According to on-chain analytics firm Glassnode Bitcoin (BTC)Although it has been about three months since it reached its all-time high, it started not to see much demand.

According to a study shared in a tweet shared on February 18, BTC seems to have experienced a big change in on-chain activity compared to three months ago.

Bitcoin, which fell from the price of $69,000 to the price of $ 33,000, has caused it to become a crypto asset that is less interested in by mainstream consumers. The latest data detected shows that the same is true for existing on-chain assets that hold one or more wallets.

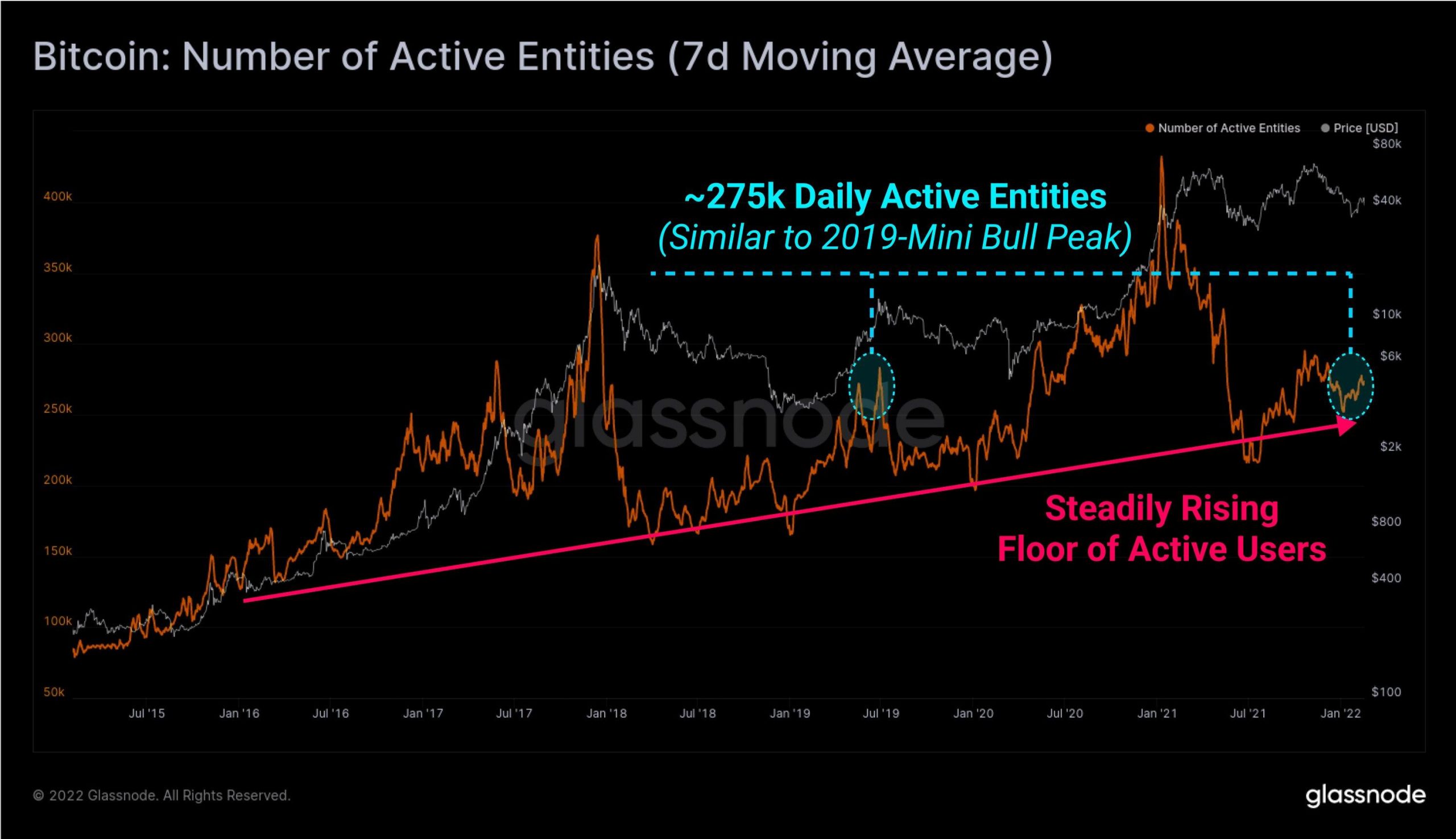

The Bitcoin network, which processed over 400,000 daily transactions in November 2021, ranks around 275,000 these days.

This reduction means that daily active assets are now at mid-2019 levels and even well below the peak of the last halving cycle in December 2017.

“This level of activity is well below bull market highs, indicative of lukewarm demand from new users,” commented Glassnode.

The researchers added that regardless of the cycle stage, the trend is the growth of asset numbers, which predictably gives rise to Bitcoin’s network effect.

According to a report by Cointelegraph, while the activity drop was significant for such a short time, the number of wallets continues to increase and the number of wallets containing 0.01 BTC (around $400) or more currently averages around 10 million.

glassnode Discussing their data, the popular Twitter account TXMC argued that whether the entities involved are human or not, there is still a reason for them to send BTC over the network, thereby verifying the entity numbers at a certain point.

“This level of activity is well below bull market highs, indicative of lukewarm demand from new users,” he shared.

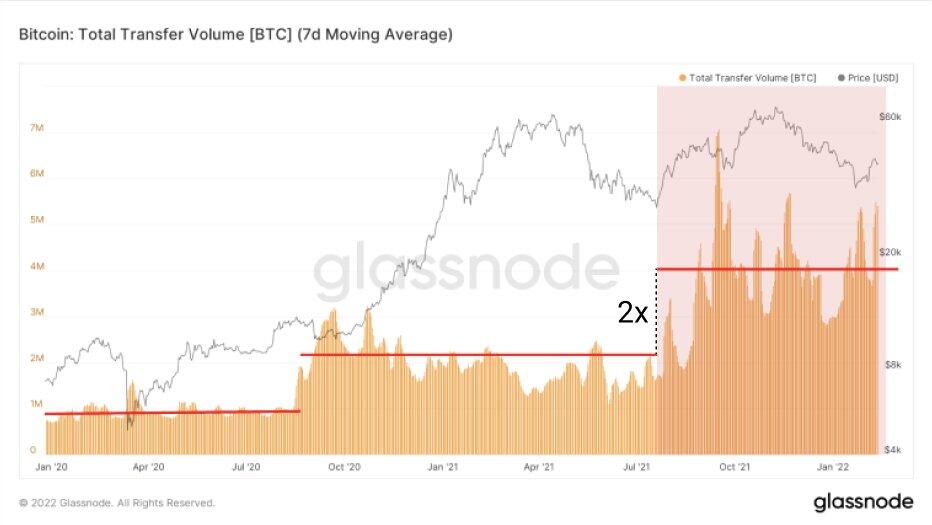

Meanwhile, in the latest issue of the “Uncharted” newsletter, Glassnode also confirmed that on-chain demand is trending “up and to the right”.

The daily transfer volume increased in the middle of last year and the weekly moving average, BTC/USD It sits around twice as much as October 2020 before exiting its three-year range. Since January 2021, long-term investors, wallets whose funds have not been moved in at least 155 days, have added another 3 million BTC to their balances as another sign of long-term investment.

Glassnode co-founders Yann Allemann and Jan Happel shared on Twitter last week that “Institutions in the market are a sign of greater adoption.”

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.