After FTX’s bankruptcy, investor pressure was building on centralized exchanges, according to new data. DeFi and growing interest in decentralized exchanges (DEX).

According to current data shared by crypto tracker Token Terminal, some crypto protocols have made a profit of over $ 1 million in the last seven days, despite the sway in the market.

The largest smart contract platform Ethereum, It took the top spot with a profit of $8.5 million. The second and third rank platforms were OpenSea and dYdX, with a profit of $1.5 and $1.3 million, respectively.

Investors Headed to the DeFi Industry!

FTX, one of the largest cryptocurrency exchanges, declared bankruptcy in two weeks. The bankruptcy of a global stock market has greatly broken investors’ trust in central institutions. Activity on DEX platforms has soared in recent days as the crypto community questions the tangible assets of other exchanges.

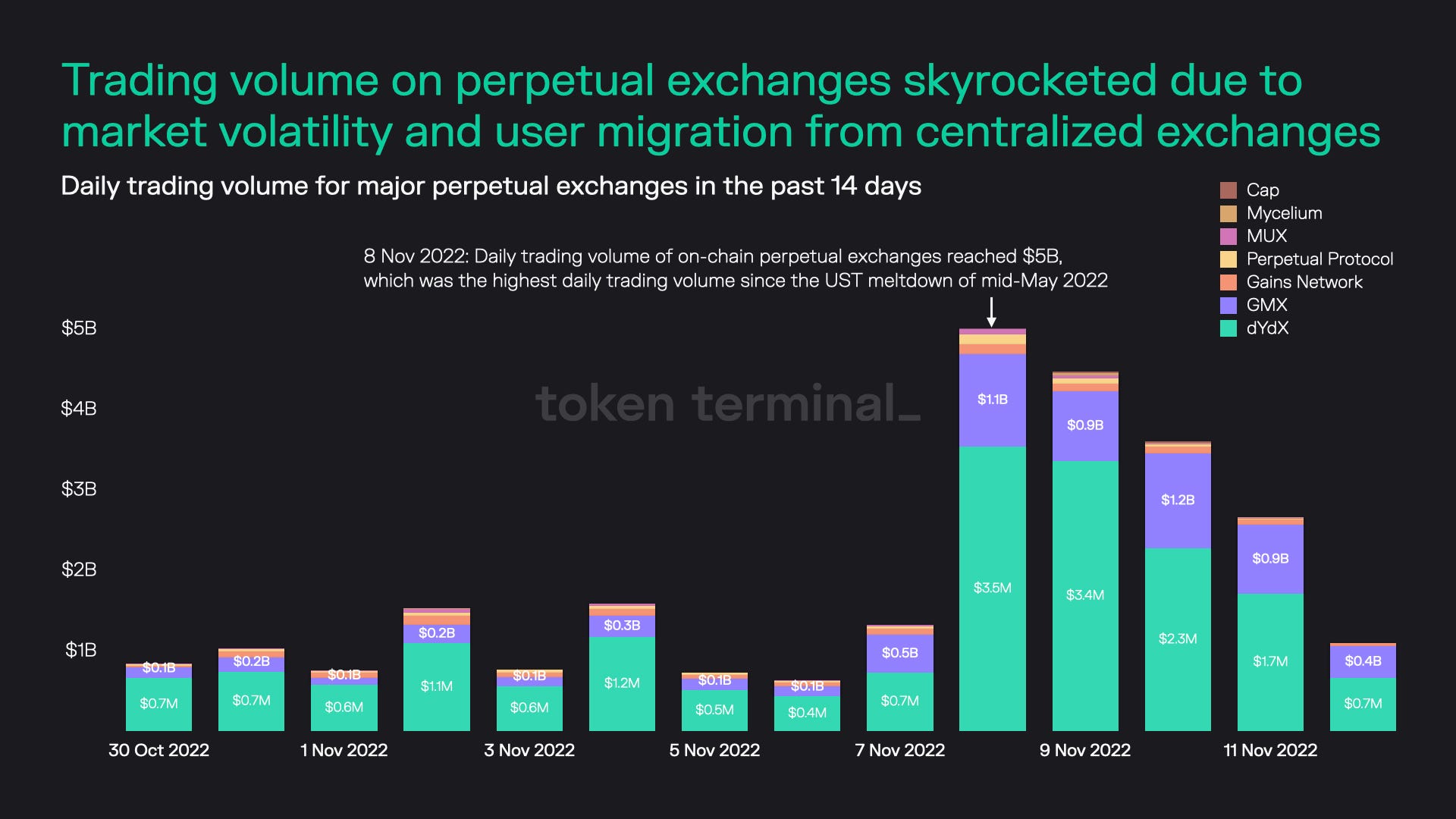

According to another chart shared by Token Terminal, the daily trading volume on decentralized exchanges rose to $5 billion as FTX’s bankruptcy shook the crypto markets.

TVL Values Cannot Follow Volume Exactly

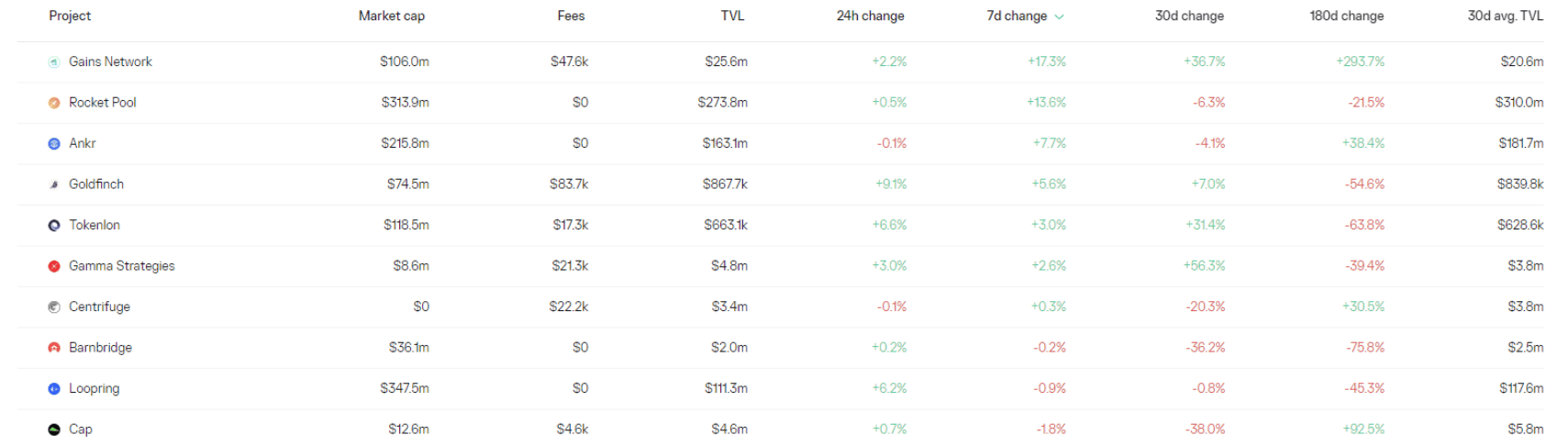

The last data shared by the crypto follower is DeFi on the total crypto value locked on their platform. While the volume is increasing in the decentralized finance sector, the amount entrusted by the investors to the platforms does not increase in parallel.

During the past week, only 7 DeFi platforms were able to increase their TVL value. DEX project running on Polygon network Gains Networkattracted attention with an increase of 17%.

For exclusive news, analytics and on-chain data Telegram our group, twitter our account and YouTube Follow our channel now! Moreover Android and iOS Start live price tracking right now by downloading our apps!