Crypto analytics firm CryptoQuant Ethereum He shared some on-chain data for (ETH). Investors could potentially trigger massive selling pressure, according to data the firm has analyzed.

CryptoQuanthighlighted the Shanghai hard fork scheduled for next March. The update will also unlock 15.3 million ETH. These openings can trigger a potential selling pressure.

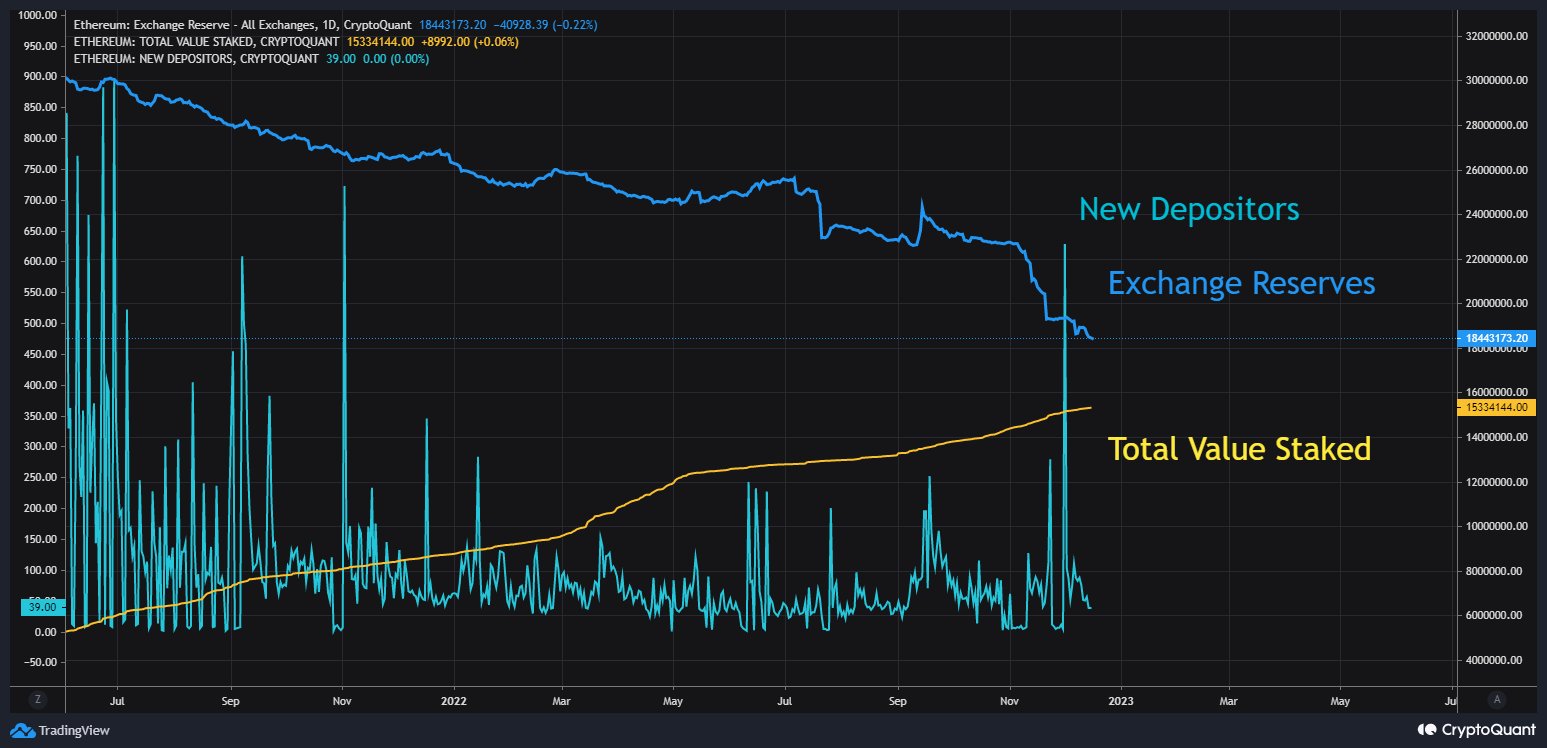

CryptoQuant underlined that as staked ETH accumulates, Ethereum reserves on crypto exchanges tend to decrease.

“A big selling pressure on the Ethereum front? The amount in ETH2 smart contracts accumulated and contained 12% of the total supply. ETH exchange reserve has shrunk to 15% of the total supply and continues to decline. But what will happen after the Shanghai hard fork is unknown.”

Ethereum’s move to proof-of-stake consensus has paved the way for investors to earn returns in the form of ETH through staking. CryptoQuant underlined that early next year, around 15 million ETH worth over $17.7 billion will be unlocked. Investors may choose to sell these assets to make a profit.

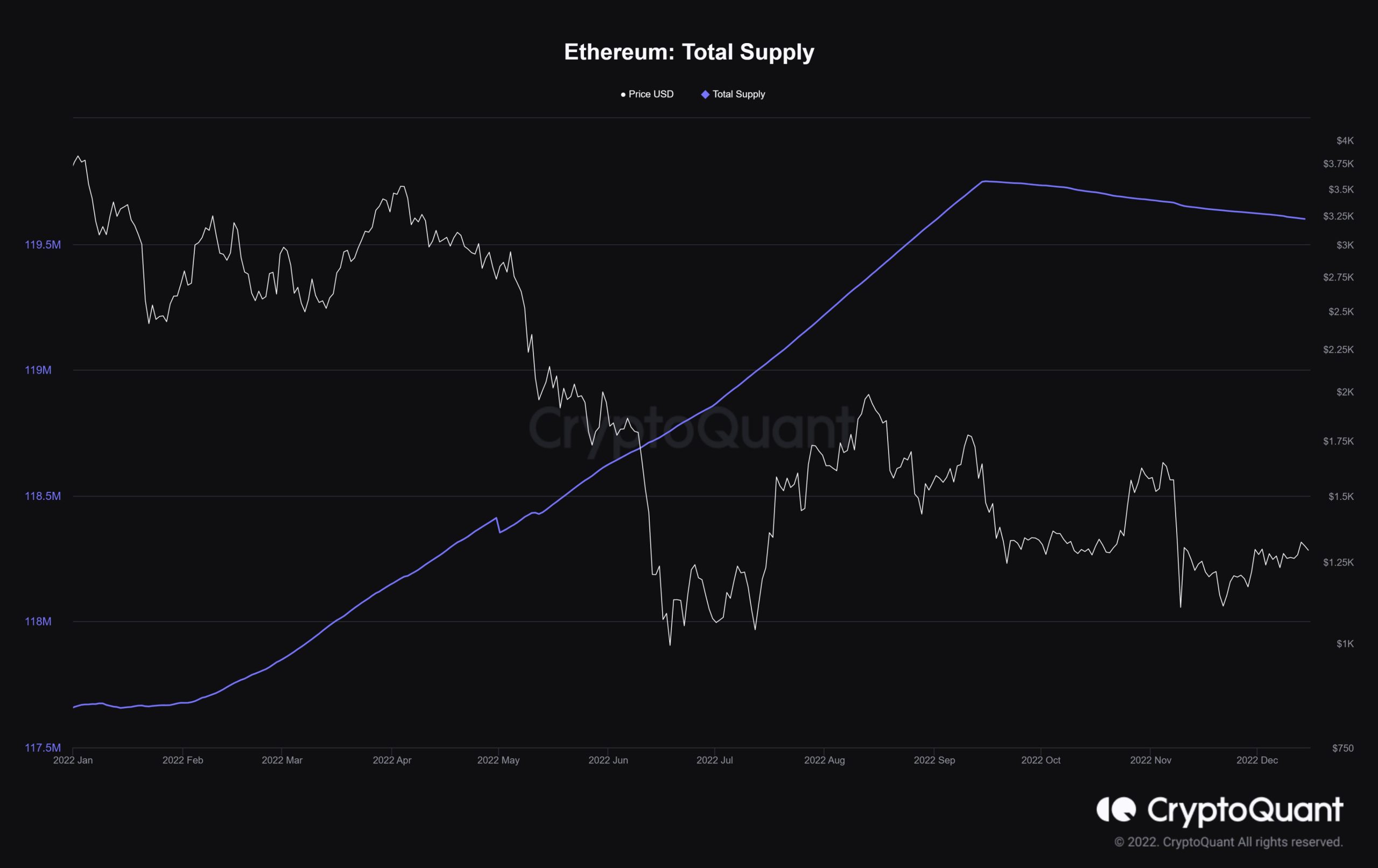

“After the merger, the supply started to drop by 0.1 million. Supply and demand dynamics will change after the hard fork. ETH price is barely fluctuating. Will the Shanghai hard fork trigger the bulk sale? Or will it offer an opportunity to buy more ETH, providing more liquidity? Only time can tell.”

You can follow the current price action here.

Disclaimer: What is written here is not investment advice. Cryptocurrency investments are high-risk investments. Every investment decision is under the individual’s own responsibility. Finally, Koinfinans and the author of this content cannot be held responsible for personal investment decisions.