The leading cryptocurrency that opened the year 2022 at $ 46 thousand bitcoinfell to $ 15,700 during the year due to macroeconomic conditions and the bankruptcy of some of the industry’s giant companies.

The bankruptcy of FTX, one of the largest cryptocurrency exchanges in the industry, last November caused great panic among investors. However, as the last days of the year approached, the volatility in the market fell to the lowest level of the last 2 years.

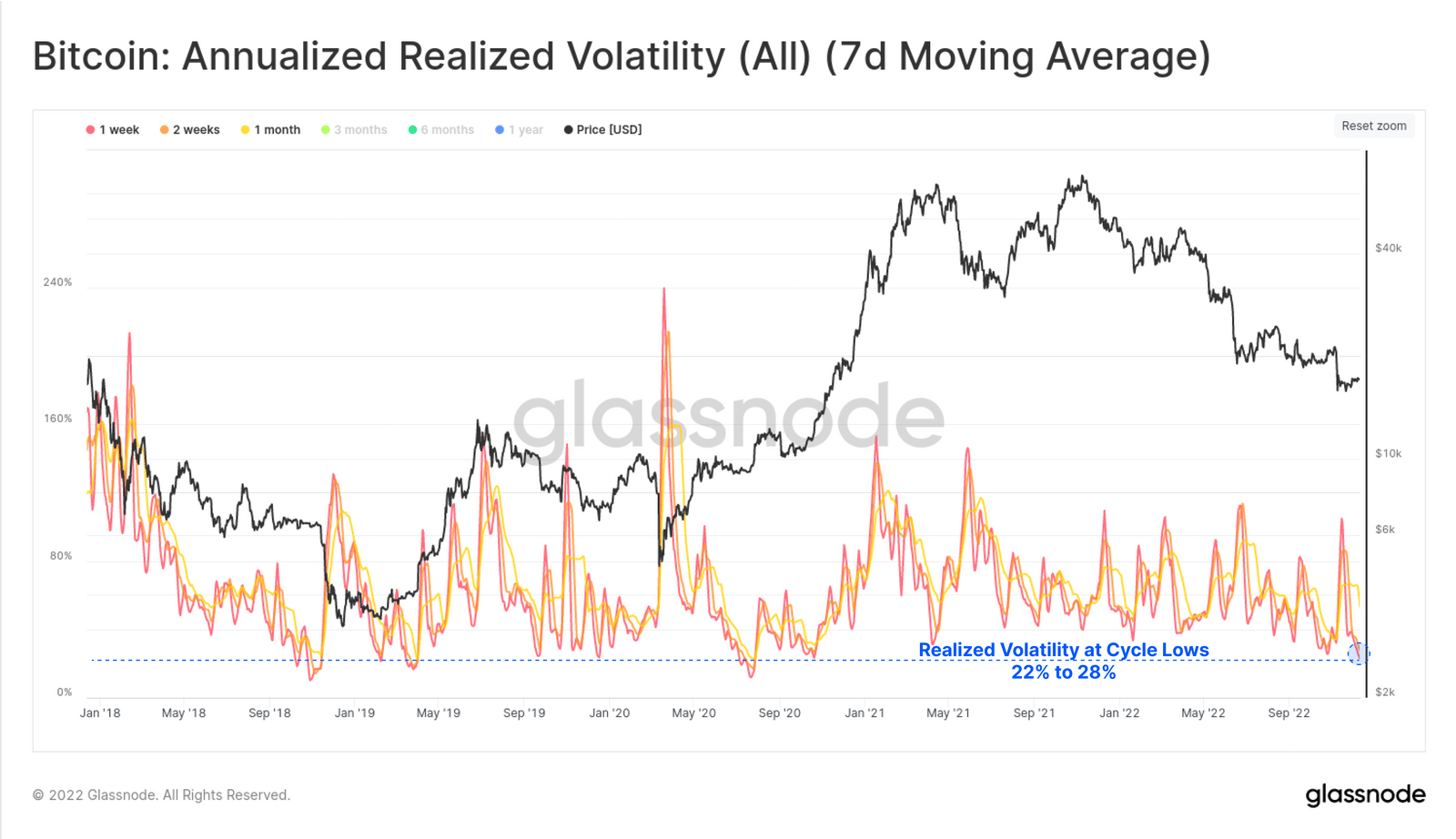

on-chain analytics firm Glassnode has released weekly on-chain data for Bitcoin. Analysts found that BTC weekly volatility dropped to 22%, the lowest level since October 2020.

According to the data, the volatility rate in the market was around 110% in the week when FTX went bankrupt. The highest volatility week of the last 4 years took place in the week of March 12, 2020, known as the COVID collapse in the markets.

glassnode Another on-chain data shared by analysts supports the notion that the market recession has resumed.

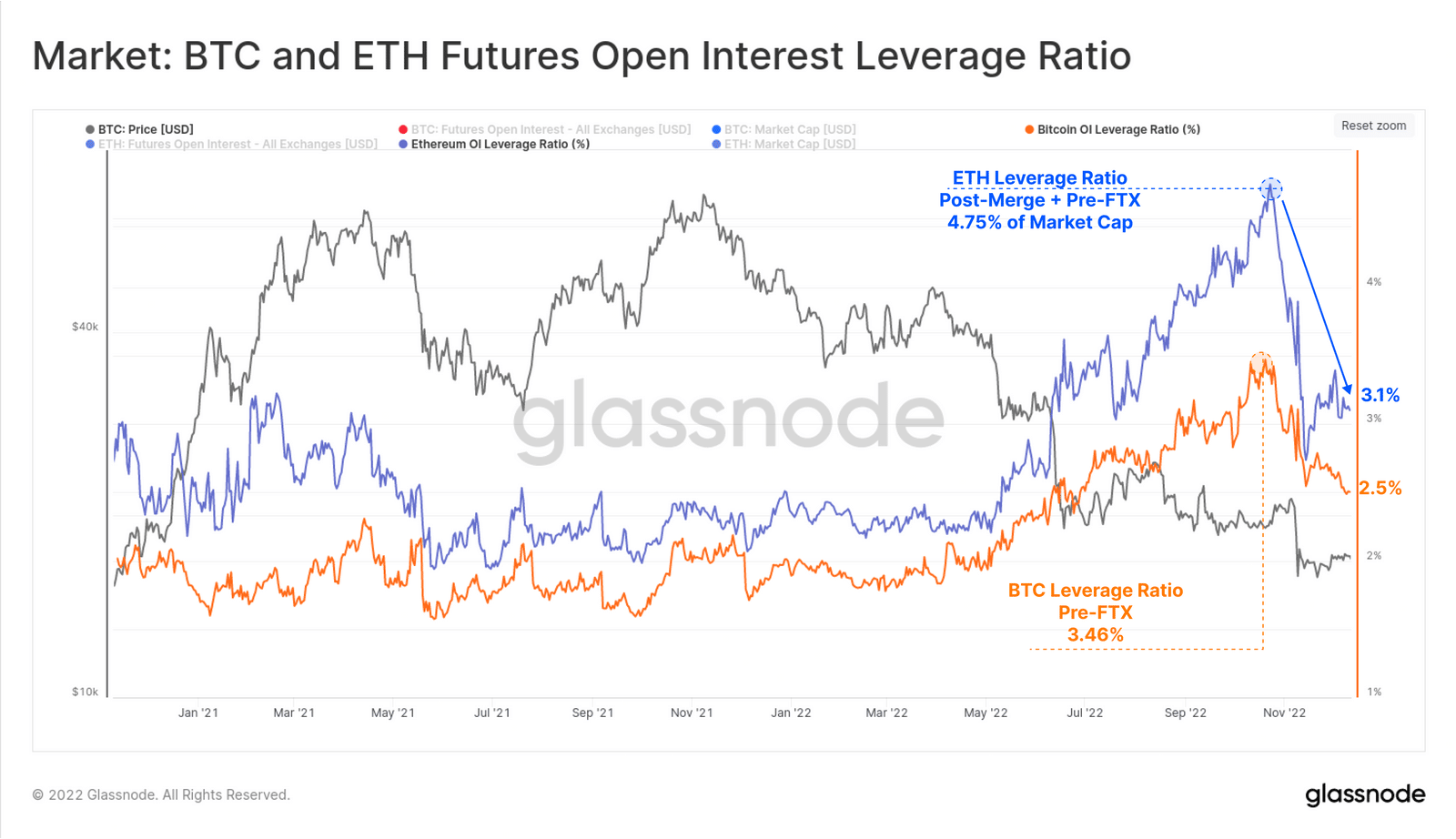

Open-Interest Leverage Decreasing

Glassnode experts have found that the risk taken by investors who trade in continuous futures markets (leverage) is reduced. Ethereum Merge in the first days of September when the update took place ETH and BTC leverage ratio was 4.75% and 3.26%, respectively.

However, with the decrease in the general interest in the market towards the end of the year, leverage ratios decreased to 3.1% and 2.5%.

When all these are evaluated with different on-chain data, we can say that we are at or close to the bottom as stated before, and that we are in areas that can be evaluated for long-term investors.

*Not investment advice.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!