Bitcoin (BTC) The price is currently trading around $19,200 and has remained stable over the weekend. Investors have widely differing views on which direction Bitcoin will take next. Some of the on-chain data has revealed that there is a possibility of a price increase relative to the “Bitcoin futures market” of BTC.

CryptoQuant Analyst Dan Lim noted that there is less selling pressure in the futures market of Bitcoin, noting:

“The amount of Bitcoin sent from the spot exchange to the derivatives exchange has fallen sharply since October. Since the drop in June, this volume has continued to rise, although Bitcoin held its low of $17,600 in June, but volume is currently falling rapidly and the possibility of strong selling pressure is decreasing day by day.”

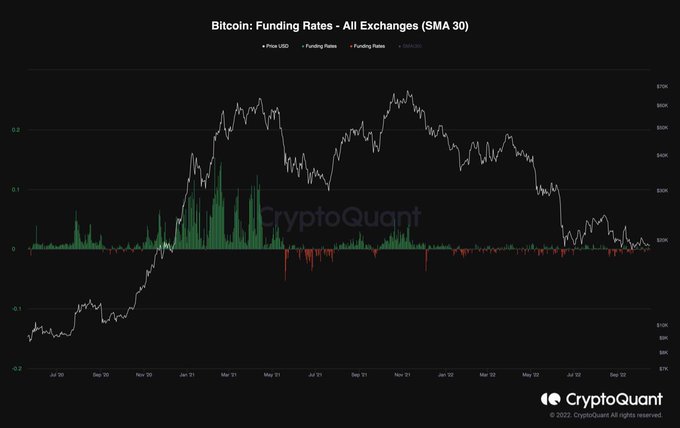

However, at the same time, Bitcoin futures funding rates in the futures market presented a negative outlook as the BTC price dropped from $22,000 to $19,000. Compared to the 2019-2021 period, these metrics are at very low levels, indicating a huge lack of demand and activity in the futures market.

Koinfinans.com As we reported, CryptoQuant analyst Greatest_Trader explains that this indicator usually results in a “consolidation and range phase” period.

“… excessively negative values increase the likelihood of short-term jamming and cryptocurrency may cause a reversal in the price of the unit.”

Bitcoin Futures and Volatility

While market experts continue to share their predictions on which direction Bitcoin will move, some traders expect more volatility ahead. Popular crypto trader Michael Van de Poppe noted:

“After four months of consolidation, it’s only a matter of time before massive volatility returns to the markets. The majority still assumes that we will continue to go downhill in the markets, but I think the possibility of upside momentum is increasing.”

However, as global macro conditions worsened, so did traders who shared opposing comments. DataDash founder Nicholas Merten shared a related macro view:

“For the first time in 14 years Nasdaq Composite closed weekly below the 200-week moving average This was a pivotal moment for the previous two 50-80% bear markets in 2000 and 2008 #Bitcoin has never experienced anything like this so expect much more pain to come ”

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.