Cryptocurrency market is far from showing signs of recovery. The value of all cryptos in the market has not changed much in the past days, with an average total value of 809.49 billion. Bitcoin price has also remained unchanged throughout the past day, trading at $16,800 on Thursday.

The market has yet to fully recover from the damage done by the collapse of FTX and is grappling with difficulties. Market investors, on the other hand, continue to act cautiously and anxiously. The Fear and Greed index measured 28, which is a low value.

However, some names think that there will be positive developments in the end of the crypto market. Binance CEO also expressed similar views.

Web3, crypto, blockchain will continue to grow.

— CZ 🔶 Binance (@cz_binance) December 21, 2022

What Are Bitcoin Investors Doing?

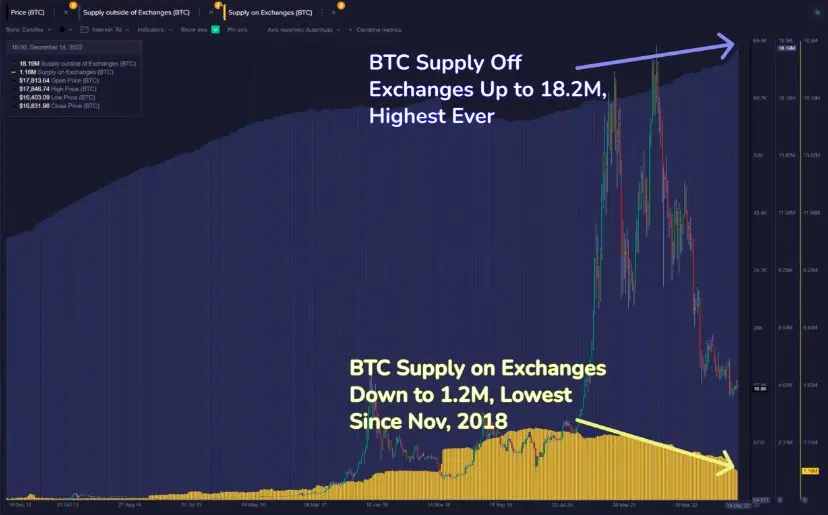

Despite the fact that there is a lot of FUD at the moment, participants continue to be cautious. you were santiment datas of investors bitcoin He stated that he tends to keep his assets in his own wallets. The number of coins stored in personal wallets is at all-time highs.

However, it is also noteworthy that the stock market supply has fallen to the lowest level in the last 4 years. Investors are likely to transfer these assets to their own wallets and tend to keep them long-term.

Noting the current balance on the exchanges, Santiment noted: “Meanwhile, the coins on the exchanges are at the lowest level in the last 4 years with only 1.2 million Bitcoins.”

BTC Investors Trying to Resist

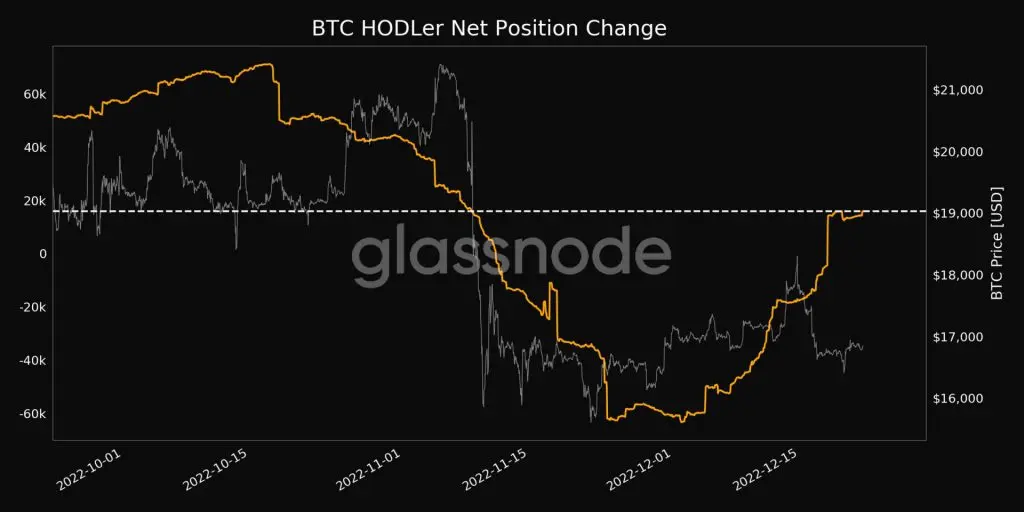

Such periods tend to break the faith and discouragement of investors. The low selling pressure was the main reason that prevented possible decreases in price. Long-term investors continued to accumulate, however, keeping their hopes up.

Data from Glassnode revealed that Bitcoin investors net position started a change in trend in December. The downtrend started to turn into an uptrend. That metric hit a 1-month high of 15,967,248 on Thursday.

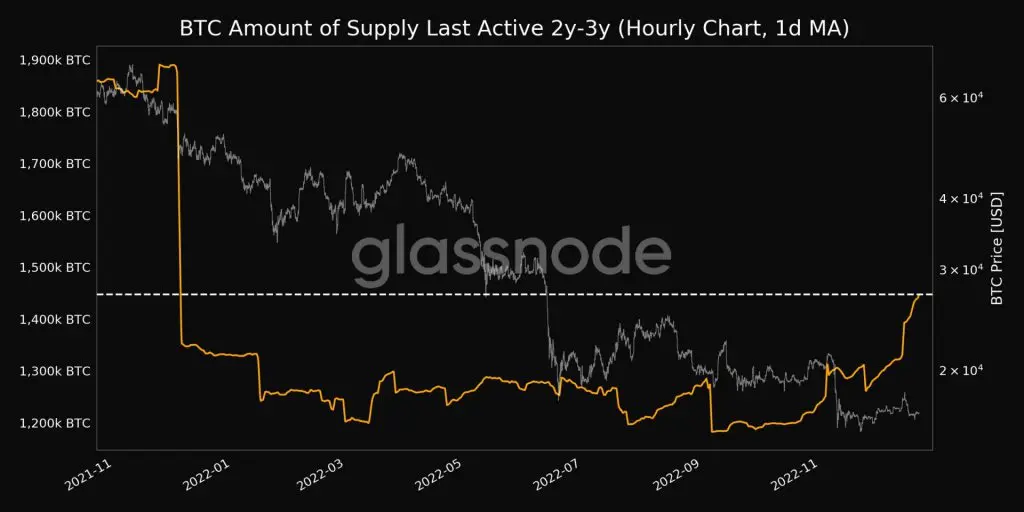

Parallel to this, inactivity began to increase. As shown below, the last two to three years’ supply reached a 1-year high of 1,447,479,093 BTC, confirming the data in question.

As a result, on-chain data shows that investors have not yet succumbed to FUD and are making rational moves.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.