We observe that the selling pressure increased in the markets before the FED meeting.

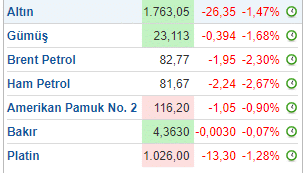

While the US stock markets continued their partially red and flat course, sales in the commodity group in particular reached 2%. Gold is trading at $1760, down 1.5% before the Fed meeting.

The Fed is not expected to raise interest rates at this meeting. Today, the tone of the statements regarding the reduction in asset purchases and the general economic outlook will be followed.

While the uneasiness of the FED is dominant in the markets, we see that the crypto money prices are also affected by this uneasiness.

Shortly before the FED decision, Bitcoin fell to $ 61600. With the effect of the withdrawal in Bitcoin, the losses in altcoins rose to the 5-10% band. In the FED news we reported yesterday, we conveyed that this is an expected situation.

The Fed’s decision will be announced at 9:00 pm. Powell is expected to make a statement later. If Powell continues his previous dove statements, we can see the ups continue as the risk turns positive. In these short-term fluctuations, it would be healthier to follow a watch-see policy for a while rather than panicking.

Currently, technically supported by its 20-day average ($61800), Bitcoin closing the day above $61800 will strengthen our expectations that the rise will continue.

*Not Investment Advice.