As the United States cuts risk assets, with stronger-than-expected jobs data bitcoin It fell to a three-week low on March 8.

According to TradingView data, the BTC/USD pair dropped as low as $21,858 on Bitstamp. The pair was trying to protect $22,000 as support at the time of the news.

Founder of trading firm Eight Michael van de Poppe“Bitcoin does not show the strength I wanted to see at the beginning, there was a slight bounce yesterday” commented made.

In this case, some more downward momentum is sought towards a sweep of the $21,200 lows before a bounce occurs. If we want $30,000, we need to get $23,000.

Daan Crypto Trades, on the other hand, argued that the volatility was due to movements in the Bitcoin futures markets.

Bitcoin Price Is Highly Volatile

Fed Chairman Jerome Powell‘s speech in front of the US Congress the previous day did not cause a reaction, but the employment data announced during the day brought the mood down.

“Expectations were that 197 thousand people would be employed. The actual figure is 242 thousand, which is more positive than expected.” Van de Poppe made this comment in part of his comments on the day’s non-farm employment increases.

Not great for risky investors as we’ve heard that Powell is looking to raise interest rates further in 2023.

Such “high” employment numbers have traditionally made risky assets uneasy, as they mean the Fed has more room to keep financial conditions tight for longer.

US Dollar Strengthens

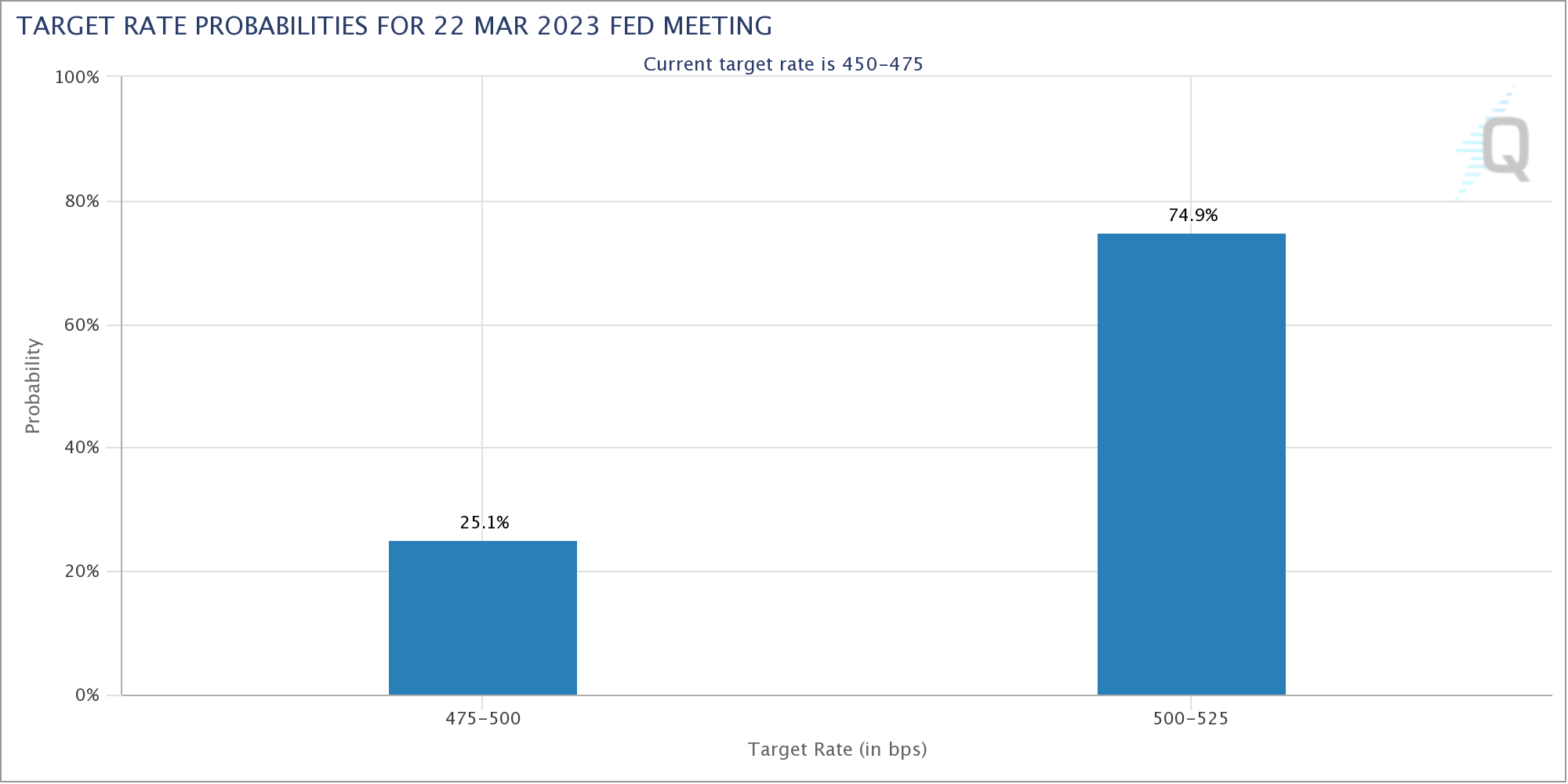

Fed’s Federal Open Market Committee (FOMC) Forecasts about how much of an increase it will make at its next meeting on March 22 show that uncertainty about the decrease in inflation has increased.

According to data from CME Group’s FedWatch tool, the market now favors a larger 50 basis point rate hike instead of 25 basis points in February.

The US dollar index (DXY) likewise prepared an unwelcome surprise for Bitcoin bulls.

After a strong March 7 session, the Index consolidated during the day after hitting 105.88, its highest level since December 1, 2022.

“Watch DXY… above 106 there is an almost perfect setup for a negative divergent rise, then at least a major pullback or a dip below 100 begins,” trader David Brady reacted.

You can follow the current price action here.