Bitcoin (BTC) and Ethereum (ETH) are on the rise, pushing the entire crypto market up. Meanwhile, billions of BTC positions have been liquidated. So, why did they originate? Crypto analyst Kyle White clarifies these issues.

Bitcoin and altcoins rally in bear market

Bitcoin price rose today, triggering a market-wide rally in crypto prices. This shows that Bitcoin (BTC) and Ether (ETH) are aiming to complete October with black. As of October 26, most major cryptocurrencies are posting single-digit gains. As the current price fluctuates, BTC is holding above the psychologically important $20,000 level.

Stocks start the day lower as Bitcoin remains above $20,000. Bitcoin’s momentum has been going on for three days now. It also sees green candles on October 26. The recent price surge brought the total cryptocurrency market cap to over $1 trillion. This comes after months of Bitcoin trading in a tight range between $18,000 and $20,000.

Hand in hand with Bitcoin’s growth, most major cryptocurrencies including Ether (ETH), Solana (SOL), Cardano (ADA), Polygon (MATIC), Ripple (XRP) and Tron (TRX) have increased by 10% over the last 48 hours. It recorded more than 10 price increases. There are several reasons for the crypto rally. The current rally in BTC and other major cryptocurrencies likely points to an increase in confidence in the market after a few key developments. Here are the main factors of growth.

$1 billion short position liquidated

Since the price of Bitcoin dropped to $ 17,600 on June 18, the open interest on BTC futures contracts has been increasing. The current price action has triggered a liquidation wave. One data point to consider is that we are seeing a sharp drop in total open interest.

The data shows that Bitcoin shorts made $550 million in the last 24 hours. The $704 million cross crypto short position was liquidated on October 25. Also, the liquidation on October 26 was $275 million.

Short liquidations force automatic buying pressure. So it directly helps to raise the Bitcoin price. The current rally sees open interest gain momentum after staying consistent since October. This explains most of the sideways trading as well as the current rally.

Macro movements are starting to turn in favor of Bitcoin (BTC)

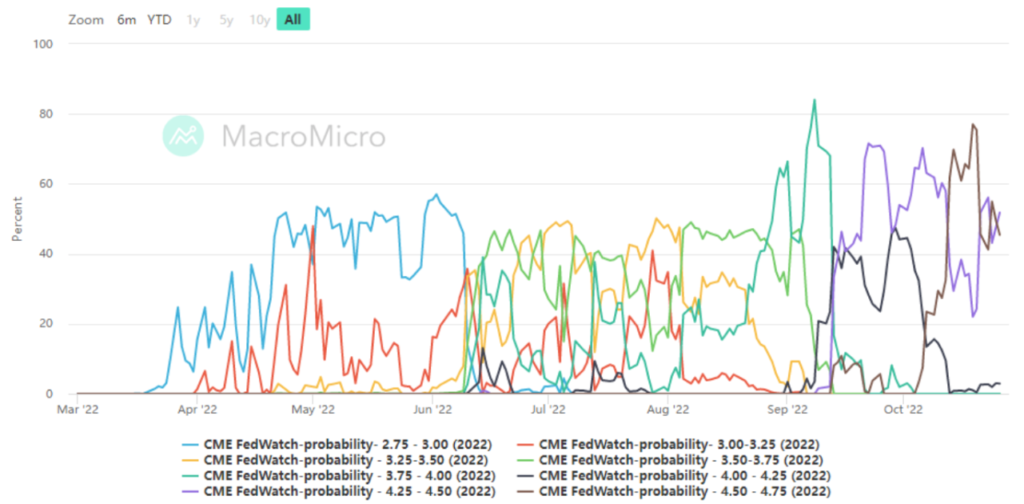

cryptocoin.comAs you follow, there are hopes in the markets that the Fed will pass smaller-scale rate hikes in the next two months. This, in turn, is likely to have increased investors’ confidence in the crypto market. Interest rates will likely be lower than previously predicted in the near future, according to MacroMicro, a firm that publishes investors’ consensus forecasts on expected changes in interest rates.

The chart points to a possible slowdown in interest rate hikes. The public predicts that rates will fall in the future. Also, investors think this creates the possibility of a broad crypto market recovery.

The S&P 500 provides an overview of the economy in general. Currently, Bitcoin and the S&P 500 share a high correlation coefficient. Therefore, a similar turnaround in the stock markets is possible if interest rates fall and the economy grows. If this happens, it is possible that Bitcoin will continue to rise. The better the macro climate, the better for the Bitcoin price.

A multi-day rally in equities and a crypto-friendly leader in the UK

It’s possible that Rishi Sunak’s becoming the UK’s new prime minister has heightened crypto investor sentiment. Altar is a crypto advocate. As a result, many expect him to make major reforms in the crypto industry. Meanwhile, during his tenure as finance minister led by Boris Johnson, Sunak expressed his desire to make the UK a cryptocurrency hub. In April 2022, Sunak said:

It is my aim to make the UK a global hub for crypto asset technology. The measures we’ve outlined today will help enable companies to invest, innovate and scale in this country.

It is too early to say whether the rally is a sign of a trend change. But one thing is clear. It is also driven by the factors affecting the Bitcoin price and the crypto market, obviously the forced settlement of futures contracts. In addition, the positive movement in the macro markets and the investors’ expectation that central bank policy and crypto regulatory frameworks will improve are also influential.

Contact us to be instantly informed about the last minute developments. twitter‘in, Facebookin and InstagramFollow and Telegram and YouTube join our channel!

Risk Disclosure: The articles and articles on Kriptokoin.com do not constitute investment advice. Bitcoin and cryptocurrencies are high-risk assets, and you should do your due diligence and do your own research before investing in these currencies. You can lose some or all of your money by investing in Bitcoin and cryptocurrencies. Remember that your transfers and transactions are at your own risk and any losses that may occur are your responsibility. Cryptokoin.com does not recommend buying or selling any cryptocurrencies or digital assets, nor is Kriptokoin.com an investment advisor. For this reason, Kriptokoin.com and the authors of the articles on the site cannot be held responsible for your investment decisions. Readers should do their own research before taking any action regarding the company, assets or services in this article.

Disclaimer: Advertisements on Kriptokoin.com are carried out through third-party advertising channels. In addition, Kriptokoin.com also includes sponsored articles and press releases on its site. For this reason, advertising links directed from Kriptokoin.com are on the site completely independent of Kriptokoin.com’s approval, and visits and pop-ups directed by advertising links are the responsibility of the user. The advertisements on Kriptokoin.com and the pages directed by the links in the sponsored articles do not bind Kriptokoin.com in any way.

Warning: Citing the news content of Kriptokoin.com and quoting by giving a link is subject to the permission of Kriptokoin.com. No content on the site can be copied, reproduced or published on any platform without permission. Legal action will be taken against those who use the code, design, text, graphics and all other content of Kriptokoin.com in violation of intellectual property law and relevant legislation.