of bitcoin The decline in the market value throughout the year, increasing interest rates, the inability to get inflation under control yet and the rise in energy prices negatively affect cryptocurrency miners.

Some crypto experts consider miners to be the biggest factor in the bear season as they have large amounts of BTC on hand. Therefore, to predict when the rise will come, the researchers BTC It focuses on miners’ data. Except for a few minor differences, Bitcoin miners exhibit the same behavior as the old bear markets.

“The Bear Market Will Continue For A While”

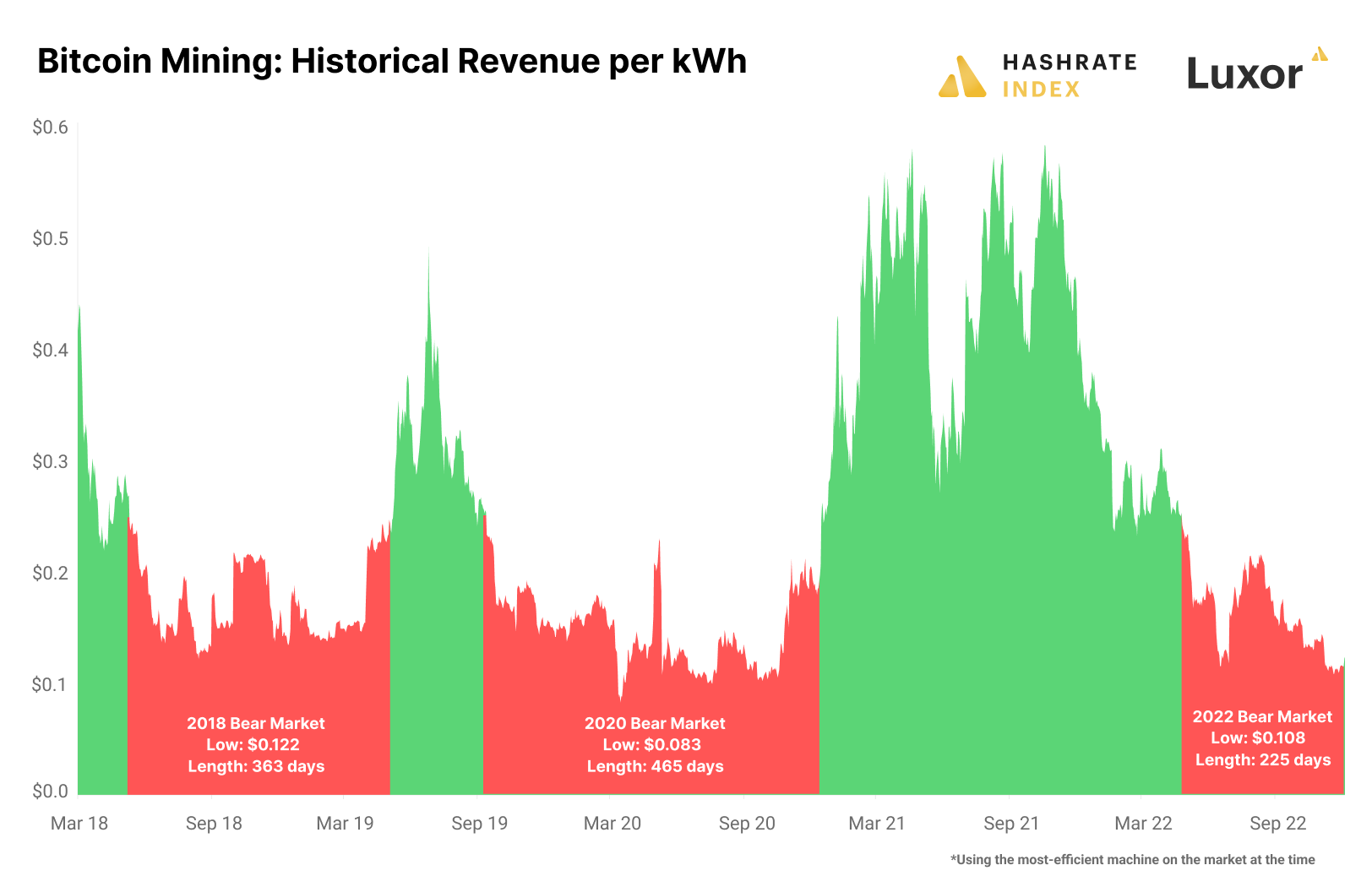

Jaran Mellerud, a leading analyst at crypto market research startup Hashrate Index, found that miners create selling pressure when they earn less than $0.25 per kWh. BTC miners per kWh today according to data $0.12 wins.

Based on the fact that the 2018 and 2020 bear markets lasted 363 and 465 days, respectively, Mellerud thinks that the bear market for BTC will continue until at least March.

What is Bitcoin Mining?

bitcoin mining, bitcoin It is an operation to provide the processing power of the network. Miners work to verify and confirm Bitcoin transactions, and while doing these transactions, they generate new Bitcoins during mining operations.

Because these processes require a large amount of computational power required for mining, computers with special hardware and high electricity consumption are used for mining.

Mining maintains the integrity of the Bitcoin network and generates new Bitcoins while at the same time allowing miners to earn the rewards they earn while doing these transactions.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!