bitcoin The price faced strong resistance at the $24,000 level despite surging towards $25,000 in the past three weeks. The new year crypto rally is still valid. BTC is forming higher highs and higher lows on the daily timeframe, which is characteristic of an uptrend.

According to analysts at Eight Global, the BTC chart shows we have a series of equally highs around $25,200. A similar bullish sentiment was shared by Kitco senior technical analyst Jim Wyckoff. He noted that the bulls still generally have the short-term technical advantage as there is a price uptrend on the daily chart.

“BTC bulls need to show more strength soon to keep the uptrend alive and maintain their technical advantage if they want to stay in control,” Wyckoff said.

Bear Trends Continue

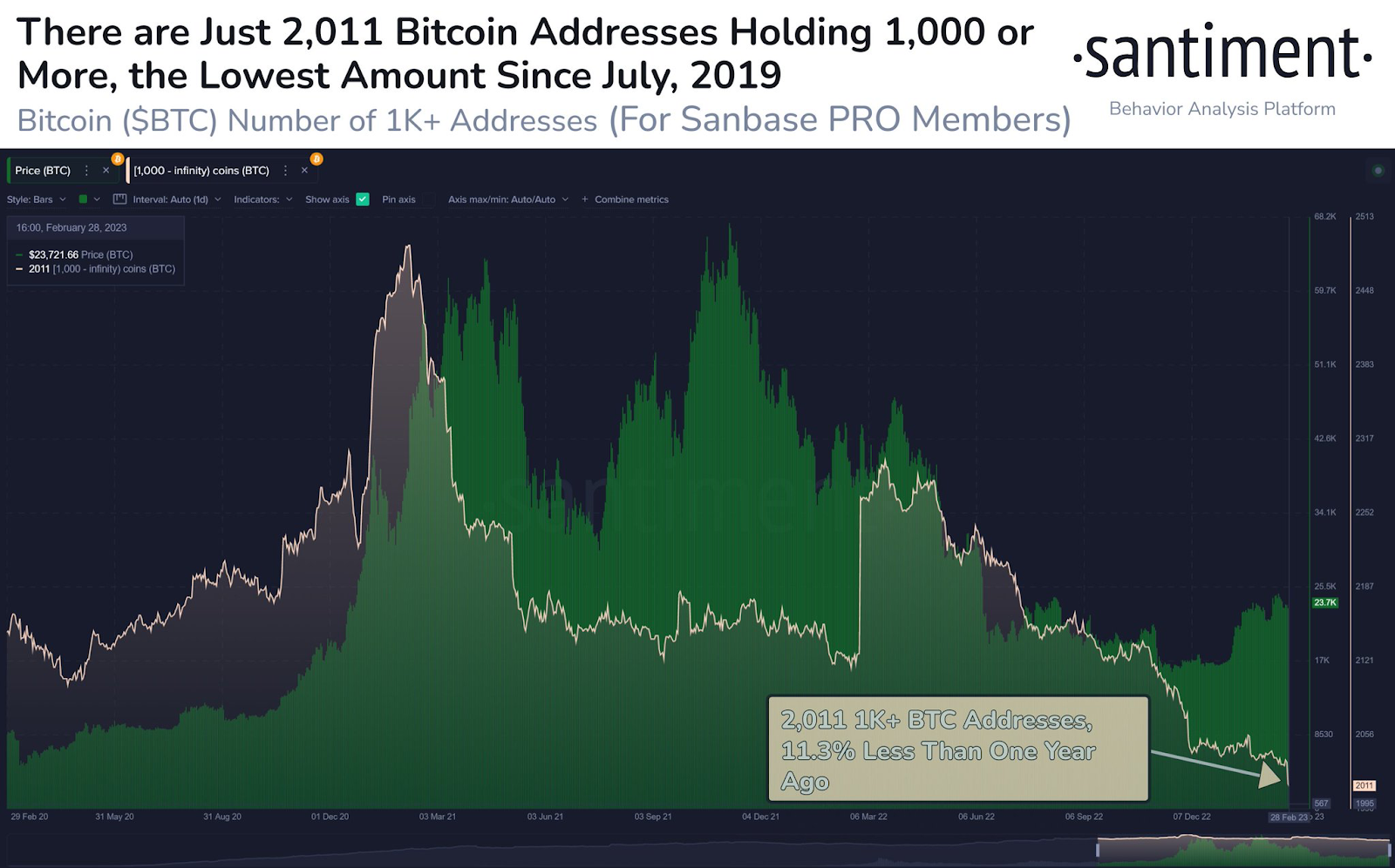

But the BTC uptrend thesis is in jeopardy as on-chain analytics firm Santiment has detected a significant drop in Bitcoin whales.

centiment “The amount of whale Bitcoin addresses available continues to decline, with 2,011 available a year ago compared to 2,266 that existed today. 2,489 was the All-Time High set on February 8, where prices rose +70% over the next 10 weeks,” said.

NEWS CONTINUES BELOW

According to the data, addresses of Bitcoin whales hit the lowest level since 2019. Thus, it signaled a possible price reversal.

Bitcoin’s daily RSI indicator also shares a similar bearish trend. Specifically, it is possible that Bitcoin price on the daily timeframe is forming a possible head and shoulders pattern as the RSI signals a falling divergence. A price reversal usually follows a combination of these two elements.

Therefore, the possibility of Bitcoin prices falling below $21,000 cannot be completely ruled out in the near term. Analysts are watching the $23,000 support level closely to identify possible breakouts.

The area at $23.8K remains to be a crucial breaker for the markets to continue the upwards momentum.#Bitcoin needs to break it for continuation. pic.twitter.com/sqRObCVPAG

— Michaël van de Poppe (@CryptoMichNL) March 1, 2023