Ludwigshafen After a significant drop in earnings last year and high burdens from the energy crisis, BASF is cutting 2,600 jobs worldwide. In addition, significant cuts in the production network at the Ludwigshafen site are planned.

BASF wants to close several plants there, including a plant for the plastic precursor TDI that was built just a few years ago, which will affect around 700 more production jobs. The Handelsblatt reported exclusively on Wednesday.

“The competitiveness of the European region is increasingly suffering from over-regulation. It is also suffering more and more from slow and bureaucratic approval procedures and, above all, from high costs for most production factors,” said BASF CEO Martin Brudermüller on Friday. Workers in production should be offered work in other companies.

Employee representatives consider the downsizing to be excessive. The works council and IGBCE demanded in a joint statement on Friday that the restructuring should not be at the expense of the employees and should not lead to a further increase in performance.

IGBCE boss Michael Vassiliadis, who is also a member of the BASF supervisory board, said: “Dismantling plants and cutting jobs is not yet a concept for a successful future for the largest chemical complex in the world.” The site is facing its very own turning point. “And we only shape this with courageous innovations and investments – not with the cost hammer,” explained Vassiliadis.

“We are only shaping the turning point with courageous innovations and investments – not with the cost hammer.”

(Photo: dpa)

In this context, the head of the BASF works council, Sinischa Horvat, called for the transformation of the site to be accelerated: “We have to invest more in green energy, green hydrogen and the circular economy in Ludwigshafen.”

As the largest industrial gas consumer in Germany, BASF felt the effects of the increased prices for energy and raw materials last year. Energy costs increased by 3.2 billion euros, of which 1.7 billion were attributable to the main plant in Ludwigshafen, according to the company. In addition, the economic environment for the chemical giant has clouded over significantly from the second half of the year.

BASF shares extend losses after weak outlook

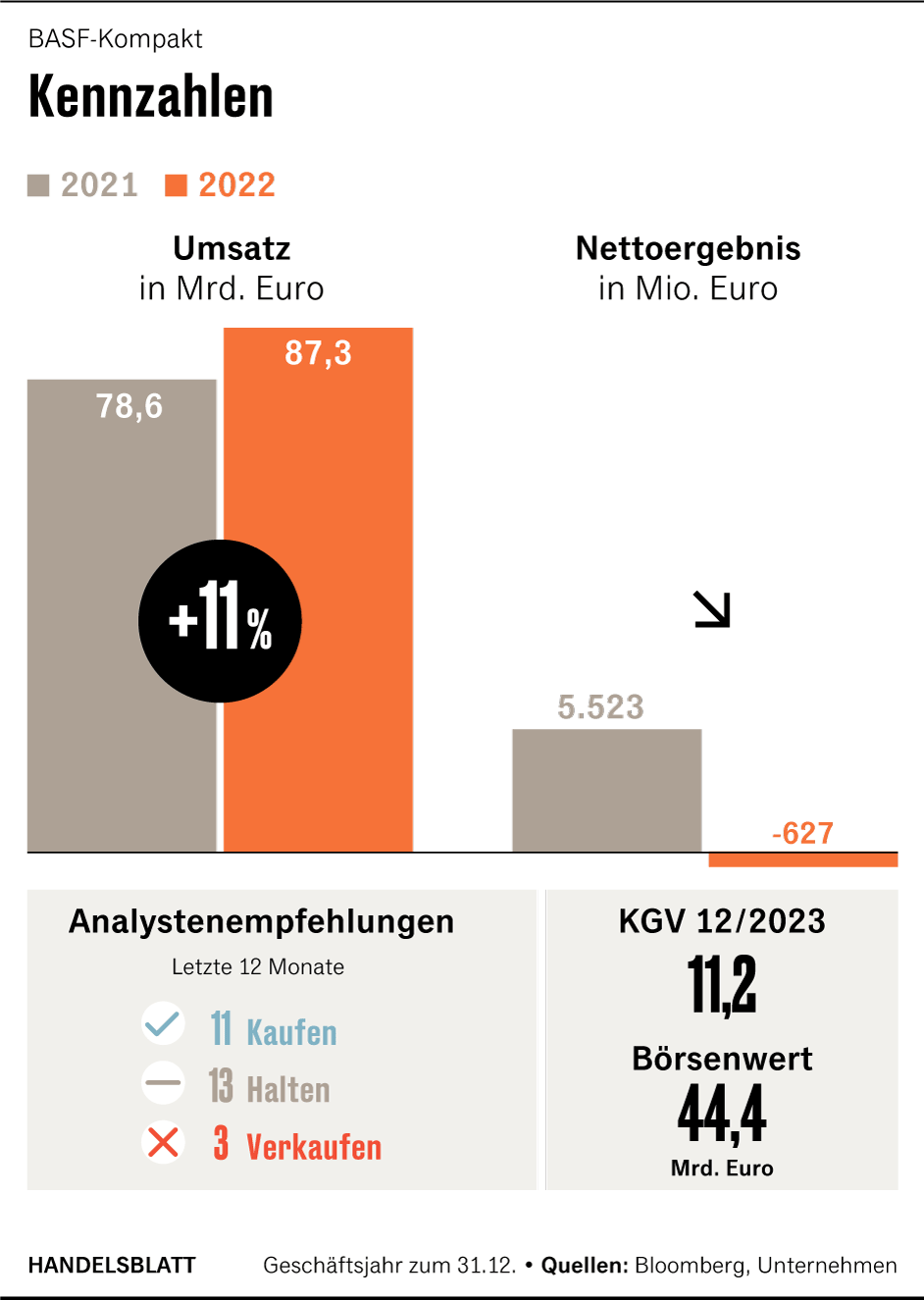

For 2023, BASF therefore expects a further significant decline in adjusted operating profit (EBIT) to between EUR 4.8 billion and EUR 5.4 billion. Last year, the result had already fallen by 11.5 percent to 6.9 billion euros. Sales are likely to fall to 84 to 87 billion euros from the last 87.3 billion. Margins have come under severe pressure, especially for basic chemicals and plastics.

“We are in a very difficult time,” said Brudermüller at the balance sheet press conference. In the meantime, he wants to hand over the chairmanship of the board to his successor in calmer waters next year.

In view of the weak outlook, BASF shares increased their losses on Friday and were down around 7.5 percent at around EUR 48.30 in the afternoon.

The group had already announced last October that it would reduce administration, service and research costs at its European locations by 500 million euros. These measures have now been specified. There are also significant cuts in production.

In addition to one of two ammonia plants, BASF also intends to shut down plants for the production of fertilizers and the plastic precursors caprolactam and TDI. In addition, the group plans to reduce capacities for a number of other chemicals. Ludwigshafen will remain BASF’s largest and most strongly integrated site. In the future, however, he will concentrate more on supplying the European market, explained Brudermüller.

The BASF boss complains about “over-regulation” in Europe.

(Photo: dpa)

The cuts are intended to reduce fixed costs by a further 200 million euros and are unusually severe and painful for BASF. Together with measures that have already been introduced in previous years, the group wants to reduce its costs by around one billion euros.

Above all, the abandonment of the relatively new TDI plant is a major setback for the chemical company. It only went into operation in 2018 and involved investments of around 1.5 billion euros, including numerous retrofitting works due to technical problems. The project thus proves to be one of the biggest bad investments in the history of the group.

The group justifies the shutdown with unexpectedly weak European demand and increased energy costs. In addition, however, the technical problems may have played a role, with which the plant struggled again and again. TDI is a precursor for the plastic polyurethane. BASF also operates TDI plants in the US, South Korea and China. The group is the world’s second-largest supplier in this field after the Leverkusen-based Covestro.

Chemical group BASF wants to cut around 2,600 jobs worldwide

Employee representatives also see the closure of the TDI plant in connection with previous cost-cutting measures. Because the group had relied heavily on external suppliers and less on its own engineers for the project. Among other things, a large part of the technical problems are attributed to this. This is “an incredible failure of management and the consequence of saving in the wrong place,” says the IGBCE statement.

Overall, according to BASF, the adjustments in production affect ten percent of the replacement value of the plants in Ludwigshafen. At its main site, BASF operates a total of around 200 closely networked chemical plants and employs around 39,000 of its 111,500 employees there. According to the current site agreement, redundancies for operational reasons are excluded until the end of 2025.

China investments rise to record levels

Regardless of the closures in Ludwigshafen and the gloomy economic outlook, BASF is continuing an ambitious investment strategy on a global level. For the next five years, the group is planning investments in property, plant and equipment of 28.8 billion euros, compared to 25.6 billion in the previous planning period from 2022 to 2026.

According to BASF, the share of investments in Asia will increase to 47 percent, primarily due to the construction of the new large plant in Zhanjiang, China, while only 36 percent will go to Europe and 15 percent to North America.

In view of the growing political tensions between the United States and China, the major project in China is being viewed with increasing skepticism by investors and analysts and was also recently controversial on the BASF board. Top manager Saori Dubourg, who spoke out against the investments, is leaving the group at the end of February.

>> Read about this: Change in the BASF board: Saori Dubourg leaves the chemical giant

BASF intends to invest around two billion euros in each of the major projects in China over the next few years. Brudermüller again vehemently defended the project on Friday. In view of the expected further growth of the huge Chinese chemical market, they continue to see more opportunities than risks.

“It’s not like we’re without a country here,” said Brudermüller. But we remain convinced that this is the right thing to do in terms of the market.” Without profitable activities outside of Europe, the transformation in Ludwigshafen cannot be managed.

Many investors and analysts were already prepared for declining earnings at the chemical company. Analysts expect adjusted EBIT for 2023 to average EUR 5.2 billion. In addition, BASF’s net loss of 627 million euros was lower than the group had announced at the end of January.

At that time, the company had assumed a loss of almost 1.4 billion euros due to the multi-billion dollar write-downs on the subsidiary Wintershall Dea. Meanwhile, depreciation on Wintershall turned out to be somewhat lower than initially expected. The BASF subsidiary complains that its holdings in Russia have been expropriated and is planning a complete withdrawal from the country. In 2021, BASF had earned around 5.5 billion euros after taxes.

BASF dividend remains unchanged

Despite the net loss at group level, BASF intends to pay out a constant dividend of EUR 3.40 per share. The sum is covered by the relatively solid free cash flow of 3.3 billion euros last year. However, there are concerns among analysts and investors that the group could be forced to cut dividends in the current year given weak business prospects, high investments and an expected significant decline in free cash flow.

The early termination of a share buyback program fueled those concerns on Friday. In combination with the waiver of a dividend increase and the management’s indication that the future distribution depends on the respective free cash flow, this puts “a question mark over the sustainability of the BASF dividend,” writes Markus Mayer from Baader Bank.

Arne Rautenberg, fund manager at Union Investment, takes a similar view: “Uncertainty about the dividend and sharply rising investment expenses are weighing on the share price. The good news for the shareholders is that Mr. Brudermüller has recognized the signs of the times and is adapting the Ludwigshafen location to the new realities in good time,” says Rautenberg.

More: BASF facing severe cuts – chemical group also shuts down plants.

First publication: 02/24/23, 06:57 (last updated on 02/24/23, 16:15).