downward sloping moving averages and the RSI in the negative zone point to the advantage for the bears. Intensification of selling is possible if DOGE price dips below $0.07. Thus, DOGE price is likely to drop to the critical support at $0.05. If the bulls push and sustain the price above the 20-day EMA ($0.08), this downside will be invalidated in the short term. DOGE could then attempt to rise to the overhead resistance at $0.11.

Cardano (ADA)

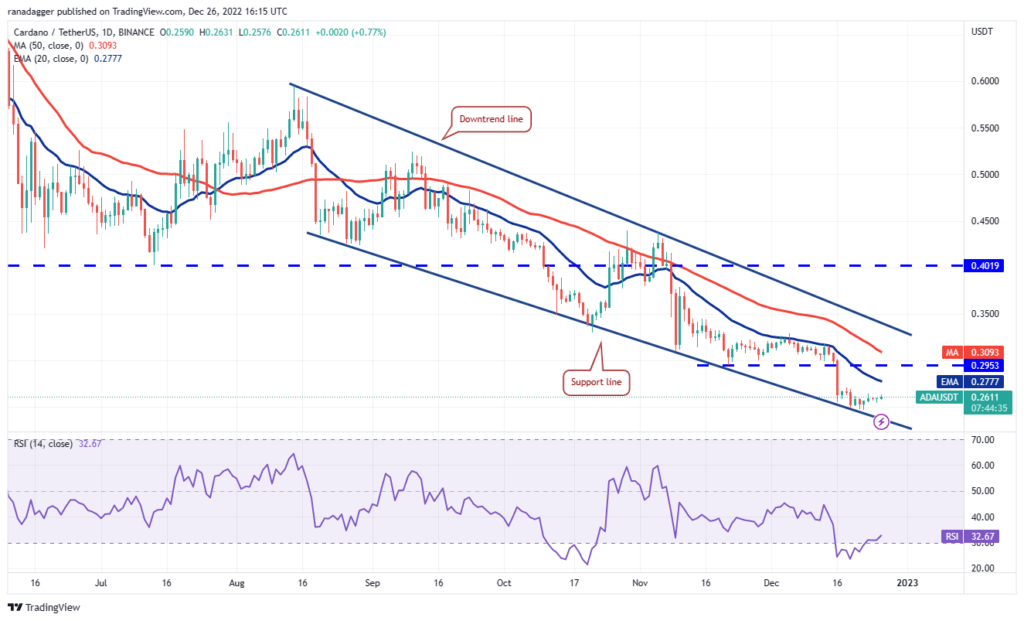

ADA has rebounded from the support line of the falling wedge pattern on Dec. Now the bulls are trying to push the price towards the 20-day EMA ($0.27).

The bears will try to stop the recovery and defend their edge at the 20-day EMA. If the price turns down from this level, it indicates that the trend remains negative and the bears are in control. It is possible for ADA to retest support at $0.25 later. If this level is broken, ADA is likely to fall back to the support line. If the bulls want to gain the upper hand, they will have to push the price above the 20-day EMA. ADA is likely to later rise to the 50-day SMA ($0.31) and then to the downtrend line.

Polygon (MATIC)

The MATIC has been swinging in a wide range between $0.69 and $1.05 for the past few months. Most of the time, trading within a range is random and volatile.

MATIC rebounded at $0.76 on Dec. Also, the bulls are trying to pull the price towards the 20-day EMA ($0.83). The bears are expected to sell the rally to the 20-day EMA. If the price declines from this level and dips below $0.76, MATIC is likely to drop to the strong support at $0.69. On the other hand, if the bulls push the price above the 20-day EMA, MATIC may attempt a recovery towards the overhead resistance of $0.97.

Polkadot (DOT)

DOT remains in a strong downtrend. The bulls are attempting to protect the support at $4.37. However, the shallow bounce raises the possibility that the downward move will continue.

The bears will try to strengthen their position by pulling the price below $4.37. If they do, it is possible for the DOT to resume its downtrend. The DOT is likely to reach $4 later. However, here buyers will try to stop the decline again. In a downtrend, bears usually sell their relief rally to the 20-day EMA ($4.80). The bulls will need to break through this hurdle to suggest that the downside momentum is weakening. The DOT is likely to move higher to the 50-day SMA ($5.30) and then to $6.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.