Bitcoin Fear and Greed Index According to the report released earlier today, it dropped to 21, showing the feeling of “extreme fear”. On September 1, although this was slightly above 20, it rose to 30 levels from time to time.

Bitcoin in Extreme Fear Zone

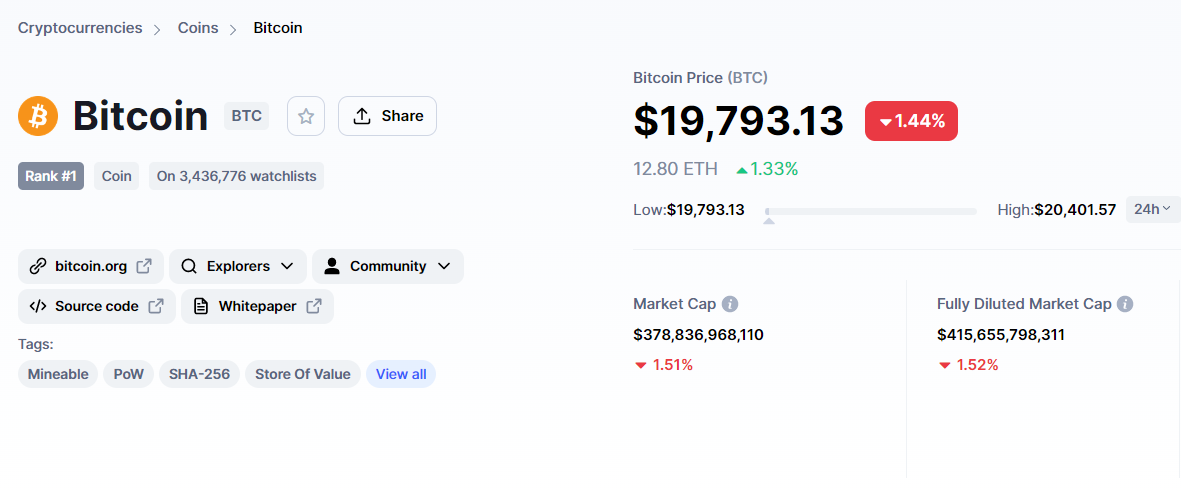

On Friday, August 2, the leading cryptocurrency, dropped from the $20,000 level it managed to hold for a while and reached the $19,800 area. Despite making several attempts to reclaim $20,000, Bitcoin failed to stabilize at this price line.

Before the decline, the regular employment report was published along with the US unemployment data. The numbers in the report came out higher than expected, 3.7 percent versus 3.5 percent, which affected the stock market and cryptocurrency with it.

However, non-farm data showed 317,000 additional jobs versus the expected 350,000. This is interpreted as critical data meaning that the Fed Reserve will not make much of a return from its current hawk strategy.

Fed chairman Jerome Powell announced in a conversation with bankers on Aug. 26 that the US central bank’s hawkish policy would continue. That day, bitcoin It started its current decline and settled below the $21,000 level.

Bitcoin Fear and Greed Index is 21 – Extreme Fear

Current price: $19.991 pic.twitter.com/3BjxqhnPCn— Bitcoin Fear and Greed Index (@BitcoinFear) September 3, 2022

Could Price Drop To $15,000?

Max Gokhman, chief investment officer of the AlphaTraI fund, made a frightening prediction and stated that the price of Bitcoin could decline to $ 15,000.

He also noted that stronger-than-expected numbers in the employment report are likely to indicate that the Fed will continue its tight monetary policy, which will push Bitcoin down the price ladder even harder.

Peter Schiff, known for his opposing views, made a post on his Twitter account to find out if they expect Bitcoin to recover above $20,000. According to Schiff, buyers are close to extinction and may experience a large drop as a result.

Earlier this year, he tweeted that BTC is likely to test support below the $10,000 level.

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.