After the Russian invasion of Ukraine, commodity prices continue to rise, while Bitcoin (BTC) remains highly correlated with the stock market.

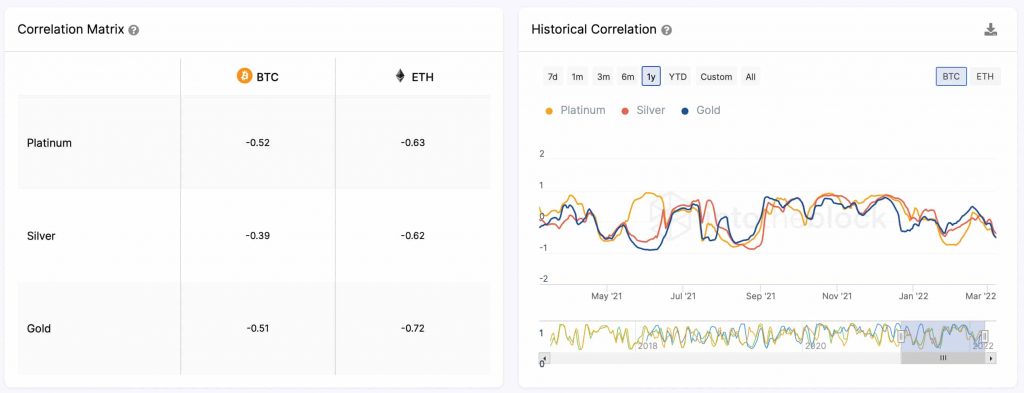

However, according to data provided by IntoTheBlock, the correlation between the flagship digital currency and precious metals has dropped to its lowest level since August 2021. In other words, the relationship in question is at the lowest level in 7 months. The research platform highlighted on March 7 that:

“The Bitcoin correlation with Gold, Silver and Platinum shows their lowest correlations since August 2021.”

More specifically, the Sharpe and Sortino ratios reveal how these commodities outperformed Bitcoin and Ethereum in response to their volatility, respectively.

Besides, it is worth noting that the vast majority of Bitcoin holders are not affected by the recent price fluctuations. The number of ‘HODL’ addresses that Bitcoin has with balances for over a year is currently at an all-time high and continues to rise steadily. IntoTheBlock said:

“The majority of Bitcoin holders are unaffected by the recent price movements. The number of HODLERs, i.e. addresses holding BTC for more than 1 year, is currently at its highest and is growing consistently. These represent 57% of all hodlers in BTC.”

Similarly, the number of Bitcoin addresses is increasing rapidly as the price of the cryptocurrency rises, indicating that retail investors are becoming more interested in the market.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.