Grayscale, the world’s largest crypto fund issuer Ethereum According to the current index analysis, the investment fund Grayscale Ethereum Trust (ETHE) created for ETH It continues to trade at 60% lower than its price.

Although the mutual fund has traded above the spot market in recent years, it lost its one-to-one mobility with Ethereum with the bearish market that started in December 2021.

Ethereum, the largest smart contract platform since the first day of 2022, has dropped 68%, while the Grayscale ETH fund, which has $3.6 billion in assets under management, has dropped 85%.

The situation is the same with the BTC Fund!

The first crypto fund that Grayscale Investments launched years ago Grayscale Bitcoin Trust It’s the same for.

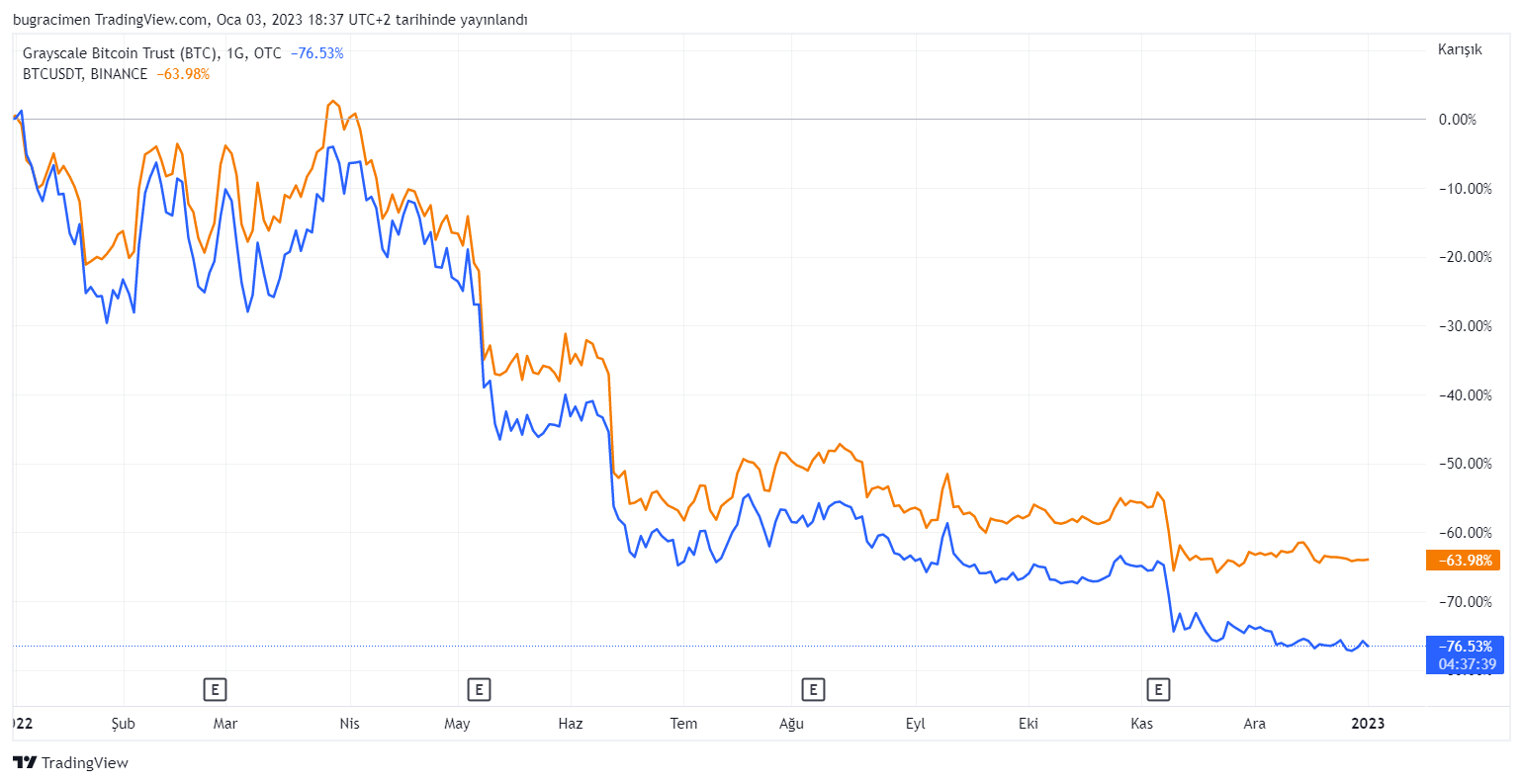

Leading cryptocurrency Bitcoin has dropped 64% since the first day of 2022, while the Grayscale BTC Trust fund has dropped 76%. GBTCfinds buyers 45% lower than Bitcoin traded on the spot market.

grayscale The biggest reason why its products are trading lower than the spot market may be recent claims about parent company DCG.

Last month, Netherlands-based cryptocurrency exchange Bitvavo claimed that DCG was in a deep liquidity crisis and was suspending its payments.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!