To be frank bitcoin its price has been pretty stagnant and boring for a while. The price held steady at just over $19,000 yesterday. On the other hand, volatility fell to the lowest level in the last two years. While the price was trading slightly lower at the time of writing, it remained relatively stable. So when will the expected mobility come? Here are the details.

Despite the stable outlook, Bitcoin price occasionally turns ‘red’. Mobility is at its lowest level in two years. While Ethereum was also falling, Dogecoin rose from time to time. Analysts indicated that a continuation of the decline in BTC is likely, while technical indicators surprised.

As Koinfinans.com previously reported, some technical indicators reveal that the price is quite ‘cheap’ at the moment. However, the ‘negative’ course of macroeconomic developments manages to overcome these technical indicators.

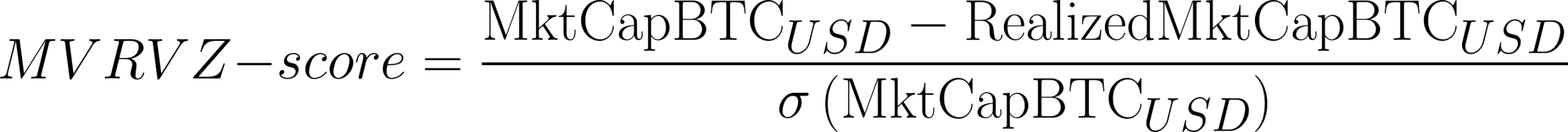

According to on-chain data on Bitcoin, the price has been trading quite low since 2020. The indicator known as the “MVRV Z-Score” is used to measure whether BTC is cheap or expensive on a relative historical basis.

What is Bitcoin MVRV Z-Score?

The indicator measures the difference between an asset’s market cap – the number of outstanding tokens multiplied by the spot price – and its ‘realization limit’ – the number of tokens times the price BTC last moved on the blockchain.

This difference is then divided by the standard deviation of the asset’s market value. Similar to other technical indicators, it theoretically highlights areas where an asset is over or undervalued.

How is the General Outlook in the Markets?

Polygon saw a spike following the growth in the network, but then things started to get much worse. MATIC continues to keep the weekly outlook ‘green’ even though it has dropped more than 5.38%. Prominent meme coin Dogecoin, on the other hand, shows a slight rise from time to time. On the Cardano and Solana front, the decline continues.

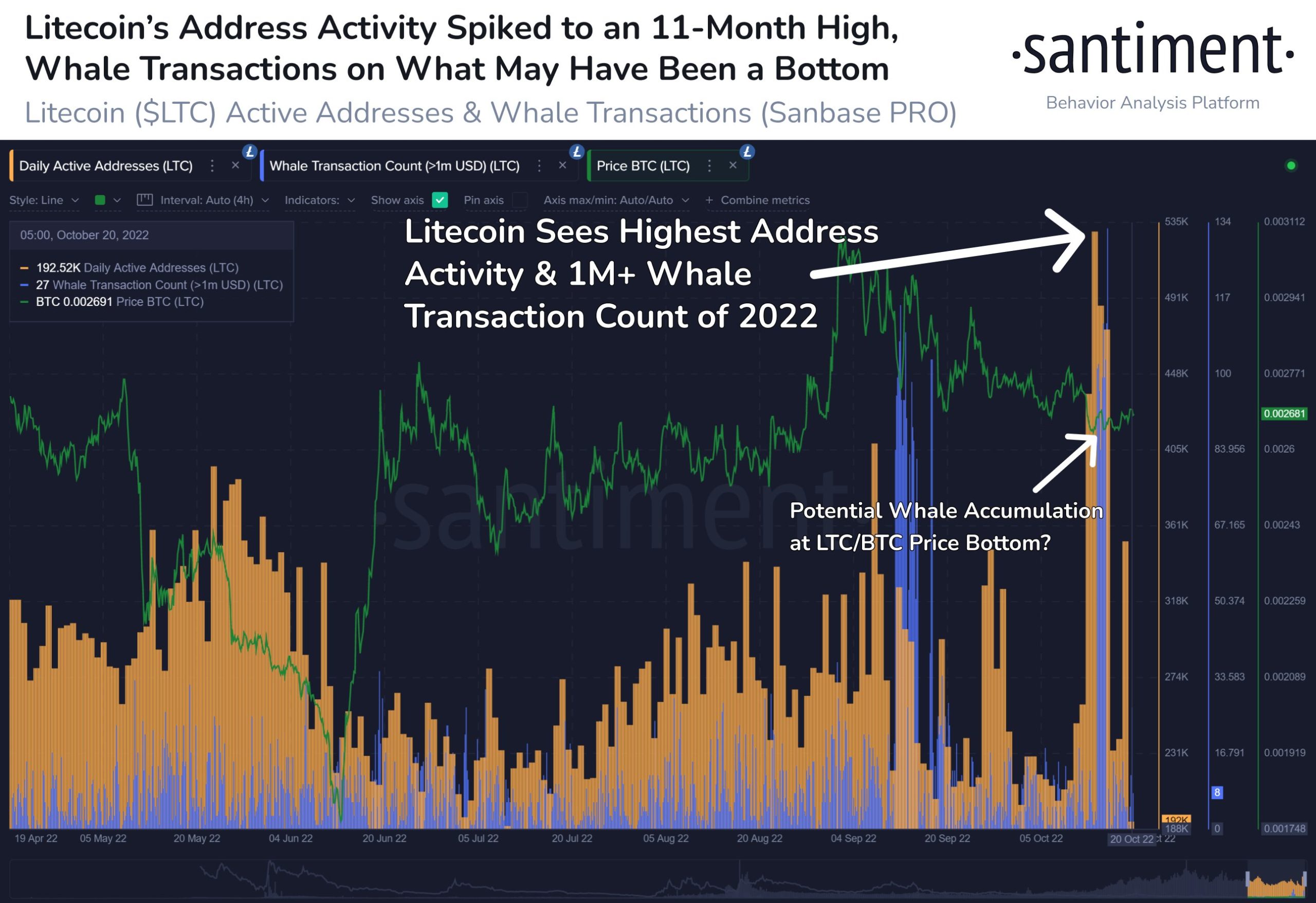

“Litecoin was quietly under the radar in 2022, but this week address activity and whale transactions exploded. As Santiment reports, especially in transactions valued at over $1 million on the network, the timing of these increases was just as LTC started to rise compared to LTC.

The biggest loser of 2022 was surprisingly Axie Infinty. The fact that AXS tokens will be unlocked will result in huge selling pressure in the market. Early investors, on the other hand, may rush to the stock markets to seize the long-awaited selling opportunity.

US stocks closed lower on Thursday. The Dow Jones Industrial Average fell 0.3%, the S&P 500 Index fell 0.8% and the Nasdaq Composite Index ended the day down 0.6%.

That’s more than double the US Federal Reserve’s rate hikes this year, the average 30-year fixed-rate mortgage rate since April 2002, and 3.09% last year, as released Thursday by financial services firm Freddie Mac. followed by a report drawn to a value.

The Fed raised interest rates from nearly zero in March this year to 3% and 3.25%. It is determined to reduce inflation from its current 8.2% rate to a target range of 2%. The Fed is expected to raise interest rates by 75 basis points at its next general meeting in November.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.