According to crypto analyst Ibrahim Ajibade, the altcoin is showing multiple green signals as the Ripple (XRP) price approaches $0.55 for the first time. Analyst alias Altcoin Sherpa says that Phantom (FTM) is bullish. Analyst Ekta Mourya is assessing whether Polygon (MATIC) can reconquer the $2 bullish target. Analyst Aaryamann Shrivastava talks about a 25% rally for Chainlink (LINK) under certain conditions.

Altcoin price prediction: Journey to $0.60

cryptocoin.comAs you follow, XRP has increased by 45% since its last local low on March 18. The move saw XRP approach the $0.55 milestone for the first time in 10 months. However, despite the positive market reaction, on-chain data shows that a huge cloud of uncertainty still surrounds the upcoming decision in the Ripple v SEC case.

Market Cap to Real Value (MVRV 30D) data shows that most traders who have purchased XRP in the past 30 days are in the green 20%. And according to analysis of historical data, the price may increase by another 6% before holders start taking profits en masse. As shown below, altcoin price may struggle to climb above the $0.56 resistance. However, if this resistance does not stop the rally, most holders could reach the 38% profit line at $0.63 before they start selling.

Still, if the bears take control, MVRV data shows holders could stop selling if profits drop 10% to $0.49. However, if this support zone does not hold, XRP could drop towards the 4% loss zone at the $0.44 level, where traders can stop selling to avoid further losses.

This altcoin is looking to rise!

Prominent crypto analyst Altcoin Sherpa tweeted his analysis for Phantom (FTM) yesterday. According to the tweet, the price of FTM was low at the time of the tweet and is looking to make another uptrend in the near future. The price of FTM seems to have entered the bullish that Altcoin Sherpa predicted as it rose 4.28% on the day. FTM gained 1.61% and 2.11% strength against the two crypto market leaders Bitcoin (BTC) and Ethereum (ETH) over the same period. As a result, the price of FTM currently stands at $0.5107. Analyst Steven Walgenbach reviews FTM’s technical outlook.

The daily chart for FTM shows that the altcoin price will continue to rise in the next 24-48 hours given the new bullish flag triggered between the 9-day and 20-day EMA lines. Currently, the 9-day EMA line is trading above the longer EMA line after the two lines crossed last Wednesday.

In addition, there is a bullish triangle chart pattern formed on the daily chart of FTM. This is after the altcoin has hit higher lows in the last 2-3 weeks. If this bullish chart pattern materializes, the price of FTM will likely move towards the next major resistance level near $0.5170. A safe break above this level will open the door for a rise for FTM towards $0.5775. On the other hand, if the bullish chart pattern is invalidated, the price of FTM could drop to the nearest support level at $0.4130. Confirmation of this bearish move would be when the price of FTM loses the support of the 9-day EMA line in the next 24 hours.

What are the obstacles for the MATIC price to rise to $2?

MATIC is facing competition from other Ethereum Layer 2 scaling tokens. At the same time, MATIC price is currently in a support zone, as seen in the MATIC one-day price chart below. MATIC must rise above $1.30 to conquer the support zone and face resistance at the 38.2% Fibonacci Resistance at $1.31. There is a key resistance zone between $1.35 and $1.46. This is crucial for MATIC’s rise to $2. Because once the Layer 2 token reaches its latest $2 bullish target, this will be where it is battling resistance.

As seen in the chart above, beyond the resistance zone, the next set of resistance is the 50% Fibonacci Retracement at $1.74 and $1.87. These are the two levels that acted as resistance on MATIC’s previous $2 breakout. Should the bullish thesis be invalidated, the altcoin could find support at the monthly low, which coincides with the 23.6% Fibonacci Retracement level at $0.94.

This altcoin can only be pulled up when this happens

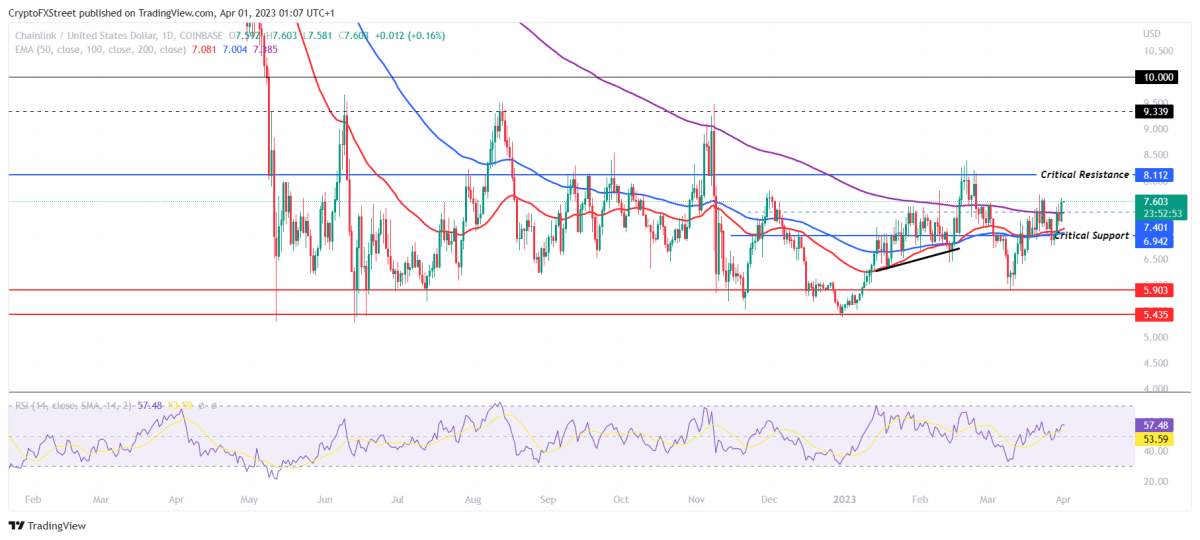

Chainlink price is trading at $7.6 and it is currently climbing above the immediate resistance level of $7.4, which acts as an immediate support base. Standing below $8.0, the 2023 high, LINK is looking forward to traders looking to break through the critical resistance of $8.1 and start a recovery towards the seven-month high of $9.3 to mark a 25% rally. will need support.

If these conditions are met, along with positive broader market sentiment, a potential rise to $9.3 is possible. If that doesn’t happen and Chainlink price fails to surpass $8.1 again and drops above the $7.4 support, the altcoin could drop to the critical $6.9 support. Losing this support invalidates the bullish thesis and pulls LINK to the March low of $5.9.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram And YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.